The Inflation Reduction Act appropriated $80 billion of additional funding to the IRS, which includes funding for tax enforcement activities. For the average person, this sounds like increased potential for an IRS Audit.

So how do businesses navigate complicated tax issues and proactively prepare in case they are chosen for an audit? What are the best practices to keep an IRS audit from becoming too burdensome?

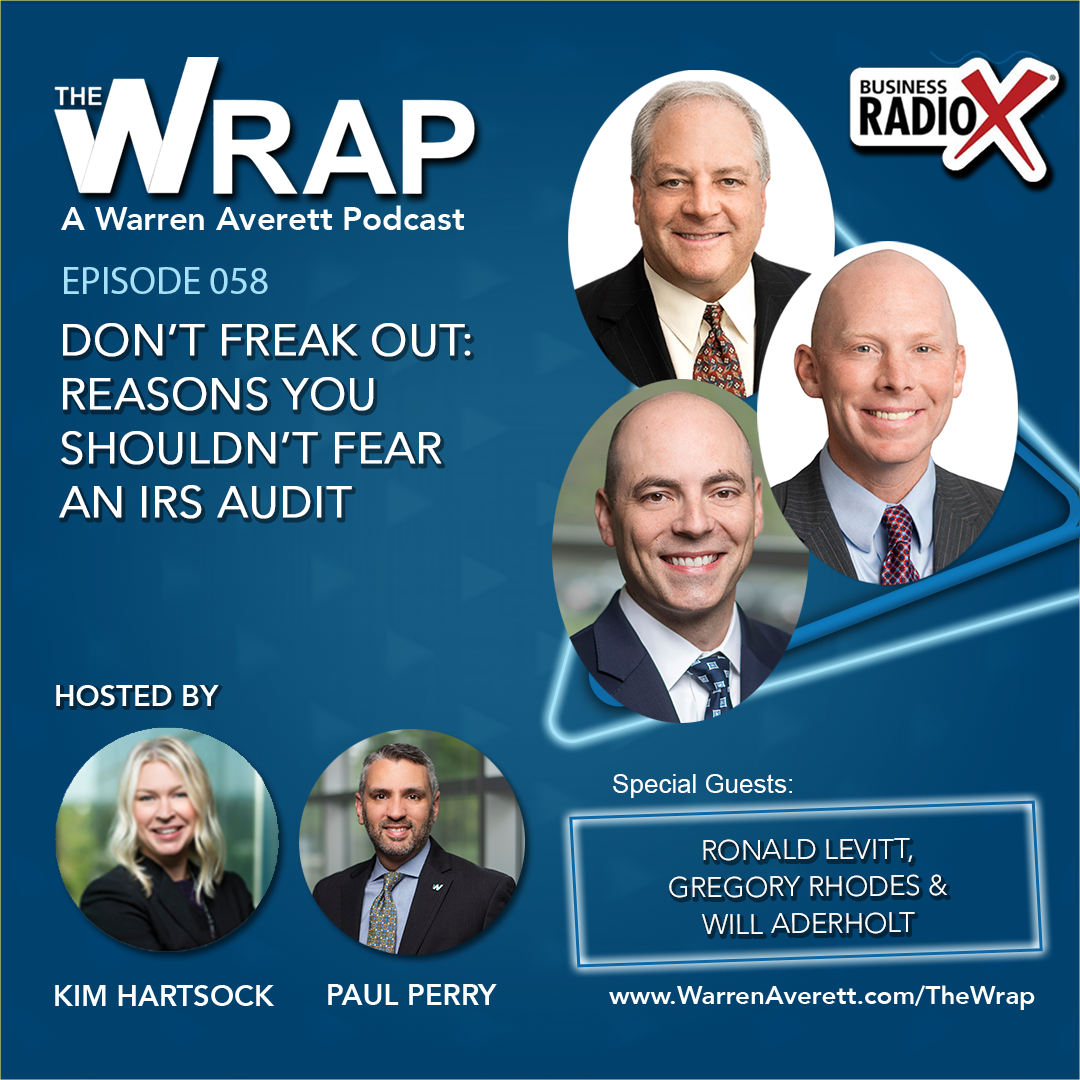

In this episode of The Wrap, our hosts welcome Ronald Levitt and Gregory Rhodes, both Shareholders and members of the Tax Practice Group at Dentons Sirote, as well as Warren Averett’s own Will Aderholt, CPA, CCIFP, to discuss how business owners and high-net-worth individuals can best prepare for a potential IRS audit.

In this episode, you’ll learn:

- How increased funding to the IRS through the Inflation Reduction Act could lead to increased audits

- Potential roadblocks to the IRS’s expanded capabilities

- Areas the IRS is most likely to focus on in the near future

- Why you shouldn’t fear an IRS audit if you’ve planned ahead, kept proper documentation and worked with a professional CPA.

Additional Resources: