Beth Miller, Executive Velocity; Matt Hyatt, RocketIT; and Uli Dendy, TrueLanguage (Profit Sense with Bill McDermott, Episode 20)

Host Bill McDermott welcomed Beth Miller to discuss leadership development, Matt Hyatt with commentary on IT services and cybersecurity, and Uli Dendy to discuss her translation and language services business. “ProfitSense with Bill McDermott” is produced and broadcast by the North Fulton Studio of Business RadioX® in Alpharetta.

Beth Miller, Leadership Development Advisor and Executive Coach, Executive Velocity

Executive Velocity is a leadership development advisory firm committed to ensuring the success of top-level executives, business leaders and high potential employees. We are dedicated to helping companies hire great people, develop leaders and have solid succession plans for future success. EV leaders maintain certifications in such assessment tools as Myers-Briggs, Business DNA and Hogan Assessments.

In 2006, Beth founded Executive Velocity as an outlet for her trademark enthusiasm and energy for assisting clients with their most valuable asset – their people. Through her proven approaches, she provides expert advice on leadership capabilities and builds succession plans for organizational continuity.

Beth served as a Chair with Vistage, the most prestigious CEO and business owner peer advisory organization in the world for 13 years. As a Vistage Chair, Beth facilitated peer advisor meetings and coached business owners and executives to grow and develop in their roles and careers.

Matt Hyatt, CEO, RocketIT

Rocket IT is the outsourced IT department for all kinds of businesses, providing the strategy, security, and support needed to help organizations thrive. The organization virtually manages all of its clients’ day-to-day technology requirements for a flat monthly fee, with no contracts to tie them down.

With businesses becoming more dependent on technology every day, it’s almost impossible for companies to keep up with all the complexity. It’s more than one internal IT person can handle, and it requires more strategic insight than most IT support companies offer. That’s where Rocket IT comes in.

Rocket IT’s unique three-pronged approach includes 1) services built around the people instead of technology, 2) real strategic foresight, not just break/fix hindsight, and 3) a better way to ensure trust and accountability.

Rocket IT gives small businesses the capability of a full IT department, with a 98% client satisfaction rate and a 25- year track record of helping people thrive. Since 1995, Rocket IT has helped businesses meet their goals through the effective use of technology. Today, the organization actively supports a long list of growing companies in diverse industries including finance, healthcare and manufacturing.

Uli Dendy, CEO, TrueLanguage

At TrueLanguage, Uli Dendy leads a dedicated team of experts in providing the full spectrum of language services, from translation and proofreading to desktop publishing, typesetting, subtitling and dubbing, and more. Uli and her team have a deep understanding of the value of clear, complete and consistent communication. They support a broad portfolio clients on the world stage with the latest in quality assurance solutions, centralized project management, and the best expert resources available, in any language, in any medium.

TrueLanguage is an ISO 9001:2015 and WBENC-certified business, and its team has accumulated more than 50 years of professional experience in the language industry. They are also proud to support the American Society for Testing and Materials (ASTM) in lobbying the US Government for greater national recognition and establishment of standards for the language industry.

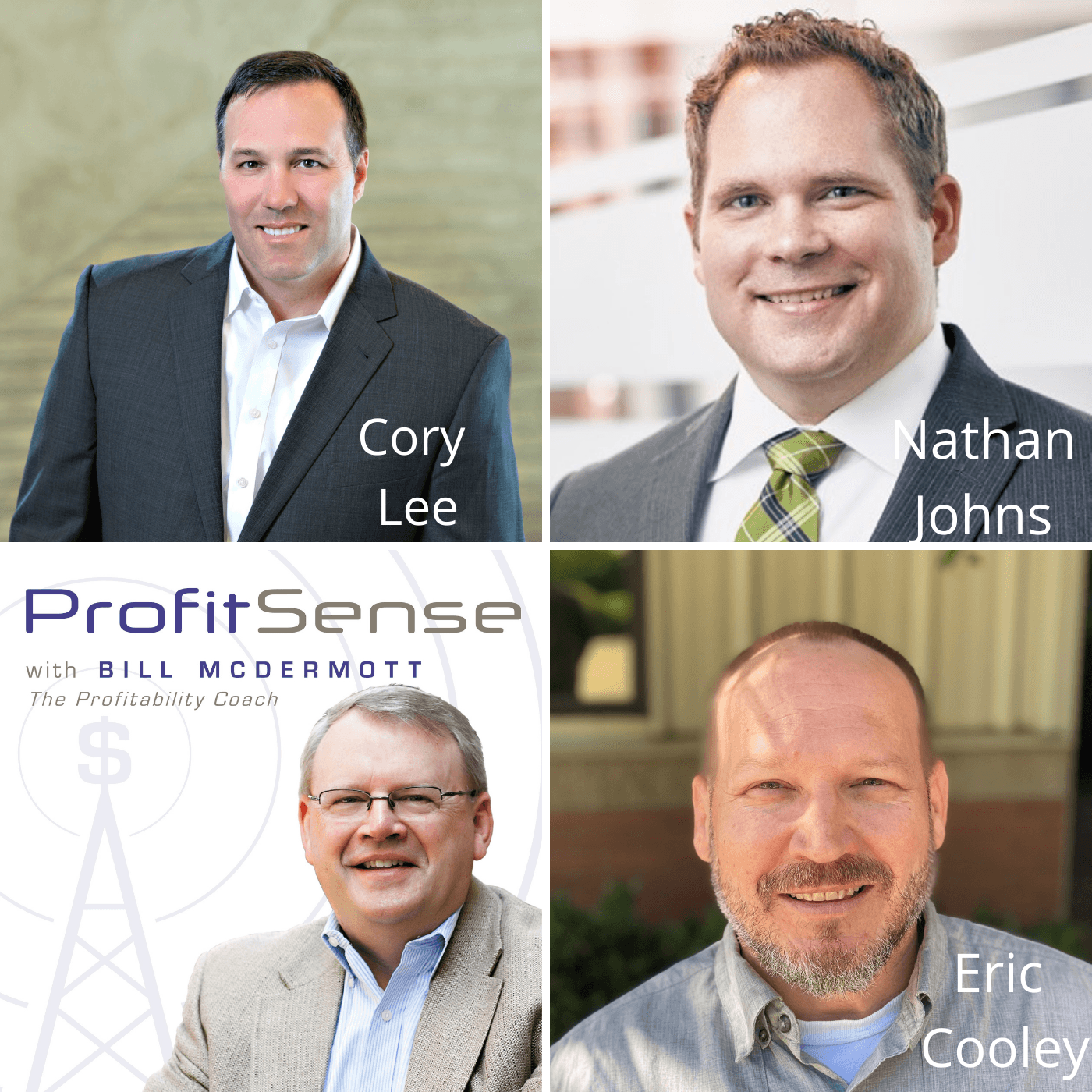

About “ProfitSense” and Your Host, Bill McDermott

“ProfitSense with Bill McDermott” dives into the stories behind some of Atlanta’s successful businesses and business owners and the professionals that advise them. This show helps local business leaders get the word out about the important work they’re doing to serve their market, their community and their profession. The Show is presented by McDermott Financial Solutions. McDermott Financial helps business owners improve cash flow and profitability, find financing, break through barriers to expansion and financially prepare to exit their business. The show archive can be found at profitsenseradio.com.

Bill McDermott is the Founder and CEO of McDermott Financial Solutions. When business owners want to increase their profitability, they don’t have the expertise to know where to start or what to do. Bill leverages his knowledge and relationships from 32 years as a banker to identify the hurdles getting in the way and create a plan to deliver profitability they never thought possible.

Bill currently serves as Treasurer for the Atlanta Executive Forum and has held previous positions as a board member for the Kennesaw State University Entrepreneurship Center and Gwinnett Habitat for Humanity and Treasurer for CEO NetWeavers. Bill is a graduate of Wake Forest University and he and his wife, Martha have called Atlanta home for over 40 years. Outside of work, Bill enjoys golf, traveling, and gardening.

Connect with Bill on LinkedIn and Twitter and follow McDermott Financial Solutions on LinkedIn.