Show Summary

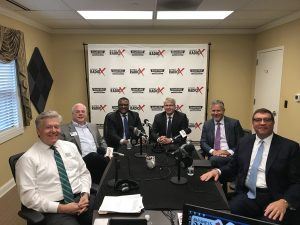

A team of senior officers from Cadence Bank, led by CEO Sam Tortorici, joined this edition of Frazier & Deeter’s “Business Beat.” Topics included the recent merger with State Bank & Trust, serving Georgia and the North Fulton market specifically, and . This inspiring story of business success is brought to you by Alpharetta CPA firm Frazier & Deeter.

Cadence Bank

Cadence Bank is a regional bank that excels in two areas – above and beyond. With locations in Alabama, Florida, Georgia, Mississippi, Tennessee and Texas, Cadence provides corporations, businesses and consumers with a full range of innovative banking and financial solutions.

Committed to helping its clients succeed financially, Cadence’s experienced bankers take the time to discover more about their clients’ banking needs and pain points, building long-lasting relationships that work. This is accomplished through an array of services including commercial and business banking, treasury management, specialized lending, commercial real estate, payroll and insurance services, SBA lending, foreign exchange, wealth management, investment and trust services, financial planning, consumer banking, and mortgage lending.

See why Forbes ranks Cadence among the “Best Banks in America”.

Learn more at cadencebank.com.

Sam Tortorici, CEO of Cadence Bank

Sam Tortorici is Chief Executive Officer and Director of Cadence Bank, N.A. and serves as President of Cadence Bancorporation. Tortorici has served in this role since July 2011, during which time Cadence has completed four acquisitions, raised debt capital and completed an Initial Public Offering to support the bank’s growth. Today, Cadence ranks as the 75th largest bank in the country.

A Birmingham, Alabama native, Tortorici graduated from the University of Alabama’s School of Accountancy. Upon graduation, he began a 24-year career at Regions Bank and predecessor AmSouth Bank where he held a number of senior commercial, finance and general banking leadership roles, including Chief Financial Officer of AmSouth and head of Regions’ Commercial & Industrial and Specialized Industries business. While at Regions/AmSouth, Tortorici held other key leadership positions for sales and service across a variety of business units, including Central Region President overseeing the Alabama, Georgia and South Carolina markets. He also led a failed bank acquisition by Regions in the Atlanta market and helped to sizably grow Regions’ presence in Metro Atlanta.

Tortorici resides in Atlanta and presently serves on the board of directors for the Metro Atlanta Chamber of Commerce and the Buckhead Coalition.

Randy Schultz, Managing Director, Specialized Industries

Randy Schultz has extensive banking experience, having held leadership roles in commercial banking, corporate and investment banking, and global treasury management. He formed Regions Banking Group (RRB) in April 2009 and prior thereto managed Bank of America’s Restaurant and Beverage Finance Group (“RBFG”) from 1996 to 2006. Schultz joined Cadence Bank in 2011, and as the Managing Director, Specialized Industries is responsible for leading delivery of the full range of Cadence services to branded restaurant, technology and healthcare companies. He also oversees Cadence’s SBA business. Randy and his wife Cathy live in Roswell, GA where he is the chair of the Roswell DDA and a member of Art Around Selection Committee.

John W. Jackson, Atlanta Commercial Banking Regional President

John Jackson has been a banker in Atlanta for more than 30 years, having advanced through the leadership ranks of Atlanta’s most prominent middle market banks. He spent 15 years with Bank South focusing on retail banking, consumer lending, mortgage lending and commercial lending. In 1991, Jackson joined SouthTrust where his leadership responsibility grew from regional manager of East Metro Atlanta in 1991 to regional president of SouthTrust in Jacksonville, Florida. In 2004, Jackson co-founded Bank of Atlanta and served as its president and CEO. He built the bank into a profitable $230 million operation before it was acquired by State Bank and Trust in 2014. Jackson currently serves as Atlanta Commercial Banking Regional President of Cadence Bank, previously State Bank and Trust.

An Atlanta native, Jackson serves on the boards of the Winship Cancer Institute, Covenant House of Georgia, Carter Center Board of Councilors, Desire Street Ministries, Soloman’s Temple and Kaiser Permanente. He holds a Bachelor of Business Administration from the University of Georgia and serves as a member of the Terry Dean’s Advisory Council.

BJ Green, Georgia Commercial Banking Executive

BJ Green oversees the strategic development, growth, quality and profitability of commercial middle market activities for Cadence Bank in Georgia. With more than 25 years of industry experience, Green previously served as senior vice president and commercial banking team manager for SunTrust Bank’s Atlanta division, where his team focused on meeting the banking needs of companies in the food and beverage, manufacturing, distribution, logistics, goods and equipment, and energy sectors. Green joined SunTrust Robinson Humphrey, Inc. in 2007 in the syndicated and leveraged finance department before moving to oil and gas investment banking in 2013. Prior to joining SunTrust, Green was with Banc of America Securities, LLC for seven years and Wachovia Bank for five years. He holds an MBA from Emory University’s Goizueta Business School and received a bachelor’s degree from the University of North Carolina at Chapel Hill.

Frazier & Deeter

The Alpharetta office of Frazier & Deeter is home to a thriving CPA tax practice and Employee Benefit Plan Services group. CPAs and advisors in the Frazier & Deeter Alpharetta office serve clients across North Georgia and around the country with services such as personal tax planning, estate planning, business tax planning, business tax compliance, state and local tax planning, financial statement reviews, financial statement audits, employee benefit plan audits, internal audit outsourcing, cyber security, data privacy, Sarbanes-Oxley (SOX) and other regulatory compliance, mergers and acquisitions, and more. Alpharetta CPA professionals serve clients ranging from business owners and executives to large corporations.

Bradley Carroll, host of this edition of Frazier & Deeter’s “Business Beat,” is a Principal in the Process, Risk, and Governance Department with Frazier & Deeter, CPAs as their Financial Services Practice Leader. Bradley also serves on the Financial Services Advisory Board of the Institute of Internal Auditors (IIA). As a member of this Board, he has advocated on Capitol Hill on behalf of IIA initiatives.Carroll has been a member of the IIA for over 20 years. He has given presentations on QAIP, Fraud, CoSourcing and OutSourcing, Annual Risk Assessments, Inherent vs. Residual Risk, Risk Assessment vs Control Evaluations, Data Analytics, BSA Independent Testing, IPPF, KPIs for Audit Committee Reporting, and has presented at the IIA’s All Star Conference, past Financial Services Exchanges, the IIA’s International Conference, various local IIA Chapters and various banking groups. He is a CPA, CIA, CFSA, CRMA, is Certified in Financial Forensics (CFF), and has a Qualification in Internal Audit Leadership (QIAL) by the IIA. He has a BBA in Accounting and is currently working on an MBA in Data Analytics.

Find Frazier & Deeter on social media:

LinkedIn: https://www.linkedin.com/company/frazier-&-deeter-llc/

Facebook: https://www.facebook.com/FrazierDeeter

Twitter: https://twitter.com/frazierdeeter

Past episodes of Frazier & Deeter’s “Business Beat” can be found here.