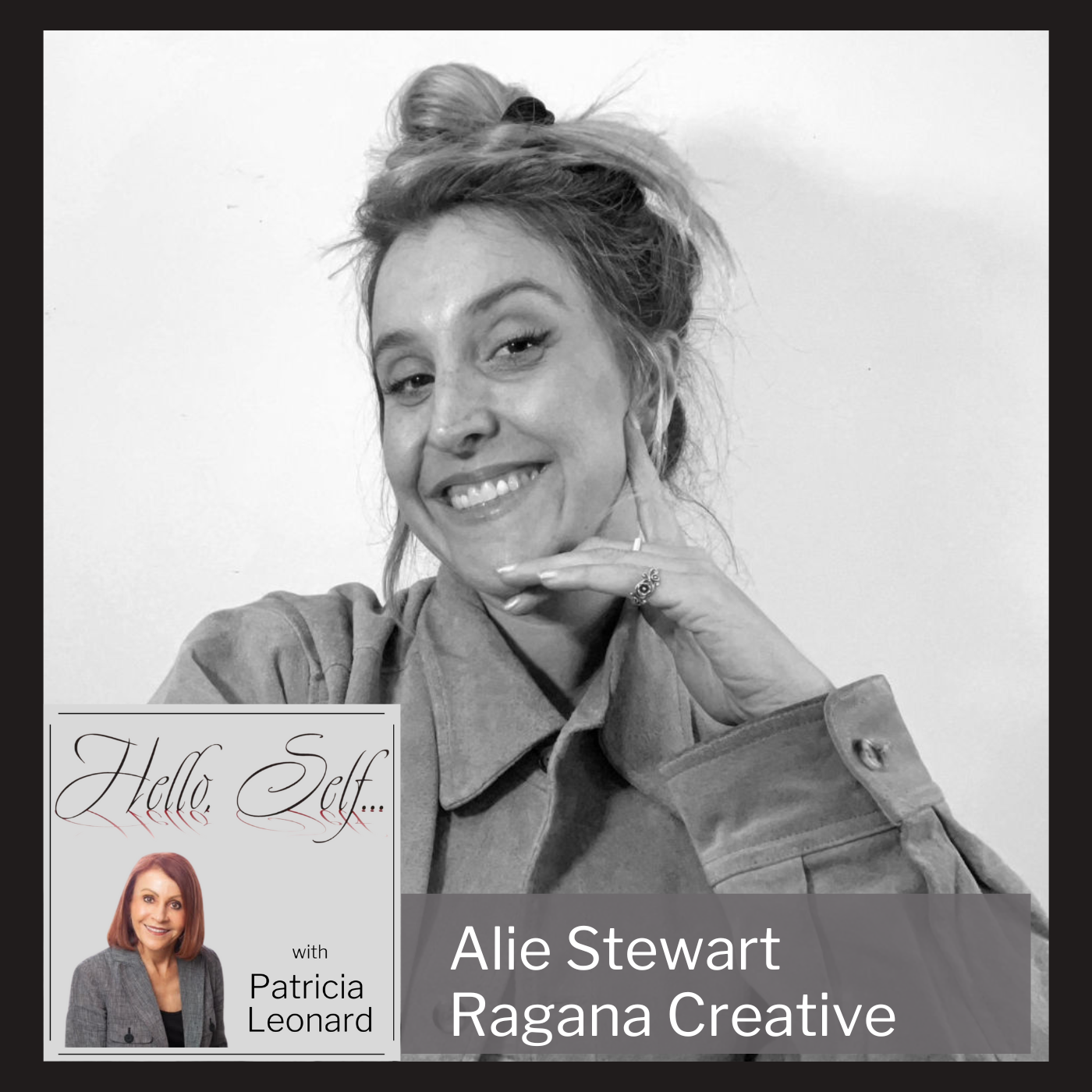

Alie Stewart, Ragana Creative (Hello, Self… Episode 15)

On this episode of Hello, Self…, Patricia’s guest is Alie Stewart. Alie is an Emmy-nominated producer, consultant, and owner of Ragana Creative. She shares with Patricia the Hello, Self.. moments that changed her life, including reading Be Here Now by Ram Dass, her subsequent travels, and how she found her stride following her intuition. She and Patricia also talk about the culture differences locally and in other big cities, the value of the diversity in Nashville, and how that fuels expression and Alie’s work.

Don’t miss this wide-ranging conversation and where you can find her new upcoming show, Never Sent, on March 31st and April 2nd, 2023.

Hello, Self… is presented by Patricia Leonard & Associates and produced by Arlia Hoffman in association with the North Fulton studio of Business RadioX®.

About Never Sent

Ragana Creative Presents NEVER SENT, an event celebrating the most important conversations we’ve never had.

Holding a residency at The Barbershop Theater, this storytelling format is a hot mic for folks to expose their truth through texts, emails or letters that they’ve never had the guts to send.

Inspired by formats like The Moth and Mortified; Never Sent is a simple design. It calls to the people of Nashville, asking if they have something to get off their chests. Reads and performances range from heartfelt to heavy, all with a healthy dose of humor. Hosted by its creator, Alie Stewart, and curated with 5 – 7 reads as well as 1- 3 special performances – this show promises to deliver something impactful. It’s home, The Barbershop Theater, is an intimate space seating 50 guests, the perfect size for a gathering of this nature.

Never Sent was created to build community through honoring individuality – forming a loophole for conversation and a stage where participants, sometimes unheard, can finally express themselves. “This all started when I was sitting around during the pandemic and had some extra time. I was going through my drafts on my phone and was extremely entertained” laughs Alie Stewart, creator of Never Sent and founder of the company behind it, Ragana Creative.

Alie Stewart, Producer and Owner, Ragana Creative

Based out of Nashville, Alie is an Emmy-nominated producer, development director, event curator and consultant. She has a diverse background in TV and film production, tech media, talent relations and curating avant-garde events.

Her career has crossed multiple facets of the creative industry, beginning in film & TV production on the independent creators side. She then grew into collaborations with executives at some of medias most exciting production companies, agencies, and platforms like Netflix, Verizon, National Geographic and Microsoft.

After some important time experimenting on her own, Alie took what she knew in authentic storytelling and implemented those truths into uniquely formatted events. She now holds an event series titled Never Sent in Nashville and produces fundraisers, drag, comedy and other storytelling shows.

Alie grew up in a rural town of Southern California and has lived in San Francisco, New York, and Los Angeles. She has a loud laugh, an immense amount of respect and pride for a good outfit, and a cat named Boozy.

Website | LinkedIn | Instagram

About Hello, Self…

Hello, Self… is a biweekly podcast focused on inspiring stories of turning dreams into reality. Join coach and author Patricia Leonard and her guests as they share life-changing Hello, Self… moments.

Hello, Self… is brought to you by Patricia Leonard & Associates and is based on the new book by Patricia Leonard, Hello, Self.., available here.

The show is produced by Arlia Hoffman in association with Business RadioX®. You can find this show on all the major podcast apps. The complete show archive is here.

Patricia Leonard, Host of Hello, Self…

Patricia Leonard is President of RUNWAY TO SUCCESS, a division of Patricia Leonard & Associates located in Nashville, TN. She is a MESSAGE ARTIST speaker, career & business coach, author and magazine columnist. Patricia consults with clients on leadership, empowerment, career management, entrepreneurship and the power of language. Her work is focused on helping clients find their runway to success!

She has a professional background in management, human resources, corporate training, business consulting and talent development. Patricia has worked with companies in the service, music, banking, manufacturing, publishing, warehousing, healthcare, academic, retail and financial industries, and has taught management classes as an adjunct professor.

Patricia has a degree in Human Resource Management, is certified as a Career Coach and Consulting Hypnotist and is MBTI qualified.

Her volunteer energies are focused on Women in Film and Television-Nashville, where she is a Board Vice President; Dress for Success as the Advisory Board President; and International Coaching Federation-Nashville where she held Board roles for several years.

Patricia is the author of Wearing High Heels in a Flip Flop World, BECOMING WOMAN…a journal of personal discovery, THE NOW, HOW & WOW of Success, Happenings, a full year calendar of inspirational messages and a spoken word album titled, I AM…

She enjoys songwriting, creating poetry and has written a one-woman show and artistic speech she performs titled Hello, Self…, about a woman in midlife reinventing herself, which led to her new book by the same name, available here.

On the personal side, Patricia, describes herself as a woman, lover of life, mother, grandmother, career professional and message artist; AND in that order! Her goal is to continue inspiring others, of any age, to START NOW creating and expanding their Runway to Success.

She believes that life is a gift, the way we wrap it is our choice.

Executive Perspective features executives and business leaders from a wide variety of sectors. Host Danny Vander Maten and his guests cover industry trends, insights, challenges, success strategies and lessons learned. Executive Perspective is underwritten and presented by

Executive Perspective features executives and business leaders from a wide variety of sectors. Host Danny Vander Maten and his guests cover industry trends, insights, challenges, success strategies and lessons learned. Executive Perspective is underwritten and presented by

DutchCrafters is a niche retailer, selling more than 15,000 products on its Amish furniture website

DutchCrafters is a niche retailer, selling more than 15,000 products on its Amish furniture website

The Mike Cottrell College of Business serves business and technology students across all five UNG campuses and currently enrolls more than 20% of the entire UNG student body. The college prepares students to lead in the workplace and strengthen their communities through academic excellence, experiential learning, innovative teaching, as well as, entrepreneurial and ethical leadership development. Students learn the skills and expectations necessary to become strong and effective leaders in their future careers. In addition, the Mike Cottrell College of Business is a valued partner in regional economic development.

The Mike Cottrell College of Business serves business and technology students across all five UNG campuses and currently enrolls more than 20% of the entire UNG student body. The college prepares students to lead in the workplace and strengthen their communities through academic excellence, experiential learning, innovative teaching, as well as, entrepreneurial and ethical leadership development. Students learn the skills and expectations necessary to become strong and effective leaders in their future careers. In addition, the Mike Cottrell College of Business is a valued partner in regional economic development.