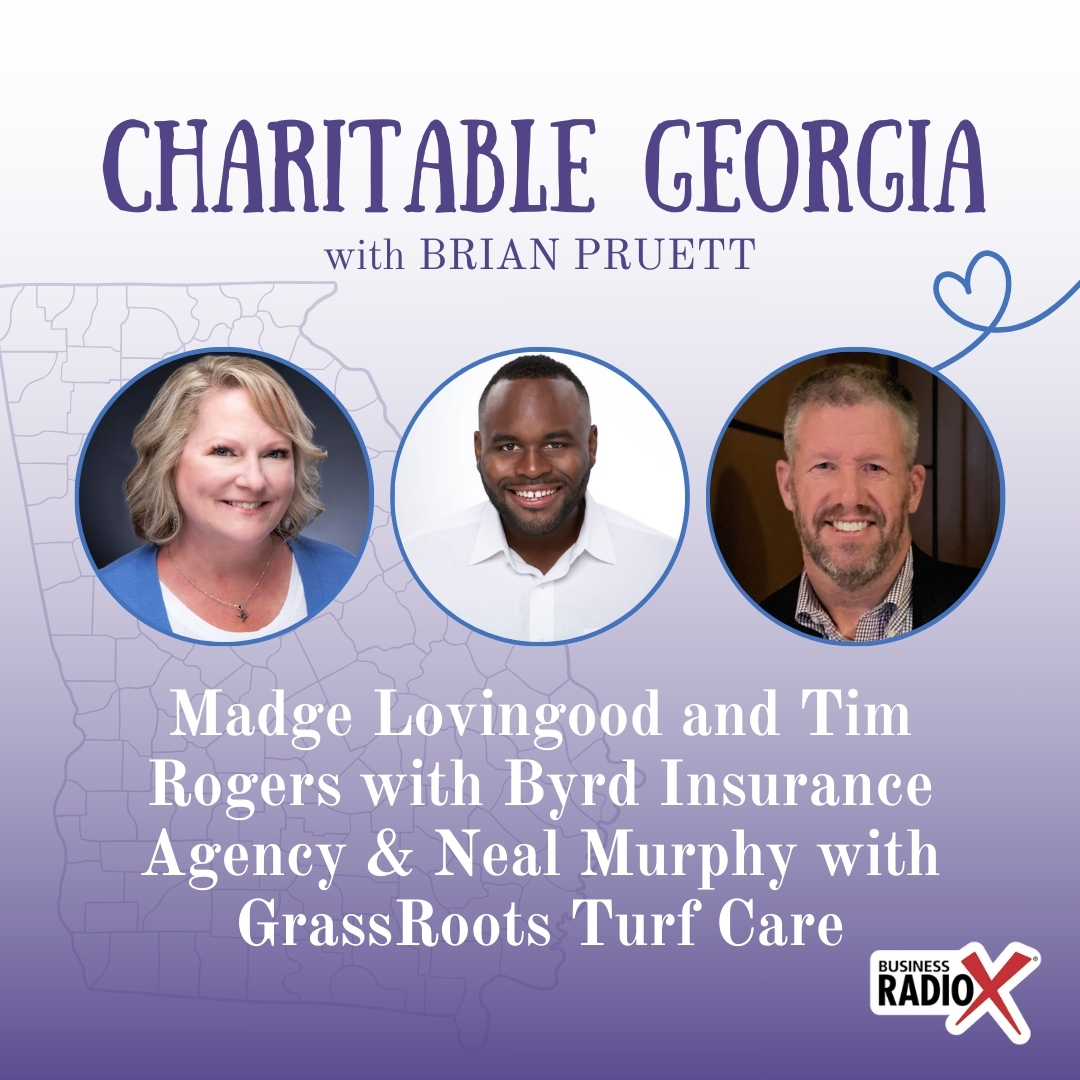

In this episode of Charitable Georgia, host Brian Pruett is joined by Madge Lovingood and Tim Rogers from The Byrd Insurance Agency, and Neal Murphy from GrassRoots Turf Care. They delve into a variety of insurance topics, such as homeowners, renters, pet, and flood insurance, while also touching on the intricacies of insuring personal property and collectibles. Tim and Neal share their individual journeys in their respective industries, emphasizing the importance of fostering community connections.

Madge Lovingood flew into the Insurance Industry in 1989. She has been an Agent, an Adjuster, and an Underwriter. The majority of Madges’ time has been in the agency which is where her passion is.

Madge Lovingood flew into the Insurance Industry in 1989. She has been an Agent, an Adjuster, and an Underwriter. The majority of Madges’ time has been in the agency which is where her passion is.

She likes to say the Byrd Insurance Agency soars above the rest to give you our very best! She joined The Byrd Insurance Agency in 2000 and became a partner in 2004 and has been the sole owner since 2014.

Madge has been married to Brian Lovingood for 20 years. They’re empty nesters except for two furry kids; Ruger, a Redbone Coonhound who is 9, and a 3 year old Anatolian Shepherd who weighs 120lbs.

She has two granddaughters who still love to come to Nana and Papa’s . She loves her family, being a grandparent and a dog mom. Madge also enjoys Golf, NASCAR and Corney Jokes!

Tim Rogers resides in Canton, Ga with his wife and 2 boys. He is an avid outdoorsmen and sportsman. He has been in the insurance industry since 2019 and truly has a passion for developing relationships with his clients and peers.

Tim Rogers resides in Canton, Ga with his wife and 2 boys. He is an avid outdoorsmen and sportsman. He has been in the insurance industry since 2019 and truly has a passion for developing relationships with his clients and peers.

In the ever-changing landscape of the insurance world, Tim understands the importance of gaining and maintaining trust. “For me at the start of every transaction and ANY business opportunity, Trust, Transparency, Professionalism and Industry Insight will always be the driving factor behind my every day-to-day routine”

When the going gets tough and the challenge ahead gets hard, Tim pushes himself to go higher, work harder and maximize every opportunity. He’s super excited to be a part of the Byrd Agency and looks forward to many years of continued service in the wonderful communities he serves.

Neal Murphy grew up in Boston, MA, but eventually relocated down to Charlotte, NC, in 1998 and then Canton, GA, in 2004.

Neal Murphy grew up in Boston, MA, but eventually relocated down to Charlotte, NC, in 1998 and then Canton, GA, in 2004.

The majority of his professional career has been in a technology role for a variety of industries including banking, consulting, education and legal. However, with his son and daughter then in college, at the end of 2019 Neal decided to exit his 30-plus years in the corporate environment to pursue the opportunity to be a new franchise owner for GrassRoots Turf Care, a lawn spray company located in Acworth, GA.

Since January 2020 Neal has been the owner of two GrassRoots Turf franchise territories in north Georgia, with his base of operations in Cartersville. Neal moved from Canton to Cartersville in early 2021 to be closer to his business as well as the Cartersville community.

He has been an active member of the Cartersville Chamber of Commerce as well as the Cartersville Business Club, and regularly looks for opportunities to promote other local small businesses and owners just like so many have graciously done for him.

He and his GrassRoots Turf franchise also look for ways to give back to the community in more charitable ways including monetary donations and sponsorships. They have been so happy to support numerous charitable organizations this past year including Advocates for Children, Red Door Food Pantry, Good Neighbor Homeless Shelter, Footprints on the Heart, and Backpack Buddies.

This transcript is machine transcribed by Sonix

TRANSCRIPT

Intro: [00:00:07] Broadcasting live from the Business RadioX studios in Atlanta. It’s time for Charitable Georgia. Brought to you by B’s Charitable Pursuits and resources. We put the fun in fundraising. For more information, go to B’s Charitable Pursuits dot com. That’s B’s Charitable Pursuits dot com. Now here’s your host, Brian Pruett.

Brian Pruett: [00:00:45] Good fabulous Friday. It’s another fabulous Friday morning and I don’t know why people can’t stay healthy in Georgia, but obviously we go from negative something to 60 something, so it’s just crazy. Anyway, welcome to Charitable Georgia. This is your first time listening, this is all about positive things happening in the community. And I’ve got three fabulous guests this morning. And, uh, we are going to start with Madge Lovingood from the Byrd Insurance Agency. So, Madge, thanks for coming this morning.

Madge Lovingood: [00:01:11] Thanks for having us.

Brian Pruett: [00:01:12] So as I say, the bird is the word right? That’s right. All right. We’ll talk about the Byrd Insurance Agency here in just a few minutes. But if you don’t mind, share a little bit about your background.

Madge Lovingood: [00:01:20] Okay. Um, I’m originally from Georgia. I was born and raised in Atlanta, then moved to Cobb County, spent most of my life in Cobb County, and started in the insurance industry 35 years ago. And now I own the Byrd Insurance Agency in Hiram, Georgia, and we have a second location in Villa Rica. Um, I’m married to my husband, Brian, and we have a.

Brian Pruett: [00:01:41] Good name, by the way.

Madge Lovingood: [00:01:41] Yes, I know, great name. I have two daughters and two granddaughters and two big furry beast at my house. Nice. Yes. Two. Two big dogs.

Brian Pruett: [00:01:51] What kind of dogs are they?

Madge Lovingood: [00:01:53] Uh, Ruger is a Redbone Coonhound, and, uh, Sadie is an Anatolian Shepherd, and I think she weighs about 120 pounds now.

Brian Pruett: [00:02:00] Awesome.

Madge Lovingood: [00:02:01] So she’s huge.

Brian Pruett: [00:02:01] So do you say Ruger? Ruger? That’s an awesome name. So if you like dogs, you like big dogs. Uh, that’s a shameless plug for March 21st, I’m doing a Hometown Heroes Expo, and, uh, it’s an organization that we’re helping called, uh, The Outer Circle out there in Dallas. And they’re helping veterans and first responders on PTSD and suicide prevention. And they are bringing one of their friends that runs paws for life. We’re going to have, instead of a kissing booth, a hugging booth. Oh, and you can get a hug from Rufus.

Madge Lovingood: [00:02:29] Oh.

Brian Pruett: [00:02:30] Rufus, I’ll show you a picture when we get off the air. But Rufus is a massive dog. He likes to stand up, and he actually hugs you.

Madge Lovingood: [00:02:36] Oh, nice.

Brian Pruett: [00:02:36] So come get a hug from Rufus.

Madge Lovingood: [00:02:38] Yes. Remind me. I want to put that on my schedule.

Brian Pruett: [00:02:40] I’ll do it. Do it. So. All right, so you are very active in the community. Not only just networking, but you’re very, um, you love supporting the community. Yes. So, um, first of all, share a little bit why it’s important for you to be involved in the community and do what you do.

Madge Lovingood: [00:02:58] Well, I mean, that’s how we make our living is off the community. You know, our our customers are our community. And so I think it’s important to give back to the community. We do, um, one of the longest projects that I’ve done is we give back, um, dictionaries to all the third graders in Paulding County. It was started by our rotary group, excuse me. And we’ve done that for about 15 years. And you wouldn’t think that kids nowadays would want a book, but they still do. We’ve asked the teachers and they’re like, yeah, it’s still a viable thing. And it’s so cute to see the kids get their first book, you know, and still flip through it, which is nice. And we had a story about one kid, actually, that went through college and he still had his dictionary.

Brian Pruett: [00:03:33] Awesome.

Madge Lovingood: [00:03:34] Yeah, yeah. And still used it. So that was good. Um, another thing we do is, uh, Next Step Ministries, they have A5K. And so we’ve done that for a couple of years I think. Tim, this is the first year you were involved with that, right. Yeah. Yes, I believe so. Um, in Cherokee we do the. Women’s Service League. They have A5K run and then they do a golf tournament. And we’ve been involved with both of those things as well. Uh, this year we did a suicide walk in, uh, Paulding County, uh, for suicide awareness. And that was really touching to hear some of the stories in the people and, uh, things that they have overcome. It’s it’s amazing. It’s amazing.

Brian Pruett: [00:04:09] Yeah. Well, in the last two years, last year and this year, you’ve been a sponsor of mine that I do in Bartow County with the trivia for, uh, Giving Back charity different, uh, you know, nonprofits. So I appreciate you doing that. Um, so, um, as I mentioned, you also do a lot of networking. I see you different function as well. So we talk about networking on here as well. Can you you got a positive, uh, testimony about networking you can share.

Madge Lovingood: [00:04:33] Yes. So far it’s been positive. Um, Tim Rogers, who’s with me today? Actually, I met him at the Marietta Business Association.

Tim Rogers: [00:04:41] This is true.

Madge Lovingood: [00:04:44] So that’s been a positive, um, story that half out of that Marietta Business Association is another group, too. That’s really, really good about giving back to the community their golf tournament. And they have two other fundraisers that gives back to a different charity each year. Um, similar to you except for you give a lot of charities, right. But they usually pick 1 or 2 and give back to you. So which is good. And then um, Kennesaw Business Association I believe also gives back. And now they give back a lot of scholarships to local kids in Cobb County. Um, so that’s a good, positive thing. Um, you know, it’s just getting out in the networking and in the community and talking to people and just making those connections. I mean, like the other day, we got a call in the office from a lady that I met through a networking group ten years ago, and she called me for a quote.

Brian Pruett: [00:05:27] Well, that’s what we talk about too, is, uh, first of all, people I still run across people go to networking events for the wrong reason. They’re trying to always get that sale, you know, and and it’s more about this relationship building. It is. And it’s not going to be an immediate thing. I mean, you just said ten years ago and they called you so and they remembered that. So, um, all right, let’s talk a little bit about the bird insurance agent. You said you’re in Hiram and you have a Villa Rica. Uh, do you guys what all insurance do you guys do?

Madge Lovingood: [00:05:54] Okay, so bird insurance is actually the oldest independent insurance agency in Paulding County. We were found in 1910. So we are the wise old owl of insurance. Nice. Yes, yes. Um, we are, uh, right next to Clark Funeral Home, if you know the area. And we’ve been there. Well, they just been there since 1910, but we moved the office about five years ago. Um, right next to Clark Funeral Home. And then I last year I purchased another agency out in Villarrica. It’s a smaller agency, but it’s right off Bankhead Highway, so. Okay. Yeah. And we do, um, homeowner’s auto. Excuse me. Business insurance, umbrellas, worker’s comp, things like that. Um, we we also do life insurance. We don’t do health insurance. That’s about the only thing we don’t do.

Brian Pruett: [00:06:36] Right, right. Um. All right, so give a little bit some, uh, some tidbits, if you don’t mind, for insurance, because I know that’s kind of a crazy industry. Uh, you got some tidbits you want to share?

Tim Rogers: [00:06:45] This is my time to shine. Uh.

Madge Lovingood: [00:06:48] I’ll let him take that.

Tim Rogers: [00:06:50] So in the crazy world of insurance, right, we’re always doing our best to. To save money. And, you know, make sure that we protect ourselves. You know, one of the things that a lot of the conversations that we’re having with our friends and our clients, um, is, hey, why is my bill going up? Why are our rates are up, right? Because they’re up across many different lines personal home insurance, home, auto business. Um, and there’s many factors that contribute to that. One way that we kind of combat that is taking a look at their individual policy, looking at their coverages, suggesting recommending changes. Um, we’ve got several providers that we contract with. So the great thing about being in the independent model is even if one company goes up pretty significant on their premiums, you know, we can shop that around with other companies that haven’t. And then we can also look into additional discounting opportunities for our our clients, for those that are willing to take advantage of it. Um, and trust me when I say we’ve had to be very, very intentional and creative with the ways that we’ve helped people save money. Uh, because sometimes it can seem like everything that we’re doing is, is just for nothing, but we’re helping people out, and that’s that’s what we do it for. So we’re excited about that.

Brian Pruett: [00:07:58] So, um, what kind of things do people need to look at and think about when they’re going after insurance? I mean, there’s I know there’s different things you can get under, like the umbrella policy and stuff like that, but there are certain things that people don’t think about that you, uh, can maybe talk about, that people should look at.

Tim Rogers: [00:08:15] Yeah, all the time. So here’s, here’s a big one that I tend to have a conversation about every single week. A lot of people think if they don’t have a vehicle that’s in their name or registered to them, that they shouldn’t be on an insurance policy. It’s kind of the the big misconception with with regular people in society, what they don’t realize is that really puts them at a at a detriment when it comes to their insurance, because so much of how you’re rated as an individual really comes from your prior history with insurance. You know, how recently have you had it, in addition to several other important factors like what are your limits of coverage and liability? You know, in the state of Georgia, the state minimum requirements are very, very low. Most people think that because of that, they’re going to save the most money on their insurance if they select that, when in reality it’s the complete opposite, they’re actually going to be rated much higher. And even when they shop their rate with no activity, no claims, things of that nature, they they’re they’re they feel like they can never get something that’s more affordable. Um, so that’s, that’s one thing that we tell everyone, if you’re selling a car, getting rid of a car, um, stay on a policy, even if it’s not your own policy, stay as a driver or listed operator on a family member’s policy because it will keep that history going. And when the time does come for you to get another vehicle in relation to auto insurance, you’re now getting rated at a better category or tier, if you will, than someone that has no history or no insurance at all.

Brian Pruett: [00:09:42] So there’s a few things. I got lots of questions, so be ready for the ride. Uh let’s go Neil. Okay, so, um, so I know I’ve heard some people talk about pet insurance. Yes. Um, you guys do that as well? We do? Yeah. Um, why is that important?

Madge Lovingood: [00:09:58] Because vet bills are going up, right? Just like any other. Outrageous. I know, I just took my dog in the other day. Ruger. He’s a senior, and I took him in the other day to get some blood work because he’s been taking some medicine. And it was $285. Wow. I mean, that’s more expensive than my blood work, right, with health insurance.

Brian Pruett: [00:10:14] Right? So what does I mean? What does that look like when somebody says, I want to do pet insurance? What all does that what would cover when you take out your your your fur baby to the doctor?

Madge Lovingood: [00:10:23] My fur baby.

Madge Lovingood: [00:10:24] Uh, most of the policies, we’ve got three different carriers that do it. Um, they cover, like, uh, two wellness visits, and then they’ll cover the vaccinations, um, like the rabies and the, uh. What is it when you go shots?

Madge Lovingood: [00:10:36] Yeah, the shots, the de-worming and stuff like that.

Madge Lovingood: [00:10:38] All that kind of stuff. And then, um, you get a discount if there’s an emergency visit.

Brian Pruett: [00:10:43] Okay. Or is it all kinds of pets or are there certain pets that won’t cover?

Madge Lovingood: [00:10:48] I have not had a pet that I couldn’t cover yet.

Brian Pruett: [00:10:50] Even a fish.

Madge Lovingood: [00:10:51] I haven’t had anybody ask me about a fish. I’m going to say that’s probably a hard no.

Brian Pruett: [00:10:58] Darn, I was going to ask you, I know. All right. So now let’s talk about, uh, I guess, flood insurance. I mean, there are some, uh, it’s happened here. Um, and most people probably don’t think about that. Um. A little bit about flood insurance. You want me.

Tim Rogers: [00:11:12] To do that? Sure. Okay. Yeah. Flood. Flood insurance is important. I think first and foremost when we talk about that is, you know, agents in the industry, um, you’ve got to be in what’s known as a flood zone. So a lot of people think, well, I’ve got to get flood insurance. Right? So there’s two there’s two requirements that that generally happen in the marketplace. So there’s you’re in an area where you have to have flood insurance. Right. And then if you’re not in an area that’s zoned as a flooding area, you can still get flood insurance. Um, so we have to understand the difference between the two when it comes to homeowners. Um, also understanding that within traditional policies for your home, generally flood is excluded unless you have a flood policy. Okay. So that’s the biggest thing that we really have to make sure that our clients and customers are educated on. Just because you have home insurance doesn’t mean that if there’s a flood, it’s going to cover it because it’s not, you know, that’s a big exclusion for homeowner policy. So, um, if there’s been a history of those type of events happening on your property or on your home, in my opinion, we need to make sure we secure that for you as an individual.

Brian Pruett: [00:12:15] So are there other, I guess, acts of God in kind of insurance? If a tornado or a lightning strike or anything like that, are there other insurances for those things?

Madge Lovingood: [00:12:24] Now, if lightning strikes or there’s a storm that is covered under your homeowner’s insurance. Okay. Um, earthquake is about the only other thing I can think of that’s not covered. Um, but we do have and we do have a fault line in Georgia. Um, so there are earthquake policies that you can get as well. We’ve got two carriers that have endorsements on their policy.

Brian Pruett: [00:12:40] Okay. Um, all right, so I got a scenario for you. Uh, you you live on a property, and behind you is another property. And a tree from that property falls on your fence. Who’s the one responsible and who’s insurance takes care of it?

Tim Rogers: [00:12:57] Now we have the right answer for that question. But just out of curiosity, who do you think would be responsible for that?

Brian Pruett: [00:13:03] The persons that the property fell off of?

Tim Rogers: [00:13:05] Correct? That’s absolutely correct. So and look, this happens a lot more than people think. But you’re absolutely right. If you have a tree in your yard or in your on your property that falls on someone’s home, their vehicle, their driveway, you’re responsible for making sure that if you have the proper coverage, that they remove that tree and also cover any, you know, repairs or damages that are caused to the property.

Brian Pruett: [00:13:29] So I’ve had some people that told me it was the other way around and I never believed them. But so what our safeguards for that, because I’m sure there are people out there who says it’s the other way around.

Madge Lovingood: [00:13:39] Well, it depends on the situation. If, um, if you have it noted or you have an arborist come out there and say that that tree is dead and you’ve notified your neighbor that that tree is dead and that tree falls on your house, then they knew. So they’re responsible for it. If in a storm situation, it depends. Excuse me. Um, the insurance company, your insurance company is going to pay for your house and your damages and the removal of that tree. But the part of the tree that’s on the neighbor’s property, that is their responsibility.

Brian Pruett: [00:14:07] Okay. And so and if it damages your, like the fence, then they will take care of it. Or were your insurance then then go after the other insurance company.

Madge Lovingood: [00:14:15] Your insurance could take care of it.

Brian Pruett: [00:14:17] Yeah. All right. And does that stuff help. That will then make your rates go up. Then if that’s the case.

Madge Lovingood: [00:14:22] Homeowner’s insurance claims do not make your homeowner’s policies go up.

Brian Pruett: [00:14:25] Okay.

Madge Lovingood: [00:14:26] They just have increases okay.

Brian Pruett: [00:14:28] All right.

Madge Lovingood: [00:14:29] But you’re not surcharged. Now auto is different but the homeowner’s is not okay.

Brian Pruett: [00:14:32] Um all right let’s talk a little bit about renters insurance. Why is that important?

Tim Rogers: [00:14:37] Well, renter’s insurance is very important because when you’re renting, I mean, you’ve got valuables and things that are important to you that stay with you, right? Whether it be, um, you know, personal property. And people say, well, what is personal property? It’s it’s your stuff, okay. It’s everything from clothes to electronics to appliances to furniture, uh, anything of value that you keep in your apartment or your home or wherever that you rent. You want to have coverage for those things. God forbid there is an accidental fire. God forbid you accidentally have a mistake. And, you know, with wherever you’re renting, where those things are destroyed, if you don’t have the proper coverage, that’s a big loss that you’re taking, and you’ve got to be the individual that comes out of pocket to replace all those things. So renters insurance, you know, one aspect is for the personal property. And then of course, the other important aspect is for the liability, uh, anything that can occur, um, on that property or in that home or in that apartment that you could be responsible for and that someone could try to sue you for as well.

Brian Pruett: [00:15:37] So what about folks? I’m assuming we’re talking about people living that rent homes and apartments, correct? Correct. What about storage? If people have storage units? I know some storage units, like we have a storage unit and they make you purchase insurance through them.

Madge Lovingood: [00:15:51] So that depends on which carrier you have. We have several carriers that will cover up to 10% of your personal property on your home or your renters policy and a storage location. So if you own a home and you’re, let’s just say your personal property coverage on there is 200,000. So 10% of that will go to your storage location. Does that make sense. So you’d have $20,000 worth of coverage.

Tim Rogers: [00:16:12] Okay. But it’s also important to remember it’s for a period in time. Right. So so here’s here’s here’s the thing that I’ll say about kind of what agents will tell people. You know, first and foremost, for anyone that’s listening, you have to remember that not all insurance agents are created equal. Uh, this is a huge policies and policies and policies and companies. So there’s a lot of moving parts to what happens in the insurance industry. We have to really know what’s going on, and we have to really know the rules and regulations. The things that are covered aren’t covered within the providers that we have. You know, that we that we place for our individuals and also how that applies to real world situations and scenarios. Um, generally, if someone is moving their personal property to a storage unit permanently, right? Yes. For a period in time, their renter’s policy will cover that, but it’s for a period of time if it’s going to be there permanently there, nine times out of ten, we’re going to suggest or recommend, unless I’m wrong with that.

Madge Lovingood: [00:17:11] I’m going to correct you.

Tim Rogers: [00:17:12] Actually let my boss correct me. See this? See this? This. This is a prime learning experience, a learning experience.

Madge Lovingood: [00:17:17] But he’s right. Not all policies are the same, but we do have two carriers that will cover the stuff in storage permanently.

Tim Rogers: [00:17:24] Yes, but it has to be an endorsement. Yes, typically.

Brian Pruett: [00:17:28] Do you? Obviously. I guess there are. Sorry. Like I said, they they made us. Get that insurance through them. Do you recommend having both? Through and through an agent, as well as what they let you.

Tim Rogers: [00:17:39] Answer that one, because my answer would be no.

Madge Lovingood: [00:17:41] My answer would be no as well.

Brian Pruett: [00:17:42] Yeah. Okay. Yeah. No. All right.

Madge Lovingood: [00:17:44] You can’t collect from two different policies for the same incident okay.

Brian Pruett: [00:17:49] Alright. Good to know. All right. Let’s talk a little bit for somebody who’s listening and still confused a little bit about the insurance world because it’s very confusing. Explain what an umbrella policy is.

Tim Rogers: [00:18:00] I mean, I can do that, but you can do that. Okay.

Tim Rogers: [00:18:03] My boss wants to put me on the spot.

Brian Pruett: [00:18:06] That’s the reason she brought you.

Tim Rogers: [00:18:07] She wants to put me on the spot to make sure I’m up to game, but.

Madge Lovingood: [00:18:10] He turns his back. The best talking.

Tim Rogers: [00:18:11] The best way that I explain an umbrella, a policy. It’s excess. It’s extra coverage, right? Uh, that’s for you, the individual. Uh, when something major, a claim, an incident, a loss occurs that can provide protection for not just your auto insurance, but also your property insurance. Right? Um, this also translates in the business world, you can get umbrellas for for commercial policies for businesses, but they are separate. So you have, you know, umbrella policies for your personal insurance needs, your home, your auto. That’s also any additional items you may keep in your home that have insurance, things like, um, like boats, things like, uh, RVs, things like campers, things like, uh, you know, the fun toys that certain people have, like four wheelers and things like that. Right? If there’s a potential that, you know, these toys or these things can, can injure someone or create a loss or be stolen or what have you. Uh, you want to have a certain amount of coverage to protect against all of that, for one thing, but then also to make sure that if something happens that you’re responsible for, you don’t have someone hiring a lawyer or trying to come after you and sue you for your assets. Right? So that’s the other big aspect of of what an umbrella policy is for its excess coverage. And it you know, we call it in the insurance world. We call it an umbrella policy because it kind of sits above, you know, the limits of your home and your auto. Right, right. So that’s why it’s called an umbrella policy.

Brian Pruett: [00:19:36] Okay. Uh, and then the last thing I want to ask about is, uh, collectible insurance. I have a big collection of sports cards and sports memorabilia, and other people do antiques, things of that nature. Um, first of all, do you guys do anything with that? And second of all, why is that important?

Madge Lovingood: [00:19:52] That’s important because on your homeowner’s policy, they specifically put a limit on, uh, collectibles, jewelry, guns, silver, gold, things like that. Um, there are specialty companies out there that will insure collection and. I’m trying to think of one that we had, uh, lady collected. Um. This little figurines called humbles.

Madge Lovingood: [00:20:15] She collect a bunch of those and she had like $20,000 worth of those things, so she had him scheduled. You do need to get them appraised. And then there’s a specialty company that can insure that kind of stuff.

Brian Pruett: [00:20:25] Okay. Yeah. All right, all right. So imagine coming back to you for a second. Why did you choose to get into the insurance world?

Madge Lovingood: [00:20:31] Wow, that was 35 years ago. I actually answered an ad in the newspaper for just a service rep and went in there and, uh, the lady that I worked for, um, Linda Adrian, was a great mentor, actually, and she encouraged me to get my license. And so I did. And she said, well, when you get your license, you can get more money. And I said, oh, I can get commissions. Okay. Sure. So I just sort of fell into it, to be honest with you. But I like it because you get to deal with the people, uh, good, bad or indifferent. Most of them are good, and it’s a learning experience. I mean, it changes every day now, right? It’s a different experience.

Brian Pruett: [00:21:08] Right. Well it goes to your to your service heart as well because you’re, you know, the helping helping folks. Yeah. So so that brings me to another question too. You said it. Not only insurance agents are created equal when somebody is looking for an agent. What should they look for?

Tim Rogers: [00:21:25] Oh man, I get asked this all the time. And I think my answer changes every every other week. But, um, to keep it consistent with what I believe to be true, I think I think the most, you know, important things that someone should consider when they’re looking for an agent or an agency. Obviously, services is a big part of it. Right? Um, professionalism, being kind, uh, being informative, um, relating with that individual. So, so the service aspect of, of, you know, you want to make sure that whoever you come to or whoever you seek out, they’re going to be responsive, they’re going to know what they’re talking about. They’re going to be able to help you. Um, obviously cost to value when it comes to the numbers. Right? Because at the end of the day, you know, we can talk about insurance all day long, but how does this really affect us? Well, it affects our hard earned money for everybody. Right. And we all have to have it in certain ways. So, um, that’s generally a motivating factor for most people. Um, service is another motivating factor for most people. Uh, and then claims help and then making sure that when there is a potential claim or when they have questions about that claim or when they think they may need to file a claim, you know, we’re not just being their agents, but we’re really acting as advocates and advisors, even if you will.

Tim Rogers: [00:22:33] And I know that’s a word that people may kind of laugh or smile at, but in all reality, a lot of our clients look at us as their insurance advisors, more so than just their insurance agents. Right? Because we have to understand how to navigate the world of insurance. And most insurance agents, if not all, were all middlemen, right? You know, you have the insurance company on one side, and then you have the consumer on the other side, and we’re right in the middle. So we have, in my opinion, an obligation just as important to the consumer as we do the company. Uh, and kind of bridging that in the middle and making sure that there’s fluid converse, you know, fluid, a fluid relationship and fluid conversation on both sides to where when there is an issue or there is a problem, we’re mitigating that pretty quickly. We’re getting in front of that pretty quickly. And then we’re also making sure that we can be there for the individual.

Brian Pruett: [00:23:21] Uh, you talked a little bit about this earlier, but being an independent, you guys like brokers, right? So you can work with all different agencies. Um, what kind of an advantage, other than the fact that you’ve got the multiple agencies to look at? What other advantages that working with a broker like yourself, whereas, you know, you still might be going with a named right big named agency. And so then, well, then why would I work with you if I could just go to them?

Tim Rogers: [00:23:45] I think there’s pros and cons to both. Um, and I’ll be real brief with my answer. But, you know, how I got into the industry was was working for a direct all state agency. So I was, you know, agents call that the captive or direct side of the insurance world where you just represent one provider and you’re, you know, you’re bound to the rules of that one company. Uh, the benefit of being independent is you get options in consideration for multiple providers, right? So and you pass that on to the individual. So when you only represent one company, you can only represent one company. Right. So if that one company is astronomically high on their rates and their guidelines are strict and tight, and you know, you can only quote X amount of people that kind of fit the box, right? That’s a disservice to someone that may not fit in that category. Right. When you’re independent, you learn and you develop what kind of works best for certain individuals, and you’re giving them options, and it puts more of the experience on them in terms of the buying power, if you will. Uh, but also understanding that they’ve got choices. Right. And then it’s our responsibility as the agent to to articulate and be competent on what we’re providing to them and making sure that they can make the best informed decision. And that’s really what it’s all about for us. We want to give you the best. We want to give you the best knowledge, the best information, so you can make the best decision for yourself on where you’re going to place your coverage.

Madge Lovingood: [00:25:06] Okay. Can I ask a question? Because Tim came from a captive and he’s new to us. Would you ever go back?

Tim Rogers: [00:25:12] Absolutely not. Uh, nothing against the captive world of insurance and direct companies. Uh, again, there’s pros and cons to both. I think the pros and the positive things that come out of being in the independent market far outweigh any of the negative things that can come from this. I’ll never go back. Uh, I love the fact that we have the ability to offer so many different solutions. Um, and it just, it makes it makes the day to day better. Also, I feel like there’s, there’s, you know, like, like was mentioned before. I mean, with what we’re seeing now in the industry over the last 3 or 4 years, I mean, every day is different, right? Um, and, and sometimes you do feel like you’re hearing something bad or good every single day that’s going on in the industry. Right? Uh, and how it affects people. So, um, independents better, in my opinion. I think most people in the independent side would say the same thing. Uh, but then again, if you spoke with ten agents that were captive, they’d probably tell you that captive is better. So you’re going to hear it’s going to vary. Right. But I like giving options to our people.

Brian Pruett: [00:26:13] So talk about some of those. Uh, I’m actually with a with a broker myself, and I’ve been with him for quite a while. And he’s very proactive to like, you guys are, you know, customers and clients and matter of fact, I mean, uh, he, uh, my insurance was going up. And before I could get the phone in my hand, he called me to let me know we’re switching. So we.

Madge Lovingood: [00:26:32] Tried to do that.

Brian Pruett: [00:26:33] Too. Right. So. And that’s awesome. That’s what I appreciate about, you know, folks like that for you and other, uh, brokers. But what about these insurance agents that, uh, agencies that that you guys have as options that people may not have heard of? What kind of things are hurdles with that trying to see, you know, well, I don’t want to go with them because I’ve never heard of them.

Madge Lovingood: [00:26:50] That’s probably the biggest hurdle that we have as independent agents, because some of our carriers don’t advertise like we do represent progressive. They advertise on the TV. Everybody knows flow, right? And, um, we also represent Safeco. Some people have heard of that. Some people haven’t. Um, people have heard of travelers again, they advertise on TV, but Main Street America, um, we have uh, Grange, Donegal, Southern Trust. These are more regional carriers and they don’t advertise. Um, that also helps control their cost too.

Brian Pruett: [00:27:19] Because some point I never thought of that. Yeah.

Madge Lovingood: [00:27:21] Some of these regional carriers are very inexpensive because they are regional. So they price their products for the region that they’re in and they don’t advertise. They advertise to us the independent agents and their A-rated carriers. So not nonstandard companies, but these companies just don’t advertise as much as some of the bigger names.

Brian Pruett: [00:27:37] Okay.

Tim Rogers: [00:27:38] And I like to add something real quick, real quick to that. So Matt is absolutely correct. And for any of you guys that are listening, most people know who the big companies are. All state farmers, state farm, uh, you know, Liberty Mutual, uh, nationwide.

Madge Lovingood: [00:27:52] Stop giving them advertising.

Tim Rogers: [00:27:54] Sorry, we’re not giving them. But the point that I’m trying to make is there’s some really cool insurance companies out there that, like, no one’s ever even heard of. I mean, really, there’s some really cool companies out there that do some really neat things and that really pride themselves in the way that they take care of their people.

Brian Pruett: [00:28:10] Can you give an example?

Tim Rogers: [00:28:12] Uh, absolutely.

Madge Lovingood: [00:28:14] Donegal.

Tim Rogers: [00:28:14] Donegal is a great company.

Madge Lovingood: [00:28:16] Donegal is a great company and they give back to the community as well. Um, they have given us money for advertising and for some of the charitable events that we’ve done as well. Awesome. Yeah. So they do give back. Southern trust does something every year and it’s with their staff. I think their staff goes out and volunteers in the community there in Macon, Georgia. And Grange also gives back to certain charities. I can’t think of anything off the top of my head, but these local carers, and they don’t get a lot of, um.

Tim Rogers: [00:28:42] Uh, press if you press notoriety. Yeah.

Madge Lovingood: [00:28:44] They don’t get a lot of notoriety for it, but they do give back.

Brian Pruett: [00:28:47] That’s awesome. All right, so we’ve heard you talk to him, but we’re going to get to know you just a little bit. So Tim Rogers right. Byrd Insurance agency welcome this morning. Welcome.

Tim Rogers: [00:28:56] Good morning.

Brian Pruett: [00:28:56] Happy Friday. Mr. Rogers is in the neighborhood.

Tim Rogers: [00:29:00] That’s right. He’s in the neighborhood.

Brian Pruett: [00:29:01] But you don’t have your sweater on. I’m disappointed.

Tim Rogers: [00:29:03] No. Not today. No. Uh, yeah. Go ahead. Yeah.

Brian Pruett: [00:29:06] So just a little bit of background, if you don’t mind. Yeah.

Tim Rogers: [00:29:10] Here’s here’s my background. I’m, uh, Tim Rogers full name is Timothy Rogers. I actually grew up here in Georgia, but I’m originally from Texas, so I am a Texas guy. Was, uh, born in Dallas, Texas. Uh, but I’ve spent the majority of my life here in Georgia. I grew up in Paulding County, uh, Hiram, Georgia, back when Hiram used to be considered, you know, rural and country. And now it’s completely suburban and almost metro.

Brian Pruett: [00:29:32] But, um, and everybody knew Travis Tritt.

Tim Rogers: [00:29:34] That’s right. Everybody knew Travis Tripp out there. Yeah. I think he actually still has.

Brian Pruett: [00:29:38] Yeah, he’s still there.

Tim Rogers: [00:29:38] Yeah, he still has a mansion out there.

Madge Lovingood: [00:29:40] He does. I live down the street from him. I used to live right down the.

Madge Lovingood: [00:29:42] Street from him. Yeah.

Tim Rogers: [00:29:43] Nice. Very, very nice. But, uh. Yeah, I grew up there, went to, you know, high school, middle school, elementary out there. Didn’t go to college. Coming out of high school, I thought I wanted, uh, I was 18 coming out of high school thinking that, uh, I had different aspirations to do different things. So I kind of went into the workforce. Um, but I love people. I’m very energetic. People always told me growing up I should get into sales, uh, some form of sales. Some part of sales. Took me a while to kind of finally believe that within myself. But I got into the insurance industry, uh, back in 2019. Um, I am married. I’ve got two kids, I’ve got a two year old, uh, two years and four months. And man, that’s a wild and fun time keeping you.

Brian Pruett: [00:30:25] Busy, running around.

Tim Rogers: [00:30:26] Always keeping me busy. And I’m also a step dad to an 11 year old. And he’s such a great kid. And I’ve been married to my wife for close to two years. And, you know, we we live here in canton. We love the community. Canton has changed so much over the years, just like Woodstock. And, uh, we love to see all the positive growth. Um, I’m very much an outdoorsman and a sportsman kind of guy. I love, love being active, love being out in nature, exercising, working out. Uh, sometimes you’ll see me on the court playing basketball, you know, things. Things of that nature. Uh, do do my, do my best to to be active and find ways to do that within the family. But yeah, that’s a little bit about me.

Brian Pruett: [00:31:02] So, uh, again, you’re very active in networking. I met you at the NBA a few years ago. You just talked about the Canton Business Club a while ago. So share some positive, uh, experiences you’ve had with networking.

Tim Rogers: [00:31:12] I think networking is great. And I’m a big believer in having and creating and finding balance, right, with whatever you do when it comes to your business. So for me, networking is a big part of that. Uh, I do believe you can network too much. Oh, yes. And I do believe you can network too little, right? If you network too much, how are you focusing on yourself and making money and and doing what’s important to you, but also with your network? Too little. How are you getting yourself out there? Creating relationships? Uh, meeting people? Um, matches match was absolutely correct. I mean, we serve the community, right? We benefit off of that. So it’s only right that we continue to pour our time and our effort and our and our dollars back into the community, uh, the wonderful communities that we serve. Um, what I love about different networking groups, uh, they’re not all the same. You get different personalities, different people that come from different walks of life. Uh, and then there’s different industries that are represented in different groups. So I do my best not to, um, be biased towards certain groups and to always be open to meeting new people, learning about people. But most important, making it personal, making it personal with that individual. I think if we can do that better, we’ll see such a positive increase in, in relationships, growing with, with others. Right.

Brian Pruett: [00:32:29] So you talked a little bit just about it being part of the community. But why is it important for you personally to be a part of the community.

Tim Rogers: [00:32:35] Important for me to be a part of the community? I’m passionate about that. I, you know, and I’ve I’m a faithful kind of man. I’m a spiritual kind of man. So I think that speaks to what I believe spiritually and faithfully as well. Um, so, yeah, it’s important to me. It’s important to my family. Plus, I love I love making people smile and I love, I love providing good energy to people as well.

Brian Pruett: [00:32:56] Awesome, awesome. Well, imagine Tim, thanks for sharing a little bit of your stories. Don’t go anywhere because we’re not done with you yet, but we’re going to move over to Mr. Neal Murphy. GrassRoots Turf. Neal, thanks for being here this morning.

Neal Murphy: [00:33:08] I appreciate you having me.

Brian Pruett: [00:33:09] So, uh, Neal is another one that gives back to the community you jumped aboard this year and, uh, as well as one of my sponsors for trivia, so I appreciate that. So you’re welcome. And, uh, you do a lot within the Bartow County area. Um, you have taken over a role for, uh, co-host as the Cartersville Business Club. Um, so if you don’t mind, just share a little bit about your background and we’ll talk about grass roots.

Neal Murphy: [00:33:32] All right. So I’m, uh, born and bred in New England, actually in Boston. So my first 30 years there almost in, I think the same house the whole time, um, you know, grade school I went to. A Boston College high school in Dorchester. And then I went to college. Stonehill College in Northeastern, myself and all my my sister and all my brothers, we all went there. Um, and then I got married at 98. Sorry. I got married in 96. And then we moved down to Charlotte in 98 for a bed. The weather. Boston’s a great place to grow up as a kid, but when you get as an adult, the snow can really get on you. It gets a little more difficult. So we moved down to Charlotte and, uh, 98, and then I worked for a law firm down there. But I’m a technology guy by trade. I’m not a lawyer. Um, and then I in 2004, we kept coming down to Atlanta because the, the law firm that I worked for is based down here and actually had one of my brothers actually lives in Woodstock and has been down here since 93. Okay. Um, so I have two kids. Both were born in Charlotte, so I have a 24 year old son, um, who graduated from UGA just a few years ago and now works for PricewaterhouseCoopers in Atlanta. And then I have a 22 year old daughter who went to Kennesaw. I know you’re an owl. Yes. And, um, and she’s now the manager of the Palmetto Moon here in canton. But she’s like a also an entrepreneur as well. She’s run a few of our own kind of small businesses, which is pretty fun, um, and exciting. I am divorced, I got divorced a few years ago, but my ex-wife and I get along great. She lives down in Dallas with her parents, and I’m obviously now over in, um, Cartersville, and, um, and everything’s going pretty great.

Brian Pruett: [00:34:57] Well, you talked about the Boston, and it was funny because, you know, last week was extremely cold. Very. And you and I got there early. I always get there early, set up chairs for the CBC. And you said, this is why I got away from Boston. Exactly. I thought you brought it with you, but I came down.

Neal Murphy: [00:35:11] Here to get away from it. So.

Brian Pruett: [00:35:13] So we talked about it because like I said, you’re very active. You you’re also, uh, now a chamber ambassador. I am for the actually this.

Neal Murphy: [00:35:20] Year, especially this.

Brian Pruett: [00:35:21] Year. Yeah. Um, and you do a lot of things. I said, like I said, the co-host for the CBC. So why is it important for you to be part of the community?

Neal Murphy: [00:35:28] So my new like a franchise owner the last four years with grass roots. Right. And so it’s the first time I’ve actually been a business owner before. And so many people helped me out, especially those first couple of years, to kind of get going because everything was so new to me. I was in a, you know, new type of business environment. I was in a new, you know, city working with different people. And, you know, I just needed a lot of help in, you know, the chamber was great. Cartersville Business Club was great. And so, you know, I get to the point where, you know, I kind of built up the business big enough that I could then afford the time to do so. That first year or so, I was out in the field spraying lawns, you know, with my technician, you know, every day, all day and then trying to kind of work at night to kind of keep the business going. This past year, 2023 was probably the first year that I actually had time to kind of get back out there and give back, because now I had two technicians, and then I have a part time administrative assistant, so she could do a lot of the office stuff for me.

Neal Murphy: [00:36:17] And so I was able to, you know, participate a lot more in the business club. Right. You saw me there almost every week. Um, I go to a lot of, uh, like, chamber events. I go to a lot of different events around town when I can, even though I’m a chamber ambassador. This year, officially, I went to a lot of ribbon cuttings last year, as many as I could. I tried to, um, in Facebook this past year, just, you know, post about a lot of that, you know, not just about, you know, my business. Obviously, I’m trying to, you know, you know, sell my services as well, but I’m trying to, you know, help others who have helped me. So I try to post about their businesses, maybe people who are providing me services, you know, want to give them a shout out because I want their business to be successful as well. And I really enjoy doing that. Right.

Brian Pruett: [00:36:54] Well, that’s the thing when we don’t talk about that, but being very getting active when you’re networking, don’t just come, you got to get active. Right. And so I think we’ve all done that. But you’ve really done that this year too. So um, so you also do jujitsu.

Neal Murphy: [00:37:08] I do. I do.

Brian Pruett: [00:37:10] Do that keep you in shape or.

Neal Murphy: [00:37:11] I do.

Neal Murphy: [00:37:12] So I did taekwondo over ten years ago in my ex-wife. And I did that because our daughter was doing it. And so instead of watching the class, I said, hey, why don’t you guys do it too? So we did that. That was a lot of fun. So my wife and I, my ex-wife and I and our daughter are both black belts, all black belts in taekwondo. That’s cool. But that was over ten years ago. And so as I came to, uh, working with grassroots, I probably lost 30 pounds in my first year or so because I was spraying lawns. It’s a lot of physical activity, which felt great. It was awesome eating a lot better. Um, but then as I had a few people working with me, I was in the office more and I was like, uh oh, you know what I mean? Like the weight was starting to come back on. I wasn’t feeling as good, so I tried to look for, I’m not going to go to a gym. I’ll sign up for a gym, but I won’t go. I know I won’t, right, but I love we did a little bit of jujitsu when I was doing taekwondo, and so I said, oh, I wonder if there is some facilities around here? And I did find one.

Neal Murphy: [00:37:57] There were several in the Cartersville area, but I found one up on Main Street that I joined, uh, last year, a year ago February. Um, great bunch of people, you know, was there kind of several times a week. They unfortunately had to close in December of this year. Um, I think the, you know, the lease got raised, but they opened up a new facility in Acworth, which is probably twice the size. And it’s great down there. I just couldn’t afford the time to kind of drive down there, just, you know, too far several times a week. Um, so I found, uh, another place, Team Octopus, which I just joined last week. Right. So I’m going to go and kind of 2 to 3 times a week, and I’m, I’m kind of feeling good again. I’m a little I’m actually sore right now because of it. But uh, after a few weeks, I’ll be I’ll be back in it again.

Brian Pruett: [00:38:34] Can you explain the difference between that and taekwondo?

Neal Murphy: [00:38:36] So taekwondo is more like striking kind of on your feet, whereas jujitsu, you go into the ground and you’re kind of wrestling. And so I like jujitsu better. One is it really is a better workout, um, you know, physically. But two, if you ever get in any type of, you know, altercation, hopefully you don’t. At some point you go into the ground and once you’re on the ground, you’re not getting back up again. So you got to know how to, you know, defend yourself and kind of deal with things. So. Right. And I love it. That’s a lot of fun. And I met some great people.

Brian Pruett: [00:39:02] There you go. Yeah. Well we we talked about it. So share I know you’ve got several stories, but share a positive story of the networking you’ve done. All right.

Neal Murphy: [00:39:09] So I’ll give you it really surprised me. So Brian and I know Ann say she’s a brand photographer. And so, you know these networking groups are great. But we you know, people try to have one on ones outside of that. So Ann and I had a one on one because I was interested in doing some brand photography. So she and I met at a coffee shop and I’m coming. You know, I’ve got notes and I’ve got all these questions. And I know she had a tight schedule that day. You know, we were meeting at ten. She had a meeting at 11. I said, okay, and I’m ready to dive right in. We probably spent the first half an hour just talking about like personally each other, and I wasn’t ready for that. But Ann started that way and I’m like, I’m looking at my watch like, are we ever going to talk about like, you know, you know, the business? And I was and then I realized she had done that on purpose to kind of like build our relationship together, which, you know, made our business relationship that much better. And then I, you know, realized and I had never done that, like in in Boston, we kind of didn’t one on one that way. It was just, yeah, you’re friends, but you kind of talk about business here. It was like totally different. It was really weird. And so ever since then, every one on one I’ve had, you know, I’ve, I’ve approached it that way and others have as well. And I’ve just established some really great relationships with some awesome people. And that’s turned into, you know, not only business relationships, but really great friendships.

Brian Pruett: [00:40:16] Well, and we, uh, we do a thing with the Cardinal Business Club, uh, every so often, the reciprocity ring. The first time we did it, you asked for some stuff and you walked away with, well, how many referrals?

Neal Murphy: [00:40:26] Like like three, like I. Um, I was using an accountant out of Houston, and I’m trying to bring things more local. Right. So it’s looking for a local accountant. So our friend Jay recommended someone right away. And so now I’ve since hired that person. It’s working great. I mean, you know, my accountant, I’m trying to work with more local social media people, local SEO people, you know, all the digital kind of marketing things I’ve been doing. And it’s been great. It’s been awesome. Really much better relationships.

Brian Pruett: [00:40:50] And I think that’s cool because, you know, a lot of people, again, they come in and they want to think about themselves and sell, sell, sell. Whereas, you know, if you’re there to help from other people and somebody asks for something, I mean, I, you know, when you ask for I sent you a ton of people, right? Right. So it’s Bryan.

Neal Murphy: [00:41:04] Knows a lot of people.

Brian Pruett: [00:41:06] Um, so I again, we talked about you being involved in our community, but why is it important to be part of the community?

Neal Murphy: [00:41:12] I just I mean, we talk a lot about, like, giving back. But again, you know, so many people helped me. You know, when I first started out a few years ago as a business owner, you know, I was just extremely grateful because you could not do it on your own. You just can’t. You think you can. You can’t. And, you know, as I got to the point where I now had time to do that for others, I started doing more of that, either hiring people to provide services for me or just, you know, kind of like what you do, Bryan, you know, providing people referrals or recommendations or directing people over to someone, you know, for service. Um, it’s just, you know, we talk about kind of collaboration right over competition. Right? We’re trying to like, collaborate with each other, help each other both personally and professionally. So it just just it’s a great feeling doing so.

Brian Pruett: [00:41:54] And I love the collaboration over competition because there’s multiple insurance agencies, there’s multiple mortgage people, real estate. But not everybody does the same thing. Right. And there’s plenty of business out there for everybody. Um, and of course there’s people that, you know, like and trust and people that you don’t know, like and trust. So, yeah, uh, uh, you want to share a little bit about the CBC when we meet and all that good stuff.

Neal Murphy: [00:42:15] So the Cartersville Business Club, as far as I know, has been in place about two, two and a half years, almost three years. There’s some history kind of prior to that. And I think, um, so we meet every Wednesday at 8:00 at the Unity Grounds coffee shop, um, in right outside of downtown, uh, Cartersville. Um, so we network from like 8 to 830 and then from 830 to 930, we have a more quote unquote, kind of formal meeting, you know, going around the room, people can kind of share, um, information about the businesses. We do a lot of shout outs. We have some special education, um, sessions, uh, we have some kind of member profiles. People will talk more about their business in more detail or maybe something, you know, personal about them, which has also been helpful. And we get a good crowd about, you know, 30 to 40 people, even when, you know, that day it was ten degrees. 12 degrees. I was surprised I was too. We got a full crowd there.

Brian Pruett: [00:43:01] And ever so often you’ll have three people give dad jokes.

Speaker5: [00:43:04] So I need to go there.

Brian Pruett: [00:43:07] Yeah, it’s a lot of fun. Do you?

Neal Murphy: [00:43:08] Should come. Everybody is welcome. Doesn’t cost you anything.

Brian Pruett: [00:43:10] That’s right. Um. All right, so let’s talk a little bit about grassroots. All right. Uh, as you mentioned, it’s a franchise. It is. So first of all, how did you decide to go from working in a law firm, being in tech world and then getting into the grassroots? So, I mean.

Neal Murphy: [00:43:25] You know, a little over 30 years of, you know, going into an office every day, you know, the, you know, the the commute, the, you know, office politics, that you’ve just seen the same people every day. I just I’m just good. And you and you put on the weight a little bit, right? I call it The Office, but you definitely do. And it’s time consuming. Like I’d be leaving, you know, my house six in the morning. I might not get back until seven at night because of, uh, you know, the commute and traffic and stuff like that. Um, and so, and I always wanted to, you know, at some point kind of kind of own and run my own business, you know, but as you know, I was up towards 50. I’m like, well, am I going to start something from scratch? What can I do? And someone said, oh, why don’t you, um, why don’t you consider franchising? I’m like, oh, franchising. What do you think about you think about food, right? You know, I don’t want to on a subway. That’s not what I want to do. They’re like, no, no, no. So I went to a, um, uh, a franchise expo. Um, here in Atlanta, I met Josh wise from grassroots, who I kind of knew, but not on.

Neal Murphy: [00:44:15] I wasn’t friends with him, but I knew about him. He had just started to franchise. He was at the end of 2019. Um, so long story short, I’m franchisee number four, and there are now 12 of us over the last, you know, 4 or 5 years. And we’re adding a few more kind of every year. So our corporate office or that main office is located down in Acworth, which is only about 11, 12 miles from my kind of base of operations in Cartersville. Um, but again, we have so 12 different franchise owners. Most are in Georgia, but we cover three other. They’re in three other states, uh, North Carolina, Louisiana, Mississippi, and they’ll soon be one in, uh, Alabama. And a lot of us own multiple territories. So I own two, which is, I call it Grassroots North Georgia. But it’s that whole kind of Cartersville, Rome, Calhoun area and then all the way over, kind of this way towards ball ground Jasper, all the way over to Dawsonville and Dahlonega. So, okay, a good physical right territory. But I’m, you know, I’m only going about, you know, 20, 30 miles right now. But the idea is to scale over.

Brian Pruett: [00:45:10] Time, so. Sure, sure. Exactly what you guys do.

Neal Murphy: [00:45:12] So we it’s tough. So we don’t cut grass and we don’t install it. Right. So I’m not a landscaper. I’m not a grass cutter. So we’re the ones who spray the lawns for, you know, he likes the weeds. You know, green green grass and no weeds. That’s kind of what I say. Right? So we’re the ones that kind of like a true green. That’s kind of. A big company that everybody knows about, but we’re more kind of local and I think we provide better quality. Um, but the idea is, you know, keep their grass green, kind of keep the weeds out. You know, if there are issues like insects, fungus, things like that. You know, those are, you know, special circumstances and we’ll address those as well.

Brian Pruett: [00:45:43] So I’ve got a few questions on that. So you shared something not too long ago at CBC that I even thought about, about when the leaves were falling. Right. Talk about about that because I just assumed you just leave and go, or do you rake them up or whatever? But why is it important?

Neal Murphy: [00:45:57] What a lot of people will do is they’ll let all the leaves fall and then they’ll rake them. They might not even rake them. Once they finish falling, they wait until the end of the season, then rake them. And that’s a really bad right? So even though especially warm season grasses will go dormant, right? They’ll start to turn brown and people are like, oh well, I don’t need to worry about it. That’s not true, right? Grass still needs sunlight and it still needs water. And if you have all those leaves or like pine needles, things like that, that doesn’t allow the sunlight to get in there, and it doesn’t allow water to kind of permeate and distribute kind of properly. So it really is. And you know, you want your grass to look good, but so you want to get that all off the grass that sticks the branches. Um, get as much of that off the lawn as you can, and your grass will be a lot healthier come spring time.

Brian Pruett: [00:46:36] When you guys spray. Are you is there certain kinds of spray that you use? Things of that nature.

Neal Murphy: [00:46:42] So lots of different types of chemicals, right. So certain chemicals you can use on certain grasses and not others, certain you can only use in certain amounts, either in a given year or in a given application. Um, in certain products you can combine together, certain ones you can’t. So you got to be kind of kind of knowledgeable about all those things. So we’re mixing chemicals in the trucks every day depending on what our applications are. Kind of like that day and that week, all that’s um, you know, recorded, you know, I track all that, um, you know, we spray so many gallons a minute per kind of 1000ft. And it kind of gives us an idea as to how much chemicals we need to cover a particular property based on the size. And so, yeah, there’s just there’s a lot of math, a lot of math that goes on.

Brian Pruett: [00:47:23] In a day. Not all grass is the same either, right? Correct. Correct. So how do you figure out what to use for what grass.

Neal Murphy: [00:47:28] So most of the grass that people are aware of, the stuff that turns brown in the wintertime. That’s considered the warm season grass around here it’s mostly either Bermuda or Zoysia. There is some centipede here though. We don’t like to see it around here. It really belongs more, you know, middle Georgia down in Louisiana where it’s more kind of moist. It thrives a lot better down here. So, um, so we do our best with, with centipede and that Saint Augustine up here. Fescue is the other one. So fescue is the grass that’s quote unquote green all year long. The problem is the temperatures in North Georgia are really not conducive for it. So you really struggle, especially during the summertime, to keep your fescue grass green and even alive, um, just because of the sun and the heat. So tends to do better as you get more towards the Carolinas, or if you have an area that’s very shaded, you know, wooded areas, shaded backyard, things like that, the fescue will do a lot better. The fescue grass is also well, people talk about overseeing. So you don’t oversee the warm season grass. It grows in addition to vertically. It grows horizontally so it can fill itself in. And there are ways to promote that. Fescue grass doesn’t work that way, right? Every seed creates a clump. Bunch of clumps together. Create a lawn. Once you lose a clump of fescue, it’s gone. And not not to be, you know, recovered unless you reseed in that something you do every fall. So when people talk about overseeding, they’re really talking about fescue, or they should be talking about fescue. And then that’s it’s, you know, so it’s growing seasons like fall through spring and then you’re trying to maintain it in the summer. Warm season grasses are the opposite growing season spring through fall. And then it goes dormant in the winter. So it’s fairly easy to maintain as long as you keep the the leaves and the sticks off.

Brian Pruett: [00:48:57] What about because I know some of our neighbors, they put like turf down. You know, I’ve seen come in with just the squares of grass and they put them. Oh some sod. There you go.

Neal Murphy: [00:49:06] Yeah. So even though like, you know, warm season grasses can fill in, but if you have like a, you know, a mass, it’s I mean it’ll fill in over time, right. Small areas, you know, four feet or less kind of in diameter. You could probably fill that in over a season. But when you have like a whole front yard, you need to redo, then obviously you bring in, you know, pallets of sod that you get at a sod farm, which is grass that’s already been grown, cut up in squares or, you know, rectangles. And then you kind of lay that all down. Eventually that kind of grows together and then you have a nice lawn. So that’s just a quick way to do it. But it also is expensive, man.

Brian Pruett: [00:49:38] You just maintain that the same way. Like you’re like you’re talking about with the spraying. Yeah.

Neal Murphy: [00:49:41] Yeah. I mean once it’s, you know, once it’s fully rooted. So once it’s established then you would treat it just like any other lawn.

Brian Pruett: [00:49:46] Okay. Yep. Um, what about I know, like, my mom’s backyard is pretty much just, um. It’s not really. It’s not mold. What am I what’s the word I’m looking for? Moss. Moss? Yep. Uh, mold. Moss is all the same thing, right? Tomato, tomato. Uh, do you guys have anything for moss? So.

Neal Murphy: [00:50:01] Yes, but moss is environmental, and I try to explain that to people. So Moss is there for a reason. It’s usually too much water, not enough sun or just the soil is not great, probably too compacted. So even though they make products that can kind of get rid of moss, it’s only temporary. The moss is always going to come back unless something in the environment is changed. Unless you bring in some more sunlight, you redirect some water away. Or perhaps you can, you know, soil amendments or bring in some some better soil to allow. The grass to grow better. So we get that question a lot. And I you know, we have products like mosques. There are some products that can kind of quote unquote, get rid of the mosques, rid of the mosque. But it’s only temporary. It’s coming back because of the environment. So, right. I just say my my terms is embrace it. Right. If because people some people like love their trees, you can I mean there is some amazing things people can do with moss to make it look really, you know, you know, pretty they, um, you put some kind of benches around it. Some people have built little like, um, kind of like put a dry creek bed between it, put a little bridge over it. I mean, some amazing. I’ve got some pictures of some of the things our customers have done with their kind of moss areas that look beautiful.

Brian Pruett: [00:51:03] Well, um, so I just had a question and it went on my head. Hang on. Um, well, uh, this is what I was going to ask. Kind of the same thing when you’re looking for agent, when you’re looking for a service like yours, there’s again, multiple services out there. What’s the best way to go about choosing the right one?

Neal Murphy: [00:51:21] I mean, it depends on what’s important to you. Obviously, you know, price is important. You know what you want your grass to look like, what type of communication you do or don’t want with a service provider. You know, I mean, I’m not the I always say I’m not the cheapest out there, but I want to be the best, right? So I want to provide a good, you know, quality service. I want to be able to communicate with customers. I want to do it at a reasonable price. Um, if there are issues come up. I want to be able to work with the homeowner to kind of work through some of those. So a lot of homeowners that maybe switch from some of the larger companies, it’s always the same thing, right? You know, different technician every time. They don’t come when they say they were going to, they’re not really communicating with me. They charge me for something I didn’t ask for. Um, I’ve been, you know, I’m waiting for a supervisor to come out and they still haven’t come, you know, things like that. And so, you know, I’m very aware of that. And I’m again, we’re small enough and local enough that we can address those. And I kind of want to stay that way, you know what I mean? Like. Right. I think when you get too big, it, you know, those things start to come into play. So you’ve got to be you got to be careful.

Brian Pruett: [00:52:19] I’ll throw this into when you talked about the price, uh, you know, even if it may not be the most expensive or the least expensive, it all comes to your relationship too, right? If you can’t trust them. So I have a question. Uh, you mentioned the certain areas that you service. You can’t really go to other areas if there’s already somebody in those areas. Right. But what if what if the person wants you specifically? How do you handle that?

Neal Murphy: [00:52:44] So, you know, I’m you know, I am bound by contract so I can our territories are by zip code. And I’ve been asked this many times. One is you, Brian. Right. So and I’m kind of Cartersville is kind of like the a southern side of where my territory is. I do go into Emerson, but then that’s as far as I go. In fact, I have to cut through Canton on Highway 20 to get over to battleground. And there are two neighborhoods I passed by all the time, but I can’t service those because those are technically a canton address. Those are canton zip code. Um, so yeah, I don’t want to be, you know, I don’t want to be. I don’t want to say I want to be caught in those zip codes. I would never do that. But the same reason if I saw a grassroots truck that wasn’t mine in one of my zip codes areas, I’d. I’d kind of have an issue with that, right? I mean, right, why would they be doing that and vice versa. And it comes up all the time. So, um, you know, I try to work with whatever franchise owner or the corporate office kind of owns that area to say, hey, this is a good customer of mine. It’s their son who has a place down here, you know, make sure you take good care of him. I want you to know these two guys are kind of related, and, you know, they’d like me to go down there, I can’t, so. Do the best you can to to do what I do.

Brian Pruett: [00:53:47] And is that typical with with basically like kind of all franchises I’m guessing.

Neal Murphy: [00:53:51] Right. Yeah. I mean, you know, here in this area, a lot of our franchisees butt up against each other, right? So 4 or 5 of us, maybe six of us brought up against each other. But, you know, the guy in Charlotte, North Carolina, it’s just him. So he doesn’t have to, you know, any other grassroots franchise there yet? Um, the guys in Louisiana by Baton Rouge, they’re the only ones, the guy in Jackson, Mississippi, the only one. But his you know, as we have more franchisees in those areas, you know, that that issue will come up. And the idea is, again, we’re collaboration too. We’re franchise. We’re trying to help each other. We’re not trying to compete against each other, you know, because if you know, if if they go and do a great job, that helps out me, and if I do a great job that helps out them, especially if we’re geographically close together.

Brian Pruett: [00:54:31] Right. Um, all right. So you’ve already given the tidbit about the leaves. Is there any other tidbits people for their lawns? Because I know when I was growing up, I never we never I never saw trucks like yours going around spraying and stuff like that. So I’m guessing it might be a fairly new type of industry, but what kind of, uh, other tidbits can you share?

Neal Murphy: [00:54:48] So aside from keeping things off the lawn keep, especially during the growing season, keep the grass cut on a regular basis. Right. So one of the reasons, you know, weeds, even if you’re having sprayed it, you know, even the weeds will pop is if you give them time to do so. So if you’re cutting your grass on a regular basis in warm season grasses once a week, I would say minimum. I do my my office property. I’m doing it every four days. I’m not suggesting a homeowner do that, but at least every week. But some of my customers are like, oh, I do it every two weeks, or I do it every week and a half. It really is too long because Bermuda grows really quick. And so you give the ability for especially weeds that you might not see yet to kind of pop up. Um, and by the time a week and a half, two weeks comes along, then we’re, you know, now we’re chasing it, you know what I mean? And now it looks kind of worse than it probably would have otherwise. So on a regular basis.

Brian Pruett: [00:55:34] Is is there a certain like, how do you determine how low or how high you cut your.

Neal Murphy: [00:55:37] Grass. So Bermuda grass, ideal inch to an inch and a half. Some people like to go higher. Some people go lower with like a real mower. Get it like carpet. You can do that too. Um, a lot of it depends on just the contour of the property. Right. So if you don’t want to run a mower and you have like a little rut and all of a sudden it just like grinds everything, you got to kind of factor that in. So you don’t want to be, you don’t want, you know, bare dirt anywhere, right? As long as you have grass, that’s good. But inch to an inch and a half for Bermuda, a little bit higher for zoysia, maybe close to an inch and a half to two and then fescue a little bit higher. 3 to 3 to four inches. Okay.

Brian Pruett: [00:56:09] Yep. Two other questions on this. So one uh, I know my mom’s yard has the little seedlings and the little pine trees that come up, right. Yep. Do you guys have stuff that takes care of that as well.

Neal Murphy: [00:56:19] So no. And there actually isn’t a product. So those, uh, the seedlings from like a pine tree in the area. So the best thing for those is cut them because once that’s one, if you actually cut it, you’re going to damage it. And within, um, a few weeks they’ll actually all die. So just mow them, okay. And if you could mow them up, like mow them and bag them. Right. Um, that would be better. But yeah, there isn’t really a it’s a, it’s a tree is what it is. Right. So just like any other, you know, sapling that might be growing if you just if you just kind of cut that, um, you’ll damage it and then eventually it’ll die.

Brian Pruett: [00:56:46] Okay. And then what about those weeds that always look so cute and pretty? Like they’re very like flowers, but they’re really weeds, right? Like dandelions, things like that.

Neal Murphy: [00:56:54] I mean, you should. I mean, if you’re getting your lawn treated, you should never see a dandelion. Those are the easiest ones. So the the weeds that are most difficult to eliminate are some of the grass weeds. Right. Dallas grass a lot of people know about that. That’s, you know, just very aggressive. Usually takes seasons to get rid of. You can actually go in and hit it with a roundup to really kind of nuke it and get it out of there. But then you’ll you’ll nuke everything around it for a while. Um, Dallas grass, not such a big one that pops up. Um, these are things that don’t have pre-emergent, right? So it’s always you have to see it first before you address it. So those are kind of looks like fescue but little kind of thin blades of grass. Um, we do have products for that. And um oh brooms. Broom sedge is the other one. And it does. It looks like a broom. And that’s also, you know, can be pretty aggressive and aggressive weed. That’s tough to address. But there are products for that. You just got to hit it hard and hit it off. Right.

Brian Pruett: [00:57:43] Yeah. So I’m just curious because I you know like I said, dandelions, they look very pretty and cute. How do they damage the yard. I mean, do they are they doing any damage for your grass or something? You just.

Neal Murphy: [00:57:53] I mean, so when weed starts to grow, what they do is they, you know, they take the area that the grass should be. So it actually kind of like, you know, it can damage like turf roots and kind of like kind of quote unquote, move the grass out of the way. So once you get rid of the weed, now you have a little kind of bare spot again. And if you have and I someone mentioned crabgrass, I heard you guys whispering crabgrass. It’s true. If, you know, crabgrass is very aggressive. And if that you know, I’ve had lawns crabgrass has taken over to most of the lawn. Well, once you get rid of it what do you have left? I mean it’s, it’s dirt. So the quicker you can stay on top of that, um, those types of weeds, the better because some of them can grow quite quickly.