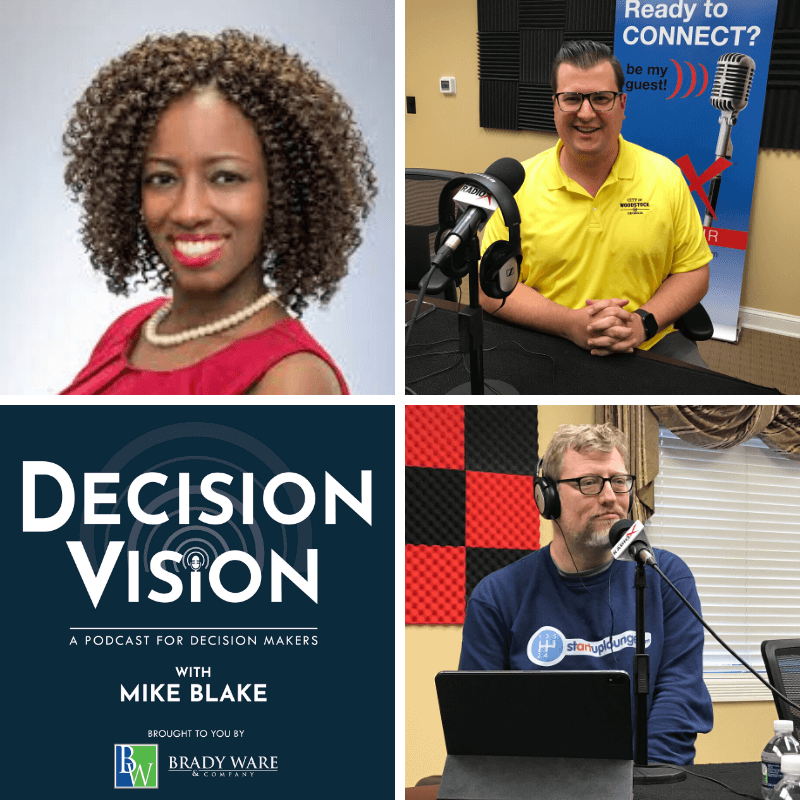

Decision Vision Episode 48: Should I Hire a Business Development Professional? – An Interview with Susan O’Dwyer, Aprio, and Ann McDonald, Morris Manning & Martin, LLP

What qualities should I look for in a business development professional? What makes a business development professional successful? The answers to these questions and much more come in this discussion with two accomplished business development professionals: Susan O’Dwyer, Aprio, and Ann McDonald, Morris Manning & Martin, LLP. “Decision Vision” is hosted by Mike Blake and presented by Brady Ware & Company.

Susan O’Dwyer, Aprio

Susan O’Dwyer is Director of Corporate Citizenship and Community Relations at Aprio. Susan’s specialty lies in the technology and venture capital industries, two industries that go together hand-in-hand. She is known throughout the Atlanta business community for her passion for connections, which resulted in Susan being recognized as one of the Top 50 women you need to know in Atlanta by the Atlanta Business Chronicle, as one of the 100 most influential people in the tech community and as a finalist for the 2012 Turknett Leadership Character Awards.

Some of her affiliations include the American-Israel Public Affairs Committee, Board Member of the Ron Clark Academy, and the Metro Atlanta Chamber of Commerce’s Technology Marketing Committee’s Venture Capital Program Chairperson. In addition, Susan and her son led efforts for relief for Tuscaloosa, Alabama, after their devastating tornadoes in 2011.

Since their founding in 1952, Aprio has grown to be the largest independent, full-service CPA-led professional services firm based in Atlanta, Georgia. Their over 450 partners and associates provide their best thinking and personal commitment to every client, demonstrating a passion for their work that fuels client success.

Aprio provides advisory, assurance, tax, cloud accounting and private client services across a variety of sectors, including insurance, manufacturing and distribution, non-profit, education, professional services, real estate, construction, retail, franchise, hospitality, technology, and biosciences.

You can find Susan on LinkedIn, and for more information on Aprio, go to their website.

Ann McDonald, Morris, Manning & Martin, LLP

Ann McDonald is a Director of Business Development of Corporate Technology and Healthcare IT at Morris, Manning & Martin, LLP. Prior to Morris Manning, Ann was been a regional sales director at INVeSHARE, a managing consultant for Gallup Organization, and vice president of marketing, e-commerce and various roles at Walsh Healthcare Solutions for over 10 years. Some of Ann’s affiliations’ activities include Chair of the Board of Directors of the Technology Executives Roundtable, member of the Board of Directors of the FinTech Society, the Technology Association of Georgia, member of the Board of Directors at the Southeastern Software Association of the Technology Association of Georgia, and past chair of the Southeast Medical Device Association Annual Conference.

Morris, Manning & Martin is an American law 200 law firm with national and international reach. They dedicate themselves to the constant pursuit of their clients’ success. To provide their clients with optimal value, they combined market-leading legal services with a total understanding of their needs to maximize effectiveness, efficiency, and opportunity. Morris Manning enjoys national prominence for its real estate, corporate litigation, technology, health care, intellectual property, energy and infrastructure capital markets, environmental, international trade, and insurance practices. Morris Manning has offices in Atlanta, Raleigh-Durham, Savannah, Columbus, GA, Washington, DC, and Beijing.

You can find Ann on LinkedIn, and for more information on Morris Manning, go to their website.

Michael Blake, Brady Ware & Company

Michael Blake is Host of the “Decision Vision” podcast series and a Director of Brady Ware & Company. Mike specializes in the valuation of intellectual property-driven firms, such as software firms, aerospace firms and professional services firms, most frequently in the capacity as a transaction advisor, helping clients obtain great outcomes from complex transaction opportunities. He is also a specialist in the appraisal of intellectual properties as stand-alone assets, such as software, trade secrets, and patents.

Mike has been a full-time business appraiser for 13 years with public accounting firms, boutique business appraisal firms, and an owner of his own firm. Prior to that, he spent 8 years in venture capital and investment banking, including transactions in the U.S., Israel, Russia, Ukraine, and Belarus.

Brady Ware & Company

Brady Ware & Company is a regional full-service accounting and advisory firm which helps businesses and entrepreneurs make visions a reality. Brady Ware services clients nationally from its offices in Alpharetta, GA; Columbus and Dayton, OH; and Richmond, IN. The firm is growth minded, committed to the regions in which they operate, and most importantly, they make significant investments in their people and service offerings to meet the changing financial needs of those they are privileged to serve. The firm is dedicated to providing results that make a difference for its clients.

Decision Vision Podcast Series

“Decision Vision” is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at decisionvision@bradyware.com and make sure to listen to every Thursday to the “Decision Vision” podcast. Past episodes of “Decision Vision” can be found here. “Decision Vision” is produced and broadcast by the North Fulton studio of Business RadioX®.

“Decision Vision” is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at decisionvision@bradyware.com and make sure to listen to every Thursday to the “Decision Vision” podcast. Past episodes of “Decision Vision” can be found here. “Decision Vision” is produced and broadcast by the North Fulton studio of Business RadioX®.

Visit Brady Ware & Company on social media:

LinkedIn: https://www.linkedin.com/company/brady-ware/

Facebook: https://www.facebook.com/bradywareCPAs/

Twitter: https://twitter.com/BradyWare

Instagram: https://www.instagram.com/bradywarecompany/

Show Transcript

Intro: [00:00:01] Welcome to Decision Vision, a podcast series focusing on critical business decisions brought to you by Brady Ware & Company. Brady Ware is a regional full-service accounting and advisory firm that helps businesses and entrepreneurs make visions a reality.

Mike Blake: [00:00:20] And welcome to Decision Vision, a podcast giving you, the listener, clear vision to make great decisions. In each episode, we discuss the process of decision making on a different topic from the business owners or executives’ perspective. We aren’t necessarily telling you what to do, but we can put you in a position to make an informed decision on your own and understand when you might need help along the way.

Mike Blake: [00:00:39] My name is Mike Blake and I’m your host for today’s program. I’m a director at Brady Ware & Company, a full-service accounting firm based in Dayton, Ohio, with offices in Dayton, Columbus, Ohio, Richmond, Indiana, and Alpharetta, Georgia, which is where we are recording today. Brady Ware is sponsoring this podcast. If you like this podcast, please subscribe on your favorite podcast aggregator and please consider leaving a review of the podcast as well.

Mike Blake: [00:01:02] So, today, we’re going to talk about hiring a dedicated business development professional. And I started to become interested in this topic a couple of years ago when I read a book called Built to Sell. And I forget who wrote it but if you Google it, you’ll find it. And if you’re interested in kind of the process of building a business that has value that can be sold and monetized, I highly recommend it as it is not a technical book.

Mike Blake: [00:01:29] In fact, it’s basically a book that sets up a hypothetical marketing services firm and walks through the conversations that take place to understand where value comes from and what it takes to build a business to sell it. And one of the things that struck me about one of the pieces of advice they give in that book is, does your company have the ability to sell when the owner themselves is not doing the selling?

Mike Blake: [00:01:57] And I think that’s a really smart point, because if the revenue is primarily dependent upon the owner, then when the owner sells and drops her keys off and they move to a condo in Costa Rica, then, you know, what value remains in the business? Perhaps some, but not a whole lot. And so, what I found myself doing as I appraise businesses myself and as I advise people on building their businesses and preparing to sell them is to think about very early, you know, how can you create systems and resources and processes and assets that generate revenue when you’re away, right?

Mike Blake: [00:02:38] And the litmus test, I often ask people and I’ll ask this in a management interview, you know, if you go away and you’re abroad and your cellphone breaks for six weeks, what happens to your business? And sometimes, yeah, the business is great. In other times as well, I probably don’t have a business when I come back. And that’s very telling. And typically, the reason that you don’t have a business when you come back is because you don’t have somebody that is a full-time salesperson.

Mike Blake: [00:03:06] So, to me, that’s a very important inflection point. Now, here’s the challenge and the other reason I think this is a very interesting topic, as I approach my 50th trip around the sun here, I’ve seen a lot of salespeople come and go in a number of roles, a number of places where I’ve been, where there’s been services, venture capital, technology, and so forth. And one conclusion I’ve drawn over the years is I think that the hardest role to hire for in any company is sales.

Mike Blake: [00:03:41] And the reason I think that is, you know, not only because I’ve seen a pretty high failure rate over the years, but because quite candidly, salespeople may not necessarily be successful selling what they’re supposed to sell, but they’re often very good at selling themselves. And so, as a business owner, how do you kind of cut through the veneer and the facade and find out not only can that person sell, are they willing to sell? It’s amazing.

Mike Blake: [00:04:13] If you read sales books, you’ll read about how salespeople themselves are reluctant to sell, right? It’s something called call reluctance and so forth. And that’s what they signed up for. But it’s still hard to get salespeople to do that. So, you know, step one is the side that you want to have a dedicated business development person. Second then is, how do you make an assessment as to whether or not that person can and is actually willing to do what is asked of them in that role?

Mike Blake: [00:04:40] And then, third and finally and I see this in professional services, how do you hire somebody and structure that role? So that if you’re not a practitioner, you can still have success in that role. And I being in the accounting industry, we’re certainly guilty of this. It’s tempting to fall into the trap of saying, well, you know, unless you can give technical advice on the spot, you can’t possibly sell. It has to be someone that’s a really good account lawyer, business appraiser, foundation repair specialist, whatever it is, but that’s not necessarily the case.

Mike Blake: [00:05:22] I’m not saying that’s easy. It’s hard, but there’s a big difference between hard and impossible. So, I hope with that preamble, I’ve convinced you that this is a rich topic. And if you’re a business owner and executive decision maker, I think you’re going to learn a lot today from the two guests that we have. So, without further ado, I’d like to introduce our guests. And these are two people that have been good friends of mine in the community for a very long time.

Mike Blake: [00:05:51] I consider them not only friends, but I consider them the mentors. And often, even if I don’t necessarily speak with them as often as I would like, I think of them a lot, especially when I have a decision that I have to make, I think. And I ask myself, you know, what would they do? If I were talking to them, what would they say? And I know them well enough that I know what they’re going to say. If I have to ask the question, I’ve already failed.

Mike Blake: [00:06:12] So, first up, in no particular order, then I just simply decide to write these bios in that order is my dear friend Susan O’Dwyer, who is a Director at Aprio, which of whom I’m an alumnus and they’re are friendly competitor of ours and is a Director of Corporate Citizenship and Community Relations. Aprio is a premier CPA-led professional services firm, where thriving associates serve thriving clients. And on a side note, I’ve always thought that re-branding is fantastic and very effective.

Mike Blake: [00:06:43] Their purpose is clear. They advise clients that they can achieve what’s next, whatever that may be. Since its founding in 1952, Aprio has grown to be the largest independent full-service CPA-led professional services firm based in Atlanta, Georgia. They have over 450 partners and associates that provide their best thinking and personal commitment to every client demonstrating a passion for their work that fuels their client’s success. Susan’s specialty lies in the technology and venture capital industries.

Mike Blake: [00:07:09] And she’s one of the founders of something called Shaking the Money Tree from PWC. And if you’ve ever read or relied upon that publication, that is at least, in part, her brainchild. So, thank her. She’s known throughout the Atlanta business community for her passion for connections, which resulted in Susan being recognized one of the top 50 women you need to know in Atlanta by the Atlanta Business Chronicle as one of the 100 most influential people in the tech community and as a finalist for the 2012 Turknett Leadership Character Awards.

Mike Blake: [00:07:41] As a director of corporate citizenship and community relations, Susan access the main point of coordination regarding civic and community activities throughout the firm. Her role is to maintain open communication with civic leaders and community partners, creating goodwill on behalf of Aprio. So, having read that, why is she here? Well, before she took that role, she was a director of business development I’m guessing for about seven or eight years or so-

Susan O’Dwyer: [00:08:03] Eleven….

Mike Blake: [00:08:04] … where frankly, she kicked butt. And then, she was later promoted into this particular role. But don’t let the kind face fool you, she understands her stuff. Some of her affiliations are the American-Israel Public Affairs Committee, the Ron Clark Academy, where she’s a board member and a big cheerleader for that organization, the Metro Atlanta Chamber of Commerce’s Technology Marketing Committee’s Venture Capital Program chairperson. And she and her son also led efforts for relief for Tuscaloosa, Alabama, after their devastating tornadoes in 2011. And I wish we had time because I would love to get her to talk about her Lady Gaga story, which I tell all the time and it just bust a gut. But maybe, we’ll have to have her back for a second podcast. So, Susan, thanks for coming on the program.

Susan O’Dwyer: [00:08:52] Thank you for having me, Mike. It’s a pleasure to be here.

Mike Blake: [00:08:55] And sitting to her left is my other dear friend, Ann McDonald, who is Director of Business Development of Corporate Technology and HealthcareIT at Morris, Manning & Martin, a role she has held for 13 years. Like Susan, Ann is one of the most respected people in the Atlanta technology community. Morris, Manning & Martin is an American law 200 law firm with national and international reach. They dedicate themselves to the constant pursuit of their clients’ success.

Mike Blake: [00:09:20] To provide their clients with optimal value, they combined market-leading legal services with a total understanding of their needs to maximize effectiveness, efficiency, and opportunity. Morris Manning enjoys national prominence for its real estate, corporate litigation, technology, health care, intellectual property, energy and infrastructure capital markets, environmental, international trade, and insurance practices. Basically, everything. Morris Manning has offices in and around Atlanta, Raleigh, Durham, Savannah and Washington, D.C. Man, I would love a chance to tour the Savannah office, I love that city.

Mike Blake: [00:09:51] Prior to the role at Morris Manning, Ann has been a regional sales director at INVeSHARE, a managing consultant for Gallup Organization and vice president of marketing, e-commerce and various roles at Walsh Healthcare Solutions for over 10 years. Some of Ann’s affiliations’ activities include chair of the Board of Directors of Technology Executives Roundtable, member of the Board of Directors of the FinTech Society, the Technology Association of Georgia, member of the Board of Directors at the Southeastern Software Association of the Technology Association of Georgia, and past chair of the Southeast Medical Device Association Annual Conference. Ann, thanks for coming on.

Ann McDonald: [00:10:26] Thank you.

Mike Blake: [00:10:27] So, you guys are pretty busy, so thank you for finding time to come on the program and come out here to be on it. Asking people to travel in Atlanta is in itself a big ask. So, Ann, let me start with you. I mean, we’ve done sort of the formal introductions, but how would you describe your role at Morris Manning? When you do your own elevator pitch, what do you say?

Ann McDonald: [00:10:49] Well, let’s look at, what do I get paid to do?

Mike Blake: [00:10:54] Okay.

Ann McDonald: [00:10:54] So, I can tell you my title, but really, I get paid to help bring in new clients. And that’s through lead generation. It’s meeting with referral sources, strategic partners, it’s being part of technology, the technology ecosystem and community to meet companies and refer those companies into our firm for legal services.

Mike Blake: [00:11:18] And Susan, how about you? And let’s talk more. I’d like to start with your current role and then, kind of go back to your prior role in terms of business development. How do you describe your current role at Aprio?

Susan O’Dwyer: [00:11:29] So, my current role is to identify nonprofits where we can make a difference through my colleagues’ financial background by serving on those boards. And as a result, further our reach, our footprint across the community and identify new opportunities where we might not have met those executives in their role as a CEO or CFO of whatever company it is, but instead, through a mutual-shared passion for whatever the cause of the nonprofit is, people have the opportunity to connect.

Mike Blake: [00:12:05] And before that, you were director of business development and you were the grand poobah of sales for-

Susan O’Dwyer: [00:12:13] Hardly.

Mike Blake: [00:12:13] … Aprio, formerly known as Habif, Arogeti & Wynne, talk about that role.

Susan O’Dwyer: [00:12:18] So, that role started because the firm realized that if they were going to grow the way they wanted to at the time that I joined the firm 12 years ago, I don’t think there were even 100 people there. And if the firm wanted to grow the way they wanted to, they’re going to need to cast a much wider net. So, I was recommended to the firm and joined to open doors that they had not even thought to knock on before. My Rolodex is very different than the Rolodex of the people that were already there. My job is not to supplant the partners, my job still is to supplement what they are working, who they were working with by identifying just like an additional client, prospects referral sources that can bring new business to the firm.

Mike Blake: [00:13:13] And to be clear, Susan, you’re not an accountant and you’re not a lawyer, correct?

Susan O’Dwyer: [00:13:18] That’s correct. CPA is just three letters in the alphabet to me. No, I’m not an accountant.

Mike Blake: [00:13:22] Yeah. And same here, right? I tell people, if I answer an accounting question, it’s instantly a malpractice. I don’t even do my own taxes. So, as non-practitioners, how do you think that impacted or impacts your ability to communicate the value of what you’re selling to the marketplace? Do you think that gives you a different perspective that is helpful? Do you think it holds you back in some way? What do you guys think? Ann, why don’t you start?

Ann McDonald: [00:13:53] Okay. Well, I have a background in business and I’ve, as you said, never worked for a law firm before. But when I talk to companies, I talk about their business with them, ask them questions about it, and find out what their needs are and then, refer them to the subject matter expert within our firm who can help their businesses grow through legal practices. Also, one of the things that I do is to help prevent the value-added services that we’re known for.

Ann McDonald: [00:14:30] So, I leverage my network of relationships to help that company grow as one of our clients. So, it could be introductions to sources of capital, it could be introductions to organizations where they will meet prospects, strategic partners of their own and then, also introduce them to potential clients who are also clients of ours. So, those are things that don’t have to do with providing legal services, but it’s a value add for our clients.

Mike Blake: [00:15:08] And Susan, how about yourself? Was not being a CPA, that gives you any kind of advantage in the market? And were there times where you felt like maybe it held you back in some way?

Susan O’Dwyer: [00:15:21] So, I was a journalism major. I never took a class in business in my life. But what I was taught was how to get the story out of a person so that we could tell it to our readers. Okay. So, I ask a lot of questions. I don’t talk a lot other than to ask questions. And as Ann suggested, that’s really just to identify what colleague would be the best source of answer for whatever it is their question is. In some ways, I think it’s been a benefit not being an accountant, because I don’t have a clue what the answer is. So, I can really focus on figuring out what their question is.

Susan O’Dwyer: [00:16:01] Sometimes, the client doesn’t exactly know, but by me rephrasing back to them what I hear them saying, sometimes, we’ve redirected what it was they thought they needed to something else. The other thing I would say is that I obviously can’t speak for lawyers, but for the accountants that I work with, sometimes, I think they can be very focused on what it is they know, but they’re not so comfortable with maybe what our other colleagues do. So, it’s being able to recognize opportunity for anybody in the firm as just opposed to what it is they specifically are able to do, which means we have a lot better shot of bringing them in as a client.

Mike Blake: [00:16:49] And that’s something. So, I want to follow-up on that. When you’re a practitioner and I am a practitioner, it is easy to fall into the trap that no matter what you see, it looks like something you do, right? There’s a saying that when you’re a hammer, everything looks like a nail, right? So, if I was an auditor and I’m talking to a potential client, then I’m thinking in terms of, how would an audit help this client, right?

Mike Blake: [00:17:15] Because that’s how I’m wired. Not that you’re a bad person, but that’s just sort of what your world view is, whereas the proper treatment of that conversation is to probe and maybe audit falls out of that, maybe tax falls out of that, maybe something entirely different falls out of that. And as more of a generalist, if I can use that for lack of a better term, that positions you and empowers you to, I guess, becoming more broadly curious.

Susan O’Dwyer: [00:17:42] The other thing I would say is that, well, it’s my job to help identify what the issue is and who the right subject matter expert is. I don’t have to know how to do what it is the subject matter experts do, I just have to listen for what are the trigger words for opportunity for every single line of service or business skill set that we have and then, be able to direct them to that. So, I can give you an example if you would like.

Mike Blake: [00:18:14] Yeah. Great. We love war stories.

Susan O’Dwyer: [00:18:15] Okay. So, I am sitting at a table for a dinner that has assigned seats at a nonprofit that I’ve been on the board of for 20-something years. And I sit next to a person who I have no idea how I miss this man, but in 20-something years, I’ve never, ever laid eyes on him. And I asked him about what he did and how long he’d been involved in the organization, so and so forth. And he tells me about his company. It’s a software company.

Susan O’Dwyer: [00:18:39] And almost as a throwaway line, the very last thing that he says to me after he’s described his company is, “We just invested $5 million in a new software that we’re going to be rolling out to our clients, which are national in the next couple of months.” And I said, “Oh, did you get the R&D tax credit?” He said, “I don’t know what that is.” And I said, “Well, the State will give you money back if your developers are in Georgia.

Susan O’Dwyer: [00:19:06] So, if you send the work to be done in another country or another state, they’re not going to pay, but if it’s here in Georgia-” He says, “Well, yeah. It’s here in Georgia”, and he named the town. And he said, “Tell me more.” And I said, “I have just told you everything I know about it. But tomorrow morning, I can have one of my colleagues, we have 25 people who specialize in this area help you. Here’s my number, call me at 8 o’clock.” Okay. I don’t ever have a problem finding a colleague who’s available for an opportunity-

Mike Blake: [00:19:37] Yeah. Sure.

Susan O’Dwyer: [00:19:37] Okay. That’s not a problem.

Mike Blake: [00:19:37] Yeah.

Susan O’Dwyer: [00:19:39] So, I didn’t have to know how to do the tax credit study, I just had to recognize the opportunity when he said we just invested $5 million.

Mike Blake: [00:19:49] Yeah.

Susan O’Dwyer: [00:19:49] So-

Mike Blake: [00:19:51] Okay. So, Ann, I want to ask you this question, Susan touched upon this about five minutes ago, but I’m curious and I’ve never asked kind of your origin story, how did you come to land at Morris Manning?

Ann McDonald: [00:20:04] Well, it’s interesting. I came to Atlanta in 2004. I worked for the Gallup Organization as a consultant and executive coach. And then, I was here for about a year working for Gallup, then was attracted to another startup in the FinTech area and worked there for about a year. And I work for John Yates and a friend of John’s who I also knew had heard that John was looking for someone who had sales background and was not an attorney, but understood the sales process. And so, he put us together and I interviewed with John and he was looking for someone. So, that’s how it happened.

Mike Blake: [00:20:56] And why did you feel, at that time, that that was a good role for you, that that was a platform where you could be successful?

Ann McDonald: [00:21:04] That’s interesting, because I don’t know that I could ever do that for another law firm. It was John. John Yates’ personality, is how dynamic he ran his sales processes. It was operated more like a real corporation rather than sort of a slow process. I was used to very fast, very successful operations. And it was the way he viewed the market. Also, the way they view their clients. This group is much more than a transactional law firm, they believe in relationships. And look at new clients or look at all the clients as, “How can I make your business grow? What can I do to help you in areas other than, ‘Well, just call us when you need a transaction of some means.'” So, that was a big difference and the reason I was attracted to working for an industry that was foreign to me.

Mike Blake: [00:22:20] So, an interesting thing that’s already emerging is you two likes to ask a lot of questions.

Ann McDonald: [00:22:27] Yes.

Mike Blake: [00:22:27] Right? And I think that’s an important point. It gets back to, how do you interview somebody for a role like this? We both know there are people out in the marketplace that sell by telling basically.

Ann McDonald: [00:22:40] Yes.

Mike Blake: [00:22:40] Right? And, you know, maybe the 1960s and ’70s, there’s some effectiveness to that, but I’m not sure that’s very successful-

Ann McDonald: [00:22:48] No.

Mike Blake: [00:22:50] … today. And I think that most people I observe who try to sell by telling, I think you get some people that bite on that, but I think that the success rate is a lot less. So, is it fair to say that if I’m looking to hire somebody like you, probing for somebody that likes to ask a lot of questions might be a good thing to look for? Is that fair?

Susan O’Dwyer: [00:23:11] Not only is it fair, but I think maybe another way to say it, Mike, is it’s far better to be someone who is interested and interesting. I don’t ever want to make it about me. I was going to make it about the other person. And so, I’m not the story. My colleagues are the story. But in order to get the story, I have to find out what it is that person really needs. And like I said before, sometimes, the prospect doesn’t even know exactly what it is they need or they think they know what they need. But by asking of questions, you find out that that’s maybe not exactly what the issue is.

Mike Blake: [00:23:50] And, you know, talk about that journalism background being helpful, right? I mean, journalism is the practice of asking questions often from people who don’t want to answer questions.

Susan O’Dwyer: [00:24:00] Well, I try not to be Mike Wallace.

Mike Blake: [00:24:01] Right.

Susan O’Dwyer: [00:24:04] But-

Mike Blake: [00:24:04] So, let me go back, too, because Ann said something that segues nicely into this. You know, you’re successful. I know how successful you were and have been at Aprio. And I’m curious, what about that platform, when you’re in that role, puts you in a position to be successful? And I ask that because if I’m a listener, I’m thinking, gee, I’d love somebody like Susan or Ann to come to my company, but it’s just not to hire, I think I’ve got to create an environment for them to be successful.

Susan O’Dwyer: [00:24:35] So, the way a public accounting firm works is that there are X number of partners that are all co-owners of the firm. And at Aprio, the way it works is there is a place for partners who, obviously, they’re all very good technically, but some of them are just more outgoing than others. So, it kind of became accepted practice that some of them were very, very good at rainmaking and others would probably rather eat a box of rocks than have to go out and talk to, you know, prospects.

Susan O’Dwyer: [00:25:11] So, because I just have never really been afraid of talking to people I don’t know, it doesn’t scare me, my role was to open doors where they hadn’t been before. We had a technology practice. They didn’t know before I came very many venture capitalists. Interestingly enough, venture capital was kind of maybe is not as strong today as private equity was, but 20-something years ago, that was the flip. And so, because of my prior role, I knew a lot of those people.

Susan O’Dwyer: [00:25:56] And it was just a question of trading on your name, honestly, to open doors for the new firm. And if you do what you say you’re going to do. Even if people know she’s a salesperson, but they don’t view me that way because they view me as, when I call them, I’m calling them with something for them, usually not asking for something. In this case, I was asking for a meeting to make an introduction and all that could come from it would be more business for both sides, right? So, it’s a win-win.

Mike Blake: [00:26:33] Yeah.

Susan O’Dwyer: [00:26:34] So, that’s what I did was I just opened doors. And I had had a 20-plus-year career at one big four firm before I came to Aprio and before that, a 10-year career at another big four firm. So, I’ve always been a words person in the number’s world.

Mike Blake: [00:26:52] So, in those firms that you worked in, was there anything they did or maybe could have done better to put you in a position to be more successful? And I’ve asked that question because I’d like to try to drill down to if one of our listeners decides that they want to go the route of hiring somebody like you or maybe it doesn’t matter, maybe I’m asking a question that I think I know the answer to and I actually don’t, does it matter? Or, is hiring the right person with the right approach, with the right Rolodex so important that maybe it’s just, get out of their way and let them do their thing?

Susan O’Dwyer: [00:27:31] So, to answer a couple questions or comments that you’ve made, the first is I made sure it was never about me. It’s always about helping others. And you alluded to the fact that there’s been a very high turnover rate among salespeople, typically. I think there are some people that want it to be about them. I didn’t know that there was an expression. I mean, this was 30-something years ago, which I don’t know that had been exactly coined yet or I hadn’t heard it called servant leadership.

Susan O’Dwyer: [00:28:03] It’s never about me, it’s always about taking care of other people, hopefully. And that’s where I get my satisfaction from. I don’t need to be the star. As a matter of fact, I don’t even want to be on stage. I’m way more happy to be behind the curtain pulling the levers and strings. So, that’s number one. Number two, I would say, is I think you have to be willing to let others be the star and too many salespeople, my observation why they’re not successful is that they want to be the star.

Susan O’Dwyer: [00:28:37] And that just isn’t helpful for either our colleagues who really are the stars, because as Ann referred to them as subject matter experts, they’re the ones who have the answers, not me. And then, the other thing is, really, it needs to be all about the client or prospect, not about the salesperson. So, just turn the I pronoun out of your vocabulary and just pretend it doesn’t exist. And that’s the way to think about it.

Mike Blake: [00:29:10] So, Ann, you’ve been in your role for a long time and I suspect but don’t know, you’ve probably seen others in that role, whether it’s in your firm where others sort of come and go. Why are you different? Why do you think you’re different? I’m not going to use the word special, because you’ll never let me get away with that.

Ann McDonald: [00:29:29] No.

Susan O’Dwyer: [00:29:29] But she’s wonderful.

Mike Blake: [00:29:29] But I think you’ll get away with different.

Ann McDonald: [00:29:30] No.

Susan O’Dwyer: [00:29:30] She is wonderful.

Ann McDonald: [00:29:32] Thank you.

Mike Blake: [00:29:32] But there is something different, right? You know, it’s, if you’re around, say, a year longer than everybody else, that’s a statistical anomaly. When it’s a lot longer than anybody else, clearly, there’s something structural there. And if you want to talk about yourself, that’s fine. Maybe just contrast with what others have done, where they have not been successful, what mistakes do you see other salespeople make?

Ann McDonald: [00:29:56] Well, I think Susan touched on it. I think it’s important as a business developer salesperson that you have the maturity to understand the sales process with a service organization. And the important person or people in the equation will be the company and the attorney who they had the relationship with or attorneys, multiple relationships. And for a sales person, you have to understand, as Susan said, you are not the key person. You are not the key personality. You are the go-between and the facilitator for the relationship.

Ann McDonald: [00:30:47] The company has to have the primary relationship with the attorney in our case. And because that’s who they will trust, who they are relying on to help them make very important decisions about the future of their company and their employees. And so, the business developer or salesperson has to understand that. It’s also a different role than I have had as a salesperson in the past. And I don’t close the relationship. I don’t close the win. I make the introduction to our attorney. And then, it’s a hand-off. And I can’t close the win.

Mike Blake: [00:31:40] Right.

Ann McDonald: [00:31:41] So, that takes another level, I think, of understanding and-

Susan O’Dwyer: [00:31:52] Acceptance.

Ann McDonald: [00:31:52] … actions. In that, I help coach the attorney. You know, it’s such a hard position to be the one who’s making the widget, the one who’s providing the service and then, also the salesperson. And you have those two distinct roles in companies, but you don’t as attorneys. So, I help coach the attorney. I mean, they’re working on deals. They’re creating the legal product. But then, they also need to nurture the relationships of prospects. And as I tell them, “Don’t dig the well when you’re thirsty. You need to be part of the sales process all along, even though you’re very busy with providing the services.” But I will coach attorneys and help them with closing the deal, getting the client in. But that primary relationship is with them.

Mike Blake: [00:32:54] So, one thing that falls out of both of what you said and another kind of talking point is I think a common thread is humility. And I’m sure it sounds intuitive to the two of you, but if you think about how we portray somebody who’s in sales in the media, right? Good thing about Glengarry Glen Ross, right? Always be closing hard-charging high-ego, right? And you sort of have to own everything.

Mike Blake: [00:33:27] But in my experience, I’m curious about if you agree, you know, in a lot of way, in a lot of respects, business development can kind of be like trying to swing a baseball bat to tighter your grip at the less while it works, right? The harder you try, in some respects, the less it works, right? So, is it fair to say that if I’m interviewing somebody for that role, another thing I would look for, besides curiosity and the ability and desire to ask questions, I guess is also, frankly, some humility to it.

Susan O’Dwyer: [00:33:59] It’s a funny line that you walk because you have to be confident enough that you can call on a CEO or a CFO and expect that that person is going to take your call because you have some prior relationship and respect with each other. But then, you also have to be willing to take a step back once that person has agreed to meet with you, that someone else is really the reason why they’re there. So, it is a little bit odd.

Susan O’Dwyer: [00:34:29] I think you’re also looking, for your listeners, for some ideas about what are things that are helpful when you are looking to hire a business development person. I would say the other thing is don’t look for someone who expects this to be a regular job, a 9:00 to 5:00 job, I mean. There are countless breakfasts and dinners that Ann and I have been at that require very, very long days. It’s almost like a school bus driver. You’re really busy in the morning, you’re really busy in the evening.

Susan O’Dwyer: [00:35:01] And then, your kind of in the middle of the day is when you’re doing all of your prep work for the next couple of meetings. But when you are going to these meetings, you’re not just walking in cold, you’re doing your homework ahead of time. What is the group about? Who can I expect to be there? Are there people that I am particularly looking for? How do I connect people who I meet there with resources that will be helpful for them? All of that is happening before or after meetings. But it is a lot of very long days and you have to find people who are willing to make those kinds of time commitments, I think.

Ann McDonald: [00:35:38] I also think there typically are two different kinds of salespeople, hunters and farmers. And I think this is a combination of those roles. You have to really be hungry and be a hunter, but you also have to be a farmer. In that, you’re nurturing relationships, you’re doing coaching. There are some additional characteristics besides just being the Glengarry Glen Ross. You know, dialing for dollars kind of-

Mike Blake: [00:36:13] Right. Coffees for closers.

Susan O’Dwyer: [00:36:15] Yes.

Mike Blake: [00:36:16] Yeah. And that balance is going to depend a lot, I think, on the nature of the industry that you’re-

Ann McDonald: [00:36:23] Yes.

Mike Blake: [00:36:23] Right? And professional services, a lot of farming because that person may or may not need that service to a particular point in time, right? For me, it can be a two-year sales cycle. Maybe accounting-less, because everybody needs to file a tax return or some someplace in the middle. On the other hand, if it’s somebody that does flood remediation, then that’s a very short-sale cycle, right?

Ann McDonald: [00:36:45] Yeah.

Mike Blake: [00:36:46] So, you sort of have to understand kind of where you fall on the continuum. I put one loaded question into the list, but you guys had a chance to see it, you didn’t tell me I couldn’t ask it, so I’m going to ask it, because I do think it’s relevant. The two of you happen to be women.

Ann McDonald: [00:37:03] I knew it wasn’t going to be question number eight.

Mike Blake: [00:37:04] The two of you happen to be women. Do you think that has impacted your ability to be successful in your respective roles, either in a positive or a negative way? I don’t want to go on me, too, but-

Susan O’Dwyer: [00:37:20] Since I’ve never been a man, I don’t know that I can answer that.

Mike Blake: [00:37:23] Okay.

Susan O’Dwyer: [00:37:24] But I can tell you that it became very clear when I was in my prior firm, working strictly with venture capitalists that when I would go to the National Venture Capital Association’s annual meeting, I was one of a handful of women in a room of a thousand people. And so, how are you going to stand out? And I chose to use bright colors. So, people who know me know that I never wear black or navy unless I’m going to a funeral.

Mike Blake: [00:38:00] That’s true. I’ve never seen you in either of those colors as long as I’ve known you. That’s right.

Ann McDonald: [00:38:03] Yeah.

Susan O’Dwyer: [00:38:04] And so, you have to do something to stand out in a crowd and be different, especially when there are competitors who do not have a business development person, but send their practitioners to the same events I’m at. How am I going to relate to people in a way that will be memorable when I personally can’t answer their questions, technical questions? And so, I’ve chosen to do it with being personal, asking about family, remembering things personally about that person.

Susan O’Dwyer: [00:38:40] Do I think a man would do that? I don’t think so. I’ve yet to meet one who ever remembers anything personal about other people. I mean, at a networking event, they just don’t or they don’t ask about it. And I think being a woman, it’s safer to ask those kinds of questions without feeling like maybe the person thinking, why is this person getting so personal? That it’s more accepted, I guess.

Mike Blake: [00:39:07] Yeah.

Susan O’Dwyer: [00:39:07] Ann, how about you?

Ann McDonald: [00:39:08] Oh, I really don’t think gender has much to do with it. I do think as far as salespeople go, I think women may have an edge for some of the reasons that Susan like said.

Mike Blake: [00:39:23] Well, especially in tech, right? I mean, there aren’t that many women in tech, period, yet.

Ann McDonald: [00:39:27] Oh, well, that’s true. But it’s interesting. And of course, we go to a lot of events and there are not a lot of women typically in the room. And I don’t notice it anymore.

Susan O’Dwyer: [00:39:39] I don’t either.

Ann McDonald: [00:39:40] It’s not even something that is a factor. But, you know, we are good about making connections and probing without seeming to be too direct and-

Mike Blake: [00:39:58] And maybe more natural empathy, too.

Ann McDonald: [00:39:59] And more natural empathy. I think that may be a factor.

Mike Blake: [00:40:03] So, another question I want to make sure we get through, we don’t have a ton of time left, but this is one I’ve got to make sure I ask, you know, Ann, you and I are talking a little bit about this before we came on, imagine that you’re going to hire your successor, what is an interview question you would make sure you want to ask your successor? What would they have to answer for you in a great way to say—you’ll tell John Yates, you know, “John, well, now, I’m ready to hang it up and I’m right to be on a beach in Tahiti. This is the person you got to hire because answered this question great.”

Ann McDonald: [00:40:42] Oh, Mike, that is a tough one. One question. How good are you at putting the client first, representing the client to the firm and then, representing the firm to the client? Instead of making this a personal quest, I mean, it has to be all about helping that company, that client grow and the depth of relationship. And I’d like to know about the experience that the interviewer or interviewee would have with those kinds of relationships. And then, the whole coaching factor of helping attorneys to be successful, because that’s a good part of what this job entails. And it’s providing tools for them, it’s providing answers, it’s providing coaching in a way that they can tolerate that’s nudges and not, “Here comes the wisdom.”

Mike Blake: [00:42:19] Yeah. And that’s really interesting because I’ve long thought of both of you as much as anything being air-traffic controllers, right?

Ann McDonald: [00:42:30] Yes.

Mike Blake: [00:42:32] Controlling connections and coordinations and stuff. And the way you described that role, I think, may be different than one of a lot of our listeners’ thought going in, because, you know, the notion of sales for many people when you think of it is a unidirectional process, right? I’ve got something, I’m going communicate to you, and you want to buy it. But the way you describe it is once you initiate that relationship, now, you’re representing the client back to the firm as well-

Ann McDonald: [00:43:04] Yes.

Mike Blake: [00:43:05] … and to make sure they’re treated well-

Ann McDonald: [00:43:06] Yes.

Mike Blake: [00:43:06] … and they’re treated appropriately and they get the right service. And even if I’m wrong, and I’m going to step out here, but I suspect this is true, even if sometimes, that may mean that you’re not the right firm to serve them-

Ann McDonald: [00:43:19] Yes.

Mike Blake: [00:43:19] … necessarily, right? You know, not all things to all people can’t be if you’re successful.

Ann McDonald: [00:43:23] That’s right.

Mike Blake: [00:43:23] And so, it’s very interesting. I think there’s a big learning point in there for that piece of advice and the way to ask that question. Susan, you have a bit of extra time to noodle on that. You’re interviewing the next director of business development for Aprio, what do you ask him?

Susan O’Dwyer: [00:43:42] Describe how when you were given a prospect’s name, a company or a nonprofit, not necessarily a person, and you don’t know a single person at that company, but you have to get in the door of the CEO, how would you do it? What are the steps you would take to open that door? And how long would it take you to get there?

Ann McDonald: [00:44:10] Oh, that’s good.

Mike Blake: [00:44:11] Now, that last part is loaded, I think, because the knee-jerk reaction may be, “Well, I could get in there in two weeks.”.

Susan O’Dwyer: [00:44:24] How would you do it?

Mike Blake: [00:44:25] Because you want to show that you’re quick and effective, right? And then, I can see on your face that SO face of skepticism like, “Uh-uh. In two weeks, man”, right? We’re talking months. You’re probably looking at months-

Susan O’Dwyer: [00:44:39] Well, what’s the right way?

Mike Blake: [00:44:39] … if you’re going to sound the way that you think that is appropriate and realistic, right?

Susan O’Dwyer: [00:44:43] Yeah.

Mike Blake: [00:44:44] Two weeks is boiler room territory.

Susan O’Dwyer: [00:44:46] Yeah. That’s just nonsense. And it’s not going to work. So, you’ve already identified yourself as a phony in my book.

Mike Blake: [00:44:54] So, two more questions and we’ve got to go and let you guys get back to your day jobs. How much has social media played a role in what you guys do? Are you guys social media people at all? I know the answer to this question to some extent, but our listeners don’t.

Susan O’Dwyer: [00:45:11] I’ll defer to Ann because for me, it’s irrelevant. So, I would just be in the office-

Mike Blake: [00:45:16] Well, but-

Susan O’Dwyer: [00:45:16] I mean, we have a marketing department that uses social media.

Mike Blake: [00:45:19] Right.

Susan O’Dwyer: [00:45:20] But I live on LinkedIn. And if that is considered social media-

Mike Blake: [00:45:26] Yeah, I think so.

Ann McDonald: [00:45:26] It is.

Susan O’Dwyer: [00:45:28] So, I live on that. But tweeting and posting stuff and all of that, I completely defer to the queen of it, which is Ann, because I don’t do any of that stuff. I use it to learn, but I don’t use it to push the company. Probably, I should, but I just don’t.

Mike Blake: [00:45:46] If I ever see a selfie of you on Instagram, I’m calling the police, because I know you’ve-

Susan O’Dwyer: [00:45:51] I’ve been kidnapped.

Mike Blake: [00:45:52] … clearly been kidnapped. And that is a cry for help. And somebody is going to be dropping $100,000 in a parking lot somewhere to get you back.

Ann McDonald: [00:46:01] There’s a newspaper next to her head just to show proof of life.

Susan O’Dwyer: [00:46:02] Yeah.

Mike Blake: [00:46:06] Exactly. Ann, how about you?

Ann McDonald: [00:46:07] Well, I use LinkedIn quite a bit.

Mike Blake: [00:46:09] Yeah.

Ann McDonald: [00:46:10] And for a lot of different things, do a lot of research on LinkedIn, I post articles that I find very interesting that I think will be of interest to the people I know. They’re usually business articles, really engaging ideas that I think will help companies grow based on my background. I post events for organizations that I belong to. I think that’s important in getting support for the things that I support. Of course, I’ll re-post all of the MMM items that I think people should know about. But I think it’s very valuable. I think that’s a great sort of lifeline that it helps bring life to what I’m trying to accomplish.

Mike Blake: [00:47:13] Yeah.

Ann McDonald: [00:47:13] It is a branding tool.

Mike Blake: [00:47:15] Yeah.

Ann McDonald: [00:47:17] And that lets people know me a little bit better, personally, because of the things that I say or post, especially the articles. I’ve had people approach me at events and say, “Oh, yeah, I recognize you. I’ve seen you on LinkedIn and I follow the articles that you post.” So, it’s been of some value that way.

Mike Blake: [00:47:38] Right. You get recognized.

Ann McDonald: [00:47:39] Yeah. Yes. And so, that’s a point of conversation then to get to know somebody, to get to know a company. So, you know, I give kudos to people and it’s a nice outlet. Now, when I post things on LinkedIn, I will then, sometimes, check the box for it to be posted on Twitter.

Mike Blake: [00:48:07] Yeah.

Ann McDonald: [00:48:08] And then, Facebook is purely social, really.

Mike Blake: [00:48:11] Yeah. Yeah. So, we are unfortunately out of time. I could easily lock the door and trap these ladies here for a couple more hours, but that would be unfair to them and also illegal, so we’re going to have to wrap up. There’s so much more we could talk about. But if somebody listening would like to contact you, they have questions about this process, can they do that?

Ann McDonald: [00:48:31] Absolutely.

Susan O’Dwyer: [00:48:31] Please.

Mike Blake: [00:48:32] And if so, Ann, how best to contact you?

Ann McDonald: [00:48:36] Email, amcdonald@mmmlaw.com.

Mike Blake: [00:48:43] Susan?

Susan O’Dwyer: [00:48:43] And I’m susan.o’dwyer, and yes, I do have an apostrophe in my email, it’s O-apostrophe-D-W-Y-E-R, @aprio, A-P-R-I-O, .com. And I would welcome your questions or any way I can help you.

Mike Blake: [00:48:59] That’s going to wrap it up for today’s program. I’d like to thank Ann McDonald and Susan O’Dwyer so much for joining us and sharing their expertise with us today. We’ll be exploring a new topic each week, so please tune in so that when you’re faced with your next executive decision, you have clear vision when making it. If you enjoy these podcasts, please consider leaving a review with your favorite podcast aggregator. It helps people find us so that we can help them. Once again, this is Mike Blake. Our sponsor is Brady Ware & Company. And this has been the Decision Vision podcast.

“Decision Vision” is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at

“Decision Vision” is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at