What a Financial Planner Can Do For You, with Chris Caldwell, Highland Trust Partners

[00:00:00] Chris Caldwell: To build a team for a client to make sure that if they have a CPA and a corporate attorney and a state attorney and insurance agent, maybe an investment advisor somewhere else, but the, all the bankers, but these people, they may have them, but they’re not talking to each other.

[00:00:13] My role as a planner is to basically bring this team to the table. To talk to each other about the different circumstances our client is going through and how can we pull resources together to make this stuff happen for them to fix what’s broken or what’s not being done.

[00:00:28] We come up with the strategy solutions, basically get it ready to sign almost in some cases, and they’re not pulling a lot of time away from work to do that. Once they see where you don’t take their time, they’re energized. They’re excited to know they don’t have to do a lot, but we’re going to get to know them personally and ask them personal questions.

[00:00:45] We’re also going to get to know their families well. As I think importantly for planning for business owners, also knowing. What they need in their family. Their spouse, knowing what they have to bring home one day. Okay, so that energizes them knowing we involve the family with that.

[00:00:59] Once they know the time we save them. They know we’re putting the resources together. Make sure we reduce the risk in their lives. They know that we’re probably adding, we’re definitely adding more valuation to the business by doing this, maybe saving on other things, tax strategy, return on investments and others.

Listen to Chris’s full ProfitSense with Bill McDermott interview here.

The “One Minute Interview” series is produced by John Ray and the North Fulton studio of Business RadioX® in Alpharetta. You can find the full archive of shows by following this link.

Renasant Bank has humble roots, starting in 1904 as a $100,000 bank in a Lee County, Mississippi, bakery. Since then, Renasant has grown to become one of the Southeast’s strongest financial institutions with over $13 billion in assets and more than 190 banking, lending, wealth management and financial services offices in Mississippi, Alabama, Tennessee, Georgia and Florida. All of Renasant’s success stems from each of their banker’s commitment to investing in their communities as a way of better understanding the people they serve. At Renasant Bank, they understand you because they work and live alongside you every day.

These executives find themselves facing a range of issues, from a lack of funding and resources to market saturation and increased competition.

These executives find themselves facing a range of issues, from a lack of funding and resources to market saturation and increased competition.

Dr. Pamela Williamson is the President and CEO of The Women’s Business Enterprise Council West. She works with Women Business Enterprises (WBEs) connecting them to opportunities with corporate America and each other through targeted networking, education, and certification.

Dr. Pamela Williamson is the President and CEO of The Women’s Business Enterprise Council West. She works with Women Business Enterprises (WBEs) connecting them to opportunities with corporate America and each other through targeted networking, education, and certification.

Lauri Erickson’s inspiration and experience in various companies and positions gave her the executive-level expertise to understand where and how help was needed in business and led her to create, The Project Pros. Her background in human resources, bookkeeping, customer service, and sales gave her the insight to really understand what small businesses need.

Lauri Erickson’s inspiration and experience in various companies and positions gave her the executive-level expertise to understand where and how help was needed in business and led her to create, The Project Pros. Her background in human resources, bookkeeping, customer service, and sales gave her the insight to really understand what small businesses need.

Brandi Byers had an interesting career being a high school business teacher, Project Manager, and Consultant. She has vivid childhood memories playing business owner in her parents basement.

Brandi Byers had an interesting career being a high school business teacher, Project Manager, and Consultant. She has vivid childhood memories playing business owner in her parents basement.

Kelly Lorenzen, CEO of KLM, is an award-winning entrepreneur with over 15 years of business-ownership experience. She is also a certified project management professional.

Kelly Lorenzen, CEO of KLM, is an award-winning entrepreneur with over 15 years of business-ownership experience. She is also a certified project management professional.

Aaron Velky is a keynote speaker, CEO and coach. His career has been dedicated to building movements, companies and leaders.

Aaron Velky is a keynote speaker, CEO and coach. His career has been dedicated to building movements, companies and leaders.

Devin Butler first discovered his true passion for entrepreneurship while he was in college in 2017.

Devin Butler first discovered his true passion for entrepreneurship while he was in college in 2017.

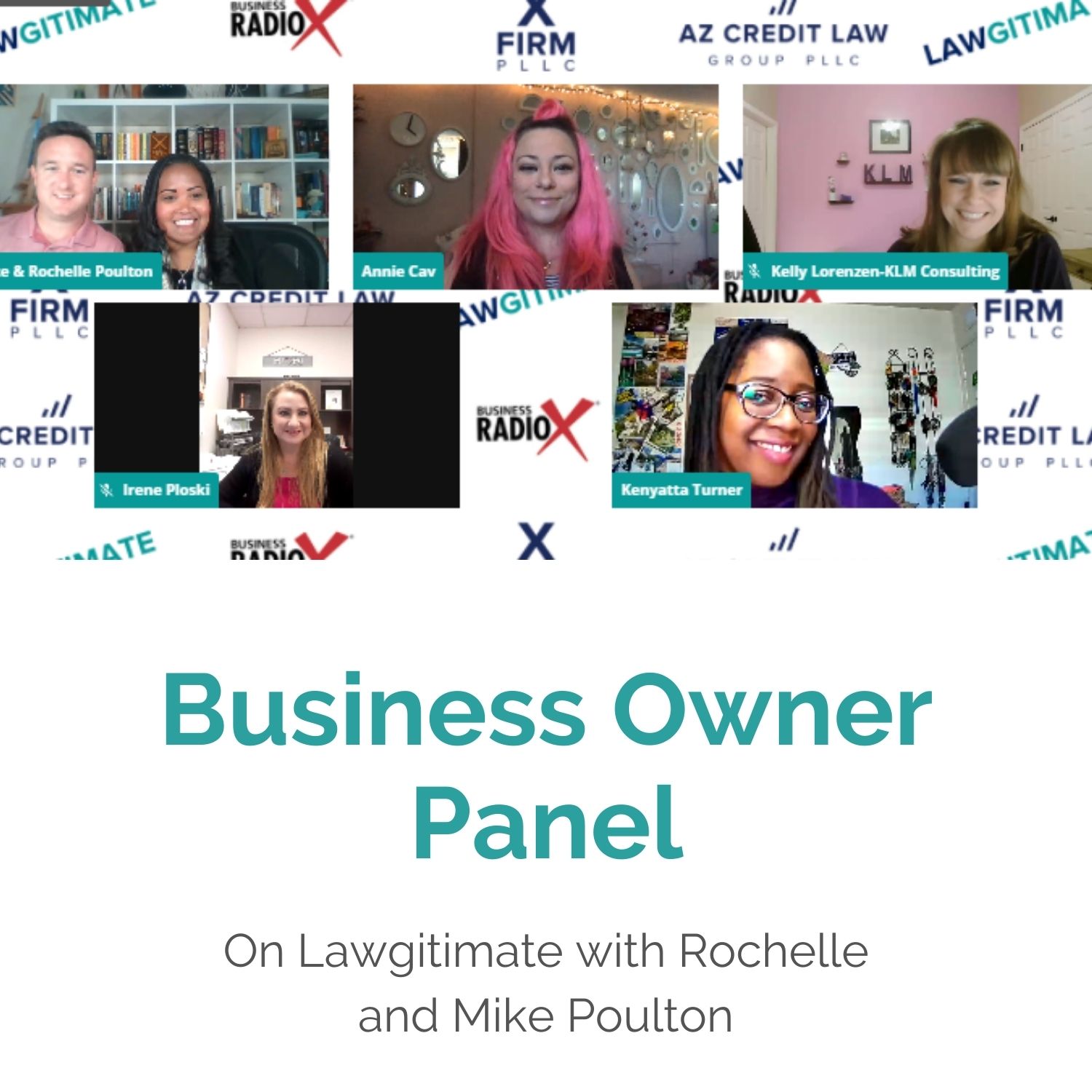

Kelly Lorenzen, CEO of KLM Consulting, is an award-winning entrepreneur with over 17 years of business-ownership experience. She has joined forces with other local experts to provide a multi-faceted team to help small businesses and non-profit organizations with their projects, create solutions-based marketing results, and build their businesses.

Kelly Lorenzen, CEO of KLM Consulting, is an award-winning entrepreneur with over 17 years of business-ownership experience. She has joined forces with other local experts to provide a multi-faceted team to help small businesses and non-profit organizations with their projects, create solutions-based marketing results, and build their businesses. Kenyatta Turner, MM is a Behavioral SuperPowers Coach, Business Consultant, Motivational Educator, and Speaker, and is an Accredited Business DNA Consultant through DNA Behavior.

Kenyatta Turner, MM is a Behavioral SuperPowers Coach, Business Consultant, Motivational Educator, and Speaker, and is an Accredited Business DNA Consultant through DNA Behavior.

Owner Annie Cavenagh specializes in color correction and balayage, but don’t miss out on trendy cuts and selfie-perfect blowouts. Also gracing the service menu are vintage styles, fashion colors, gender-neutral services, and dreadlocks.

Owner Annie Cavenagh specializes in color correction and balayage, but don’t miss out on trendy cuts and selfie-perfect blowouts. Also gracing the service menu are vintage styles, fashion colors, gender-neutral services, and dreadlocks.

Irene Ploski has been in the insurance industry since 2003. She is married and is the mom of 2 very busy teenagers, a high-energy Golden Retriever and a Doberman puppie. Irene is fluent in Spanish, and she is originally from Guadalajara, Mexico. She moved to Arizona in 2000 and became a U.S. Citizen in 2010.

Irene Ploski has been in the insurance industry since 2003. She is married and is the mom of 2 very busy teenagers, a high-energy Golden Retriever and a Doberman puppie. Irene is fluent in Spanish, and she is originally from Guadalajara, Mexico. She moved to Arizona in 2000 and became a U.S. Citizen in 2010. Rochelle Poulton is an attorney and owner of

Rochelle Poulton is an attorney and owner of  Mike Poulton, with

Mike Poulton, with