Construction is a booming industry across the United States with a bright future partially fueled by an increase in governmental infrastructure projects. However, the industry is also facing unique challenges due to a shrinking pool of trade labor, economic uncertainty in the private sector and continued supply chain issues post-pandemic.

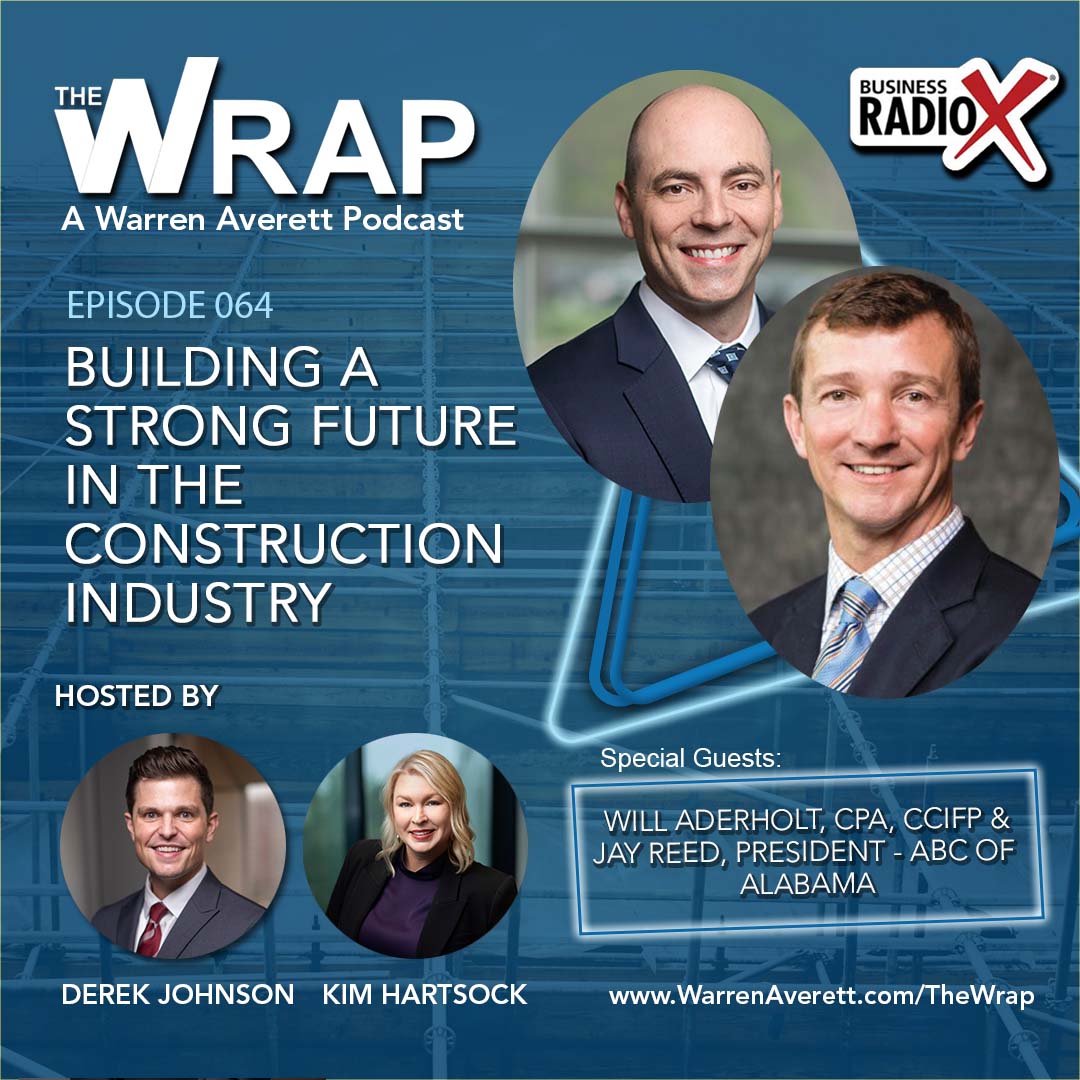

In this episode of The Wrap, our hosts welcome Will Aderholt, CPA, CCIFP, leader of Warren Averett’s Construction Industry Practice, as well as special guest Jay Reed, President of Associated Builders and Contractors of Alabama, to discuss specific challenges and opportunities affecting the construction industry.

In this episode, you’ll hear:

- How workforce development programs are looking to address labor shortages of skilled trade positions

- Information about supply chain issues and how they are still impacting construction projects post-pandemic

- Discussion surrounding the fear of a recession and how it is affecting construction projects and financing

- Insight about succession planning specific to the construction industry

- Advice for diversifying your construction business and building relationships with competitors

Resources for additional information:

- Blog: Four Economic Factors Impacting Construction Companies (And How To Overcome Them)

- Blog: Proactive Planning for Contractors in Uncertain Times

- Blog: Bouncing Back From the Pandemic: Tips for Contractors

- Blog: Selling a Business: Checklist From a Buyer’s Perspective

- Podcast: Episode 010 – Don’t Let the Sell Run Dry

- Podcast: Episode 050 – Employee Retention and Recruiting in Today’s Competitive Environment

TRANSCRIPT

Commentators (0:02): You’re listening to The Wrap, a Warren Averett podcast for business leaders designed to help you access vital business information and trends when you need it. So, you can listen, learn and then get on with your day. Now, let’s get down to business.

Kim Hartsock (0:17): Hello, everyone, and welcome to The Wrap. I am Kim Hartsock, and I’m excited to be back with you for another episode. We are continuing with our series focused on our industry experts. Today, I’m excited to have back with me co-hosting: Derek Johnson. Hey, Derek!

Derek Johnson (0:35): Hey, Kim, how are you?

Kim Hartsock (0:37): I’m doing great. I’m glad you’re back recording another episode with us, and we’re continuing with our industry focus today on construction. Why don’t you tell us who’s joining us as our guest today?

Derek Johnson (0:49): Yeah, that’s exciting. Thanks for having me back. Last time it had been a very long time since I’ve been on the podcast. And I think I’ve barely passed Paul’s exam. So, the waters are warm. I’m getting comfortable. Hopefully you’ll see more of me. But enough about me. We’re here to talk with our good friends: Will Aderholt and Mr. Jay Reed. The people need to know and they want to know, so why don’t you two gentlemen tell us a little bit more about who you are and what we’re going to talk about today?

Will Aderholt (1:19): Well, my name is Will Aderholt. I’m a Partner out of our Birmingham office and I lead our construction practice. I’ve been with the firm about 15 years and have been blessed to know our guest, Jay Reed, getting to know him over the last few years. Jay, thanks for joining us.

Jay Reed (1:35): Thank you, guys, for having me as well. Again, I’m Jay Reed, President of Associated Builders and Contractors of Alabama. And I have the pleasure now, for around 27 years, of serving the commercial construction industry in Alabama. Basically, at the end of the day, I’m responsible for ensuring our strategic plan is implemented for the construction industry and most of those bullet points in our plan that we’re going to be getting into today, because they’re certainly the pulse of the industry right now.

Derek Johnson (2:01): Thanks, Jay. Since you’re our most immediate guest, I’ll pick on you first. All right, thanks. Tell us why should we be focusing right now on the construction industry?

Jay Reed (2:13): Well, thanks. Thanks a lot for asking the easy question first, for sure. Commercial construction is already over $12 billion to the state’s economy. Our Association has just taken a pause over the last five years to ensure that not just our industry knows that when we say the economic wills of Alabama—when we say what keeps the light on at the statehouse, for lack of a better word—it is commercial construction, and our industry exports more construction outside of Alabama in the U.S. than we import right here in our own state. So, we’re fortunate to have a lot of the top contractors across the U.S. domiciled here in Alabama, and when they succeed, Alabama succeeds.

Kim Hartsock (2:57): Will and Jay, I’d love to hear both of your perspectives. But we’ve been doing a series focused on different industries, and I’d love to hear from you: what challenges and opportunities are unique to the construction industry? Maybe some things that the construction industry is facing that other industries are not. Just tell us a little bit about what makes it unique.

Will Aderholt (3:21): Yeah, I think the obvious answer is that the construction industry is facing a lot of similar issues, but maybe to a different degree. When we talk about staffing shortages, particularly in trade skilled laborers, carpenters, welders, electricians, heating and HVAC technicians, you name it—from a demographic standpoint, a lot of those really skilled trade positions, those people are aging and retiring. Face it. For the last few decades, those jobs have not been very sexy, for lack of a better word. Society has told people they have to go to college, which has led to the shortage of trade labor. If you put that on top of COVID issues and all of the issues we’ve had with people just, for whatever reason, exiting the workplace altogether, it’s just compounded. You’ve got that as an issue, for sure. Jay, the association, ABC of Alabama, and several others are trying to combat that, right?

Jay Reed (4:35): Right. That is front and center for our Association right now is workforce development. We have been really fortunate in the state. Traditionally, the governor’s office would have someone appointed to workforce development. I know for a fact this is the first time I’ve seen as many hands as possible on deck to try to ensure the workforce shortage is addressed in the commercial construction industry.

Will and I were talking, I think it was just yesterday. We’ve got the lieutenant governor in the state of Alabama currently working on workforce development. The speaker of the house has a workforce development committee. When we talk about what’s keeping this $12 billion industry up at night right now, first and foremost, it’s going to be the workforce.

But I took the time just to jot down a couple of other things from a board of directors’ perspective right now. If I had to put everything in one bucket that’s keeping our guys up at night, it is workforce development. It’s the recession. Where’s this bubble going? What does next year look like?

You’ve got immigration, regulatory reform and then something that we’re going to get to in a minute: the supply chain issue. The supply chain issue is back, you know, at second or third. We thought that had really started to taper away a little bit, but it was the highlight of a meeting that I was in Mobile for this morning. That was one of the topics of our membership today.

Kim Hartsock (5:58): Jay, I know you’re in Alabama, I sit in Georgia and Derek sits in Florida. We’re representing our region that the firm covers in terms of our geographical footprint. I know that in Georgia, we’re having the same challenges in terms of finding that skilled labor. An initiative that the state started—I don’t recall what year it was started—but in in recent years, which is a program out of the Hope Scholarship Program, which funds undergraduate programs in the state of Georgia. But there’s also this program now focused on technical college and trying to get students leaving high school to go the technical college route and focus on the skilled labor positions just like you’re speaking about. I believe there are 11 different programs that you can qualify for and go to school for free in the state of Georgia to get a technical degree. Every state is approaching this a little differently, but all of us are having that same challenge of trying to attract the students into this as a career and provide them with the opportunities.

Jay Reed (7:10): Yeah, we’ve seen a similar pattern. We have got state legislature right now that really understands the workforce shortage needs. As an Association, we were fortunate enough to get an audience in front of the governor and other key representatives to form the Academy of Craft Training. So, I think as you saw student debt take front and center, parents got to thinking, “You know, is it really x value? And this kid is sitting here telling me he’s not for college, or she’s not for college anyway.” You had the student debt, you had construction is cool again, and now you’ve got the public-private partnership where you’ve got state funds, local funds and contractor funds all going together to help us afford the Academy of Craft Training in Alabama. It has got some of the brightest seniors. If you ever want a dose of reality and bright sunshine, look at the students coming out of this Academy of Craft Training. It’s changing lives for sure.

Derek Johnson (8:05): Jay, tell me. I mean, we could talk staffing and talent all day. That’s something that the firm has been involved with for the better part of 10 years now, but you mentioned supply chain in there. You glazed over it. Let’s peel that back. Tell us more about the current supply chain issues that you’re seeing.

Jay Reed (8:27): Yeah, well as I mentioned, we had a speaker here this morning in Mobile about it, but COVID just exposed some of those layers. Will was mentioning the COVID issue, but during that time, we just really got to looking deep into where all the components of a construction project are coming from. It just seems, for some reason, whether it’s transportation concerns or epidemic concerns, our subcontractors now are having a major issue in getting some products to the job site. So, we formed a special committee to take a look at that, and they’re now putting out a quarterly supply chain newsletter that goes through every division of a commercial construction project and gives the owner or the general contractor expectations of when that can be delivered. But it’s just a major concern now for our base here in Alabama.

Kim Hartsock (9:24): Yeah, and you referenced this, what COVID brought to us and what we’ve learned, but what it also brought is a lot of different funding sources and different opportunities. But with that comes challenges. So, I know that you hear from your members. What are they facing in terms of that funding that source and trying to meet those qualifications, but also, how are they dealing with this? Are we in a recession? Are we not in a recession? Are we going into a recession? There’s not really conclusive evidence and some industries are feeling it a little more than others. But talk to us a little bit about the economic environment right now as it relates to the construction industry.

Jay Reed (10:10): Yeah, good point. It seems like all the meetings that Will and I are in, they keep asking us for the crystal ball, and we keep saying, “Well, as it gets closer to December, we’re going to give you an answer.” We’re almost in December, and we still don’t have an answer. But the data right now…Those doing federal projects and the larger projects, they do have more certainty about next year. They see an easier path to get through, and they’ve got a great backlog. But what we’re really concerned about now is probably that $20 to $50 million window that’s doing one retail shop, one dental office. That’s real money and real funds that need to be put forward to get the project. But right now, all we are seeing is the federal funds. That’s a great thing. But unfortunately, we must bring up the fact a lot of the federal funds are tied to some regulatory parameters that does exclude some of our membership.

So, we’re working through D.C. to try to get some of those regulatory changes made so that a broader group of contractors in the state (and Warren Averett’s clients as well) can have opportunities to bid that work. Some of those obstacles are being a little bit harder than usual to overcome. But it’s again, my nutshell on that is the bigger they are, the better they see next year, and the better they see a backlog.

Will Aderholt (11:27): That’s true, Jay, and I can’t help but say it out loud, the longer I’ve worked in the construction industry, in particular, I’ve gotten more and more of an appreciation of just how much our construction clients hang on to economic data. I didn’t really have a good appreciation for why that was early in my career. Here recently, it’s really just come together, and I’ve come to realize that… and it goes back to what Kim said earlier about what’s specific to construction that sets it apart from other industries. It’s really, you know, everything. They’re building a big capital project most times, right? It’s a long lead time and a long construction period most times.

And for it to begin, there has to be some sort of capital outlay, right? The bigger the project, the more capital there needs to be. Who’s the biggest spender in our country? The government, right? It goes back to what you said, those bigger guys that are doing government work, the money seems to be there. But then from there, everything trickles down to the private sector.

People have to be pretty sure that they’re going to be able to pay for these projects when they go to spend money. Interest rates affect that. Overall economics affects that. The labor force participation rate affects that because that affects how much money people have in disposable income. So, to your point, it’s all of those factors factoring into project owners making decisions to either build or expand or not, which then affects all of your and my clients.

It’s a long lead time decision that’s dependent on looking in that crystal ball and trying to figure out what it says. It’s anybody’s guess right now, right?

Derek Johnson (13:34): What are you telling them? Give us some hints to the test. I know there’s no silver bullet, but when it comes to planning, what are maybe some tips and tricks, some best advice that you’re leaving with your folks?

Will Aderholt (13:46): I’m going to give you a non-answer, which my clients always love. You know, it sort of goes back to what I tell a lot of people is: even if you have no intention of selling your business, run it like you’re planning to sell it, because you’ll never go wrong. I think similar advice applies here, which is we all hope and somewhat expect the economy to be good and backlogs to remain strong here for the next year or maybe longer. So, you want to go capture all those opportunities, but you also want to run your business as though the backlog you have could be the last. The spigot could turn off, not to be scared, but you just want to tighten up and run a lean operation. Make sure—again, I can harp on it all day long—but, you know, construction is risky. There are so many hands in the cookie jar over that whole timeline. Put in all those safeguards. Make sure everybody’s doing what they’re supposed to do from business development to estimating to project management to close out and to warranty. There are so many people that touch a job from beginning to end, and there’s a lot of ways that things could go wrong, and little things can slip.

When things are good, nobody notices that. If they do, it’s not that big of a deal. We’re still going to make X million dollars this year. So, it’s really just focusing on not letting complacency creep in, just because we’ve had some good years and really just operating it as if things are about to maybe not be as good. Watch the little things.

Commentators (15:39): Want to receive a monthly newsletter with The Wrap topics? Then head on over to warrenaverett.com/thewrap and subscribe to our email list to have it delivered right to your inbox. Now, back to the show.

Kim Hartsock (15:52): You just said operate as if you’re always about to sell your business. We tell people that all the time. You want your business to be attractive and ready to sell, so that you can maximize your investment. We are certainly seeing that. I mean, the statistics are all there of the boomer generation that owns all of these businesses and is looking to exit in the next 10 years or so. Construction is not immune to that. I’m sure, Jay, you’re seeing it. I know we’re seeing it. How do owners of construction companies plan for succession? What are you seeing, and what are you advising them to do?

Jay Reed (16:39): Yeah, if I could jump in just really quick on that one. I’ve been 27 years with the Association. I’ve never seen the number of companies that are reaching out to us now for some type of assistance or referrals on succession planning. 10 years ago, I would tell you, there wasn’t one subcontractor in the world concerned about it. But if you take the risk that Will talked about, and you take an aging workforce that David was speaking about at the meeting this morning… everyone’s getting ready to inherit trillions of dollars. So maybe or maybe not, that takes the kids out of the equation to buy X sub-contracting firm. Then it’s the regulations we spoke of, that does have some people saying, “Okay, I’m not going for the federal funds right now. It’s not my fit, but I need to do something with my business now.”

Shake that all in a crystal ball and it comes up succession planning. Will has, fortunately, you guys have been able to have some of our clients with it in the Birmingham market, for sure. But I just never thought I would see that many people calling me to say, “Do you guys know some people who can help us with succession planning? I mean, it’s bubbled up out of nowhere, but it’s an issue.

Will Aderholt (17:55): Yeah, it is. You know, when we were talking about hot topics, which has to be up there. That’s what we get a lot of phone calls about, and it’s what I spend a lot of my time trying to help people through for a lot of reasons. The reasons you just described—the aging workforce or aging ownership, generational wealth, all of those things. If you think about other industries, I think you mentioned it earlier. There’s a lot of money in the economy. There’s a lot of private equity type financial buyers for a lot of businesses in other industries. Manufacturing businesses? Very easy to sell if it’s profitable. Just one example, almost any industry. You know, it’s easy to sell.

It’s easier for people to wait until later in their career, and maybe see if the kids want to be involved in the business. Maybe they don’t, they’re not ready to retire. You know, they can wait longer. In 12 months—I’m not being flippant here—but, you know, it’s not unrealistic that you could decide to sell your business today and in three, six or certainly 12 months, it can be sold, and you can have money in the bank. That’s true in a lot of industries. But it is not true in construction.

There are some private equity buyers in certain sectors of our industry, but it’s fairly limited. That presents a problem, right, in that there’s not some third party that’s necessarily out there as easily to come by a construction business. So, most times, what ends up happening is an internal transition, either to employees, family, whomever, and a lot of times that has to be paid for out of the cash flow of the ongoing operations of the construction business. For all the reasons we said, it’s very risky. A lot of times can be low margin, can be unpredictable. There’s very little recurring revenue. All those things make it hard. That’s where we have luckily been able to help is by coming in and really doing an overall assessment, because it’s not just about, “Hey, help me figure out a way to structure this buyout to pay the least amount of tax.”

That’s easy stuff. You know, we need to figure out how’s it going to get paid for. A lot of that then gets into all the things I talked about before, which is, you know, how good or how predictable the cash flow is going to be in the future. That’s really predicated on all of those different components working together. Business development, estimating project management, that whole accounting and finance—all of those tentacles have to be working the right way in order for everybody involved to feel comfortable with that transition. That’s just kind of a little bit of kind of what we do, you know, increasingly, often over the last few years.

Kim Hartsock (21:05): Will, you brought that up, I mean, that there are more stakeholders involved. You’ve got to make sure that your bonding company is okay with what the transition is. You’ve got to make sure that your bank is okay with what you’re planning. It’s not like most privately held businesses that can just pull together their ownership, make a decision and move on. You mentioned the risk earlier. There’s more risk. So, there are more things to consider. I’m glad, Jay, that they’re calling you and asking you for help. That’s good.

Jay Reed (21:42): You know, now that you mentioned that—just a quick, quick note on that bonding. On the bonding side of it, we’ve actually also seen an uptick because of the financial market bonding requirements out there for our subcontractor community. Right now, your larger subcontractors are required to have a bond in place. That is dropping by trade category, especially in public works. In the state of Alabama, we’ve seen a huge uptick in that. So, I think that’s something else, you know, for the listeners of this today to realize in our industry, that’s been increasing, and we’ve been doing a lot of service out in that area.

Will Aderholt (22:19): The other thing that I’ve run into a lot lately is maybe an aging business owner or two, they have their management team lined up to be the buyer of their business, and they need help structuring it and that sort of thing. Then, we get into it because of everything we talked about, particularly either banking or bonding requirements. This owner thinks, “Hey, I’ve got these five people, they’re ready to buy my business. I just need your help doing it.” Then, we start educating the buyer on “What does this really mean: to sign an indemnity on your surety bond program? You know, what does it mean to sign a note at a bank? What does it mean to have a much more complicated tax return and be dependent on the company paying distributions to be able to repay the note, either to the banker to the owner?”

We come in and start educating them on this. We all can kind of rail on the millennial generation, but it’s just true. You know, people don’t necessarily want to take entrepreneurial risk the way that these baby boomers did when they started these businesses, and so I’ve seen a lot of false starts too lately. They think they had the people lined up, and then once we get in educational phase, it peters out. Again and again, it’s a long lead time. So, we don’t want to wait till “Hey, I want to be retired in three years.” Then, we have to restart the whole thing after a year into a project. Again, just there’s a lot of ways that it cannot go as planned. So, the longer lead times you have the better.

Derek Johnson (24:10): With all these dynamics, we chatted a little bit about succession planning. We walked through some supply chain issues we’re working with, obviously the staffing piece. But for the near term, what would you say these construction business leaders should be doing to best prepare themselves for success? Again, just near term.

Jay Reed (24:30): If one of my members were to ask me that right now, soon we’re talking not just financial, but in the whole scheme of running their business. It would be relationships, partnerships and diversifying the markets that you’re performing work in. I’m not saying go out there and recreate the wheel or something, but every industry is changing. I really see joint ventures, partnerships, relationships and really starting to play a much more important role in securing work. I would say, for the upcoming future in the state, we have a lot of large projects that are moving to the front burner. A lot of those massive projects are here in the near future in the state of Alabama, and there’s going to be enough of that work to go around. But you’re going to have to put your relationships out there and relationships develop, so that you’re on some of these teams put together.

Will Aderholt (25:26): Yeah, I couldn’t say it any better than that. I mean, the two things that went in my head were relationships and diversification, because those are really your two. We talked about recurring revenue, or the lack thereof in a construction business; the one way to combat that is to diversify in the various industries, size and owners. You know, all of those things, the more experience you have, the more irons you have in different fires and different sectors. Now that you want to go, you run the risk of doing something that you’re not qualified to do. You don’t want to do that. But to the extent that you can get comfortable doing what your capabilities are in various industries or various sectors to diversify, the better off you are. The other thing was relationships. I’ve seen a lot of clients have a lot of success with recruiting and retaining talent, getting jobs and getting institutional knowledge of others. You know, the construction industry has gotten a lot better in terms of having friendly competitors. I think we’re better than a lot of industries in that respect. And a lot of that, I think, is to Jay’s credit, at least here in Birmingham. That Association, I think that’s where a lot of those relationships are formed. I think they’re invaluable. I would highly encourage clients to be there and get to know their competitors.

Kim Hartsock (26:55): Will and Jay, it’s been great conversation. You’ve left the listeners with a lot to think about, but here on The Wrap, we always like to wrap it up in 60 seconds or less. So, I’ll let you go first, Will, and then we’ll close with Jay.

Will Aderholt (27:10): Yeah, I just think, again, I appreciate Jay being on with us. I mean, if I had to give the listeners one piece of advice, it would be really to seek advice—be that from advisors, associations, competitors and owners—just be inquisitive and really take time asking questions of others. It’s really easy to get focused on our own business and the day-to-day of putting out fires. But I would encourage everybody to intentionally take time to really seek advice, and be inquisitive of others, because it can do nothing but help you.

Jay Reed (27:48): For the commercial construction industry in 60 seconds, you know, I would concentrate on workforce. If you read from the Wall Street Journal to the local business journal, worker shortage, and the sky is falling, but the resources and the amount of emphasis that’s being put on workforce development. Now, there is a solution coming. There are a pipeline of young people coming into the industry, both skilled trade, project management and estimating. Again, it’s being plugged in and being a part of some group that’s helping solve that. Do not sit in your office and scratch your head on workforce development. All hands are on deck working on that. Just get plugged into some group that’s addressing it and make sure you’re part of the end of the pipeline and getting that future workforce. Jobs are going to come, the market’s going to be okay, and the sky is not going to fall. You’re going to need people. So, plug in to some people that have those resources like great associations.

Kim Hartsock (28:49): Well, this has been fantastic. So, thank you, Jay, for joining us. And Will, it was great to have you on again. Thank you so much, and we’ll see you guys next time.

Jay Reed (28:59): Thank you guys so much for having me. It really meant a lot to be selected by Warren Averett to be on the show. I think it’s a great tool. For us to be able to showcase our strategic plan and what we’re doing to the industry to partners like Warren Averett means the world. So, thanks. Derek and Kim, it was great meeting you guys.

Will Aderholt (29:18): Kim and Derek, thanks for having me on again. I always enjoy it. It’s always fun. Jay, thanks for joining us. I appreciate our friendship and you having us in the Association, allowing us to serve.

Commentators (29:33): And that’s a wrap. If you’re enjoying the podcast, please leave a review on your streaming platform. To check out more episodes, subscribe to the podcast series or make a suggestion of other topics you want to hear, visit us at warrenaverett.com/thewrap/.

Listen to More Podcast Episodes

Listen to additional episodes of Wrap—a podcast by Warren Averett designed to help business leaders access the information that you need, when you need it, in the time that you have, so you can accomplish what’s important to you.

Keep Listening