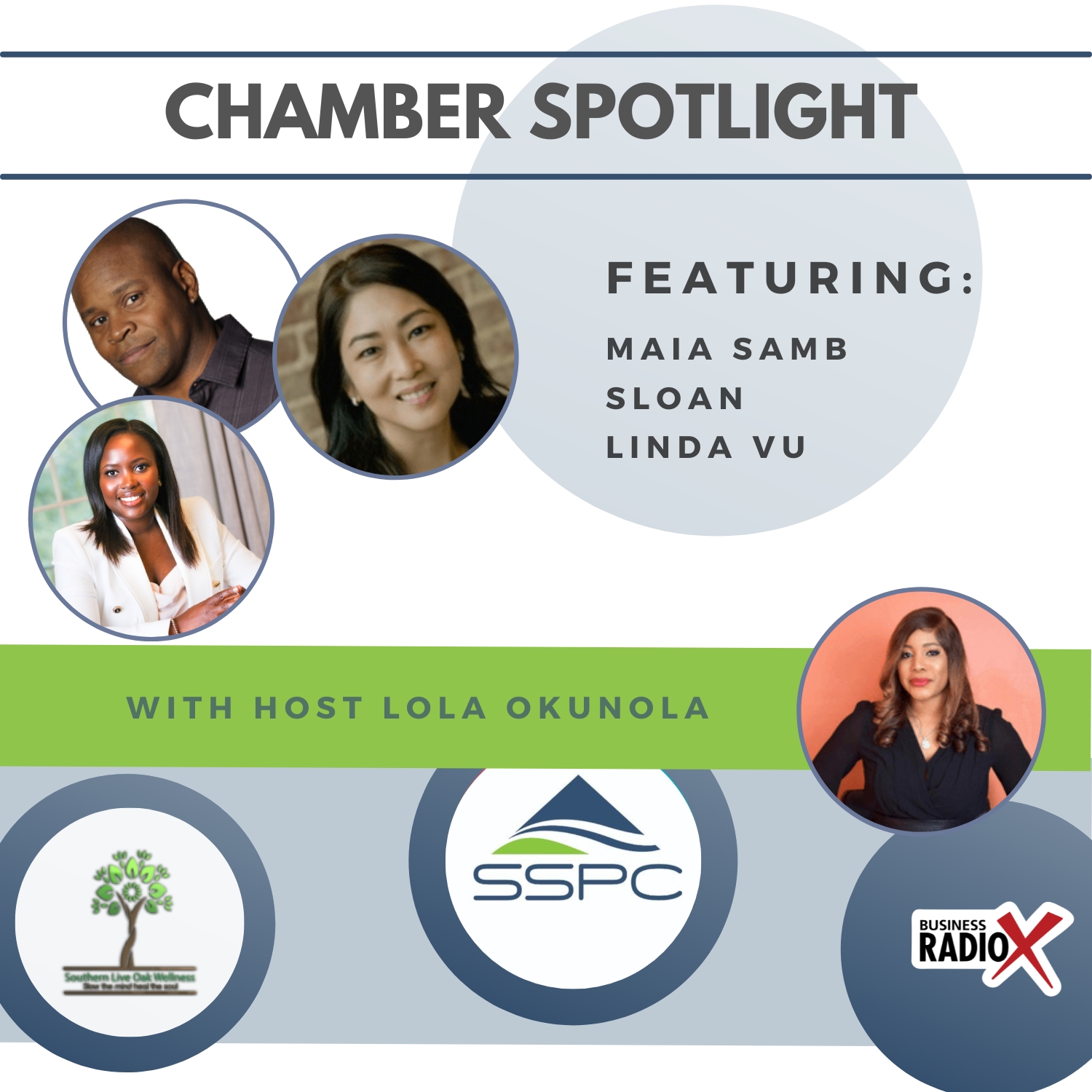

In this episode of the Chamber Spotlight, host Lola Okunola interviews Maia Samb, with Puttogo Global Group, Sloan, owner of Get Fit with Sloan, and Linda Vu, with BDL Advisors. They share their experiences and insights on their respective fields, emphasizing the importance of community involvement and collaboration.

Maia Samb is the founder of the Puttogo Global Group, a real estate firm based in Dunwoody, GA under Keller Williams Atlanta Perimeter. Puttogo offers full-service, creative real estate solutions to clients in the metro-Atlanta area, while offering a global perspective when working with real estate clients from all over the world. The team services clients in English, French and Spanish.

Maia Samb is the founder of the Puttogo Global Group, a real estate firm based in Dunwoody, GA under Keller Williams Atlanta Perimeter. Puttogo offers full-service, creative real estate solutions to clients in the metro-Atlanta area, while offering a global perspective when working with real estate clients from all over the world. The team services clients in English, French and Spanish.

Maia considers herself a multilingual global citizen having lived in 3 continents. Because of her background, Maia has a keen understanding of how to mitigate stress when it comes to relocation, and her clients greatly benefit from her unique global perspective in real estate.

Maia has 15 years’ experience in corporate marketing and communications, a Master’s in Strategic Public Relations and two undergraduate degrees. Before launching Puttogo Global Group in 2021, she was a top producing single agent in the North Metro Atlanta office, under Keller Williams Atlanta Perimeter.

Maia moved from France to Atlanta in 2008, where she has lived ever since with her husband and her two daughters. When she is not working, you will find Maia reading, traveling or enjoying exotic food somewhere around the globe.

Connect with Maia on LinkedIn and Facebook.

Sloan’s journey from a promising football career to becoming a renowned personal fitness trainer is both inspiring and indicative of his resilience. His background in sports, coupled with his academic achievements, particularly a Bachelor of Science degree with a minor in applied nutrition from the University of Oklahoma, showcases his dedication to both physical fitness and a holistic approach to well-being.

Sloan’s journey from a promising football career to becoming a renowned personal fitness trainer is both inspiring and indicative of his resilience. His background in sports, coupled with his academic achievements, particularly a Bachelor of Science degree with a minor in applied nutrition from the University of Oklahoma, showcases his dedication to both physical fitness and a holistic approach to well-being.

Despite facing setbacks due to injuries that curtailed his professional football aspirations, Sloan’s story takes a positive turn through extensive rehabilitation and the support of his physical therapist. This experience likely fueled his passion for helping others on their fitness journeys.

In 1997, Sloan took a significant step by obtaining his fitness instruction certificate from the School of Fitness and Nutrition, signaling the beginning of his career as a personal fitness trainer. Over the years, he has established himself as one of Atlanta’s top trainers, earning a solid reputation for his expertise and commitment to his clients’ success.

Sloan’s professional achievements include being the exclusive trainer for the 11Alive Wellstar weight loss challenge from 2011 to 2013 and for the Northside Weight Smart challenge. His involvement as the trainer for all 12 contestants on the Personal Weight Loss Journey further highlights his effectiveness and dedication to making a positive impact on the lives of those he works with.

Sloan’s journey reflects not only his personal resilience, but also his ability to channel his passion into a fulfilling and successful career. His story serves as an inspiration for individuals seeking transformation in their fitness and well-being, demonstrating that setbacks can lead to new and rewarding paths.

Linda Vu joined BDL Advisors in 2020 with over 20 years of experience in the financial industry, including more than a decade of Field Supervision, where she ensured that financial advisors stay compliant and act in their clients’ best interests.

Linda Vu joined BDL Advisors in 2020 with over 20 years of experience in the financial industry, including more than a decade of Field Supervision, where she ensured that financial advisors stay compliant and act in their clients’ best interests.

Linda’s passion for trustworthy financial planning ultimately showed her that she has a calling to work with clients directly. Linda will be serving clients in the greater Atlanta area and managing our Dunwoody location. Linda is a CERTIFIED FINANCIAL PLANNER™.

Connect with Linda on LinkedIn.

This transcript is machine transcribed by Sonix

TRANSCRIPT

Intro: [00:00:07] Broadcasting live from the Business RadioX studios in Sandy Springs, Georgia. It’s time for Chamber Spotlight, brought to you by Southern Live Oak Wellness, providing quality mental health treatment to a population in dire need of being treated as equal. For more information, go to Southern Live Oak wellness.com. Now here’s your host.

Lola Okunola: [00:00:42] Welcome, everyone, to another enlightening episode of the Chamber Spotlight podcast, proudly sponsored by Southern Life Oak Wellness. I’m your host, Lola Okunola, and today we have an incredible line up of guests representing real estate, fitness and financial planning. A big thank you to Southern Live Oak Wellness for supporting our community. Now let’s dive into today’s conversation. Our first guest today is Maia Samb, founder of Puttogo Real Estate. It’s a pleasure to have you on the show today.

Maia Samb: [00:01:22] It’s a pleasure to be here, Lola.

Lola Okunola: [00:01:24] Thank you. So, Maia, real estate is well regarded in our community, particularly in the perimeter area and especially right now. There’s so much buzz going on about real estate, to.

Maia Samb: [00:01:37] Say the least.

Lola Okunola: [00:01:38] Tell us, tell us some exciting things that are happening in real estate.

Maia Samb: [00:01:42] Yes, I am excited to be here and talk about it because I am number one, very passionate about real estate. And obviously we’ve all seen the headlines. They’re everywhere. Oh, market is tough. Market is challenging. Interest rates are too high. Well I want everybody to calm down because at the same goes like real estate is really stable. It’s one of those things that as human beings, we cannot yet manufacture until we find a way to occupy Mars. It is not expendable. So it is one of the best ways for people to build generational wealth and just be comfortable. Finding a place to call home is really important. So the market is interesting to say the least, because of obviously recent events in the global economic market, interest rates higher than the last three years. And yet historically, they’re actually below what we will say the average interest rates for the last 50 years. Right now, they’re right at 7%. So we do have a seller’s market still despite what buyers may think. And it is creating some very interesting dynamics between buyers and sellers right now.

Lola Okunola: [00:03:00] Yeah, I know I’ve been reading a lot about it. I think the interest rates dropped slightly. And so everyone’s running to refinance again.

Maia Samb: [00:03:09] Well, I wouldn’t say that the people who bought over the last three years or refinanced over the last three years are going to refinance out of 2 or 3% rates. Those rates are too good to be true right now. If I saw anybody offering that much, I would run and buy every piece of real estate I could buy. However, the buyers that were on the fence that were waiting for the rates to calm down a little bit are a little more enthusiastic now because the cost of ownership has gone down as the rates have stabilized a little bit and went under 7%. So that’s a good news for anybody who has been in the on the fence, I agree.

Lola Okunola: [00:03:48] So let’s dive quickly into what Parago does. What is your specialty? I know you do real estate in a different kind of way.

Maia Samb: [00:03:56] Yes I do. So I would like to say that, um, our actual full name is Parago Global Group. Okay. We want to make sure that people know we are the local experts with a global reach. And what that means. Obviously, you can hear my accent. I am not from here. I tend to joke that I am from the south, south, south, which is Africa, born and raised in West Africa, uh, grew up in France, where I studied until undergrad, moved here in 2008. The rest is history. Um, and really, one of the biggest things in my life has been moving around all the time. And every time that you move, it is brutal. Uh, moving is brutal, even when you are a local resident of an area, let alone when you come from another country. So I try to help the expatriates that are, um, calling Atlanta now home to feel like home and people who are moving out of Atlanta to not feel overwhelmed. Now, that doesn’t say that I’m our team doesn’t serve local because we really do understand the stressors that are involved with purchasing and moving from a home to another one. So we try to make the whole the whole experience stress free and give a very concierge service to people. And we operate under Keller Williams. I will have to say, okay. Yes.

Lola Okunola: [00:05:14] That’s great. That sounds fantastic. All right. Now joining us is Sloan, fitness consultant and owner of Get Fit with Sloan. Welcome to the show, Sloan.

Sloan: [00:05:28] Hey, thank you for having me. It’s a it’s a pleasure being here with you guys.

Lola Okunola: [00:05:32] So Sloan plays a crucial role in our overall well-being, right? Physically. And. You know, nutritionally. Tell us about your background, about your business. Any anything special that you want our listeners to hear about? Well, my background started.

Sloan: [00:05:50] I started off as a kid that was basically hyperactive, so to speak, and then my mom decided to put me in sports to calm me down. And from there I started playing football, running track, and then I specialized in football. And then I went on from there to, uh, play at the University of Oklahoma. And then I went from there to out with the Arizona Cardinals at the time. Uh, they call them Phenix now, but it was Arizona in the beginning, in the, in the early 80s. Stayed out there for about four years and, uh, didn’t make a full roster. But I did have an experience in, in athletics at that high level. And from there, due to a lot of injuries, uh, the guy that I was working with doing my rehab, he introduced me into really basically talked me into doing personal training because I was in the corporate. I was going to go into corporate world once my football career died out, but I didn’t really like that as much. So once I got into that, I went back to school reeducated myself in nutrition. A lot of mental work too, because it works in three phases your body, soul, you know, in your mind because a lot of times most people that have issues with their physical body is more mental, because sometimes what you feel on the inside shows up on the outside. And so I had to learn those dynamics. And working especially with, um, older people, uh, women, men, different stresses in life causes you to react differently. Some people eat more emotionally, some people work out excessively then they cause injuries. So you have to give yourself a complete balance. And when you’re working with yourself. And so all I am to do, I’m just a person that makes a person accountable. So that’s pretty much what I do.

Lola Okunola: [00:07:33] Hi. It sounds like your training approach is definitely different. Um, so tell us, like where are you located? Who is your target market? Like who who do you who is your like clientele?

Sloan: [00:07:46] Everyone okay. Everyone is my clientele. But the ideal client is someone who really wants to make a change from a health point of view. More so than esthetically. Because esthetics will come if you do the right thing. I tell people every day, if you you can eat the same diet, but if you cut it in half, you would actually lose the weight accidentally. But then when you want to go into the real truly at stake, that’s when you have to make your diet a little bit more detailed, count your macros and those kind of things. That’s where my expertise come in. But just everyday staying walking, staying active because I always tell people all the time working out is half of it, but the whole gist of it is 60% of it. You got to get moving. Yeah. And so what I do with a lot of individuals, I base a lot of things on functional training and what I mean by functional training, bending over, reaching over those things. Most people always hurt themselves, especially women trying to grab their purse. Men try to lift too heavy. They don’t use their legs. So each each group has their own drawbacks. And so, believe it or not, now you have this new trend out with all the dietary drugs people are using. Yeah, those things do work.

Sloan: [00:09:01] And it has put a lot of guys in my business out of business. Wow. Because what happened is because a person said, I’m taking these particular drugs, I don’t need to work out. I don’t need a trainer. But what they fail to realize over time, your body eats itself and uses up all your muscle. And so if you’re not. So what I’ve done with clients, they come in and say, so what do you think about me taking this particular drug? I say, sure, let’s do it. And I said, now this is what you need to do. Outside of that, they say, what do you mean? I said, you normally you need to learn how to eat, right? Do the proper thing, increase your protein intake, because that’s when you start losing a lot of muscle. And they say, I never thought of that because I have a friend. She takes this stuff and she’s very thin, but she’s not firm. I said, so this is what you need to do. Bring her over. So she comes over. Then she starts getting the muscle and then she starts looking better. And basically a person that I like to work with, or someone who’s willing to be open about different trends and not all the new fads. Um, that’s the ideal client.

Lola Okunola: [00:10:09] Yeah. Wow. Well, thank you. Thank you for sharing that. Thanks a lot. Uh, all right, now we are moving on to our next guest, Linda Vu, uh, financial advisor with BDL advisors here locally in perimeter area in Dunwoody. Um, tell us, Linda, tell us about BDL advisors. What you do. It’s nice to have you.

Linda Vu: [00:10:37] Thank you. Thank you for having me. Well.

Linda Vu: [00:10:40] Bdo advisors were a group of financial advisors. We we basically do holistic financial planning and also money management. And our clients are mostly business owners, retirees and also professionals. And so, um, as far as independent financial planning or holistic financial planning, we actually help our clients, um, with their various life events. It’s not about selling a product and walking away, but it’s about guiding and helping, helping our clients through their life and also helping their beneficiaries. And then to clarify on the independent side, what, um, you know, we don’t sell proprietary products. So, um, our models are based upon the client’s risk tolerance, time horizon and financial goals. So it’s based upon what makes sense for that particular client.

Lola Okunola: [00:11:33] Okay, that sounds great. So tell me who I mean. Financial planning. It sounds like something everybody needs to be doing, but I’m not sure that you work with everyone. What is your niche market like? Who who is your target? Do you do you have a minimum amount that someone has to come in before you start working with them? You know, what’s the criteria for you?

Linda Vu: [00:11:56] You know, our niche are really you know, most of our clients are business owners, okay? They’re mostly business owners, retirees and, um, professionals. And we don’t really have, you know, a specific amount. But we’re looking for someone who really wants leadership, who wants someone to help them with creating a strategy, and who’s going to take it serious and, and wants us to manage their assets.

Lola Okunola: [00:12:22] Okay. Wow. Well, that that sounds great. What are the, um, are there any, like, special. Programs or special areas that you? Is it real estate? Is it like particular investments? You know, education, college funds, any you know, are all of these part of what you help people with?

Linda Vu: [00:12:47] Yes. So we help our clients through various life events. And so what that basically means is, you know, a client might come to me and say, Linda, I’m about to get married. Okay. You know, help me make the good decisions on this. Or a client might be, you know, selling a business or purchasing a business or about to retire. So those are various life events or welcoming a newborn child, right. So we don’t have a specific, specific promotion or anything. But when we do holistic financial planning, we do put into consideration the client’s specific needs. And we help and we guide them that way.

Lola Okunola: [00:13:22] Okay. That’s great. Thank you for sharing that. Now, while, um, all of you are in different industries, one thing is common amongst all of you life changing events and life in general. You know, that’s what we all have in common, Sloan. Your life, your health. Maya, are you moving? Are you staying? What are you doing? You’re involved. And, Linda, like you said, divorce, marriage, college. So that’s great to see that even though we’re in a in you’re in different industries. You have this one thing in common. And since this is a chamber podcast and we’re all about community, can does anyone have anything to share about any special things that you’re doing in this community?

Maia Samb: [00:14:07] Um. I’ll start. Well, I, um, I’m in the class of leadership perimeter 2024, which has been, uh, yes, it is a big deal. It’s a big deal. It’s a big deal because I did want to entrench myself more in the community. Um, my background has been in marketing. I did 15 years of marketing before I switched to real estate, and I overmarketed the fact that our team works with expatriates to the point that people don’t realize how much of a local service providers we are. So I decided that I was going to be embedded more in the community, and I needed to do my part, quite frankly, in giving back, um, and understanding how government works at the local level, um, how different cities in the perimeter can collaborate, how I can make this area vibrant and, um, welcoming. Um, uh, one of the things like, you know, coming from Africa than Europe to here that was really shocking for me was like, how self-segregated it can be, especially in the South, it is self-segregated not even something maybe institutionalized too, but also self. Um, it’s it’s self inflicted a lot and I do not like that at all. And I think I’m going to play my part. I know I’m going to play my part in making that a more level playing field.

Maia Samb: [00:15:29] I do service quite a high, you know, high level of mass affluent people. And every time that, um, I close those transactions, it’s exciting. Yes, but it doesn’t get me going. Right. It is a much more exciting, uh, thing to do when I can help somebody who thought that they will never achieve it. And there is a banker in this, uh, Chamber of Commerce, I think a member with Ameris Bank. They offer some programs that people don’t know about that actually equalize the level, the level, the playing field for those people offer grants and people don’t know about it. And I’m really passionate about that. Every time I meet somebody like Linda who can, you know, I know as a financial advisor, you probably have to do some pro bono work also to maintain your certification. Or I see somebody who’s like, you know, health care bills are preventing them from from being, um, you know, achieving home ownership, people like that. If I can lean on the resources you have to help them get home ownership and build wealth and achieve the American dream, that’s all I’m about, really, quite frankly. So I think having this platform where we can talk, exchange expertise, see how we can help each other, help the community is one of the best thing we can do.

Lola Okunola: [00:16:51] I agree. And that actually brings me to my next topic or next question is, you know, even if we can’t talk about how we can all collaborate here at this table, I want us to be thinking about that. Right? Right. How can I who can I connect to? Linda, who needs a personal trainer, who needs real estate, who needs financial planning? You know, we should always be thinking about that because we can’t do everything, but we all have access to people, right? Right, right. And that’s what business is about. That’s what community is about. That’s what the chamber is about. So unless anyone else has anything to share about what they’re doing in the community, do you? Sloan?

Sloan: [00:17:35] Yes, I do. What I do, I work with a group of kids over at Holy Innocents in the area. Fantastic. How it all started. Started about ten years ago, where I had a couple of kids that were getting bullied. Oh, my. Actually, a young man that was over at the Mount Vernon private school. Over here, down the street from here. Okay. And, uh, what happened? Because I boxed when I was a kid, when I was about 12 years old. So I boxed up into college. And so I started teaching boxing classes. And the number one rule I had with the young men, I would talk girls to actually, believe it or not, I had some young ladies come in and start learning how to box. I said, it’s not for you to go in, uh, rough someone up, right? It’s to let you know that he who controls the power controls how it should be implemented. That’s always been my stance. Just because you know how to box, you can throw a nice punch, does not mean that you have to go and start an incident. So you have to keep. It’s basically was there to teach a lot of discipline. And so now I find more and more little kids coming through doing that, and then the influence is even greater. I shared with the parent, I said, do you realize it does not matter how much money you give me to do this? You give me me your most precious thing that is your child, to spend that time with me. So I always have to honor that.

Lola Okunola: [00:18:57] Yeah, that’s a great, great gift. I mean, for self-defense, for discipline, like you said. And even, I mean confidence, confidence, confidence, right? Yeah. Yeah. Self-confidence.

Sloan: [00:19:09] Because you see a lot of that now, you know, they call it cyberbullying and yeah, physical bullying and kids getting picked on because of their, their, their their race, their, their religion. And, and I get a lot of these kids that come to see me. And so I said let that go. I use other words, but I won’t do that on this podcast.

Lola Okunola: [00:19:28] But that’s good to know, because I’m sure a lot of our listeners have children or relatives that, you know, need to hear that, right? I mean, a lot of people are going through a lot of people go through a lot of stuff, and they don’t have anyone.

Sloan: [00:19:41] They don’t have an outlet. So I’m basically the the go between. And like I tell the parent, I say. Let me talk to him. You know, like they say, people will always lie to their therapist, but they tell their lawyers the truth.

Lola Okunola: [00:19:59] Or people they don’t know. Right. Like, have you ever been on the plane and someone tells you everything about their lives, and then the plane lands and they’re like, okay, goodbye. You’re like, wow.

Speaker6: [00:20:08] Uh, yeah. But anyway, so another subject. Yeah.

Lola Okunola: [00:20:13] But I mean, it’s true. People feel more comfortable talking to their therapist or someone that they just don’t know about things. So it’s good that you’re available.

Speaker6: [00:20:21] To do that. I do my.

Sloan: [00:20:22] Best. Yeah.

Lola Okunola: [00:20:23] That’s great. Linda, do you have any anything special, anything that you guys are doing at BDL advisors?

Linda Vu: [00:20:31] I know for us, we do collaborate with real estate agents, with attorneys and CPAs, and we work with them, work very closely with them. We’re a direct resource for them. And also, not only that, but we’re part of the team to help our clients. So being part of the Sandy Springs perimeter chamber has been nice, because I’ve been able to meet a lot of attorneys and CPAs and bankers and real estate agents. So I do appreciate being part of the being part of Sandy Springs Chamber.

Lola Okunola: [00:20:58] We love having you. I forgot to mention that Linda Vu is actually an ambassador of the chamber. Thank you. We really appreciate you being our ambassador. Thank you, thank you, thank you. Well, that concludes another episode of the Chamber Spotlight Podcast, sponsored by Southern Live Oak Wellness. A big thank you to our guest, Maya, Sam Sloan and Linda Vu. Thank you for joining us today. And to our listeners, thank you for tuning in. Don’t forget to subscribe for more engaging conversations and the and with the community leaders. Until next time, stay well.

Speaker7: [00:21:39] Securities and investment advisory services offered through Mosaic Wealth, Inc. member Finra, SIPC. Mosaic wealth, Inc. is a separately owned in other entities and or marketing names. Products or services referenced here are independent of Mosaic Wealth, Inc.. Bdl advisors is not affiliated with Mosaic Wealth, Inc. or registered as a broker dealer or investment advisor. Insurance services offered through BDL advisors.