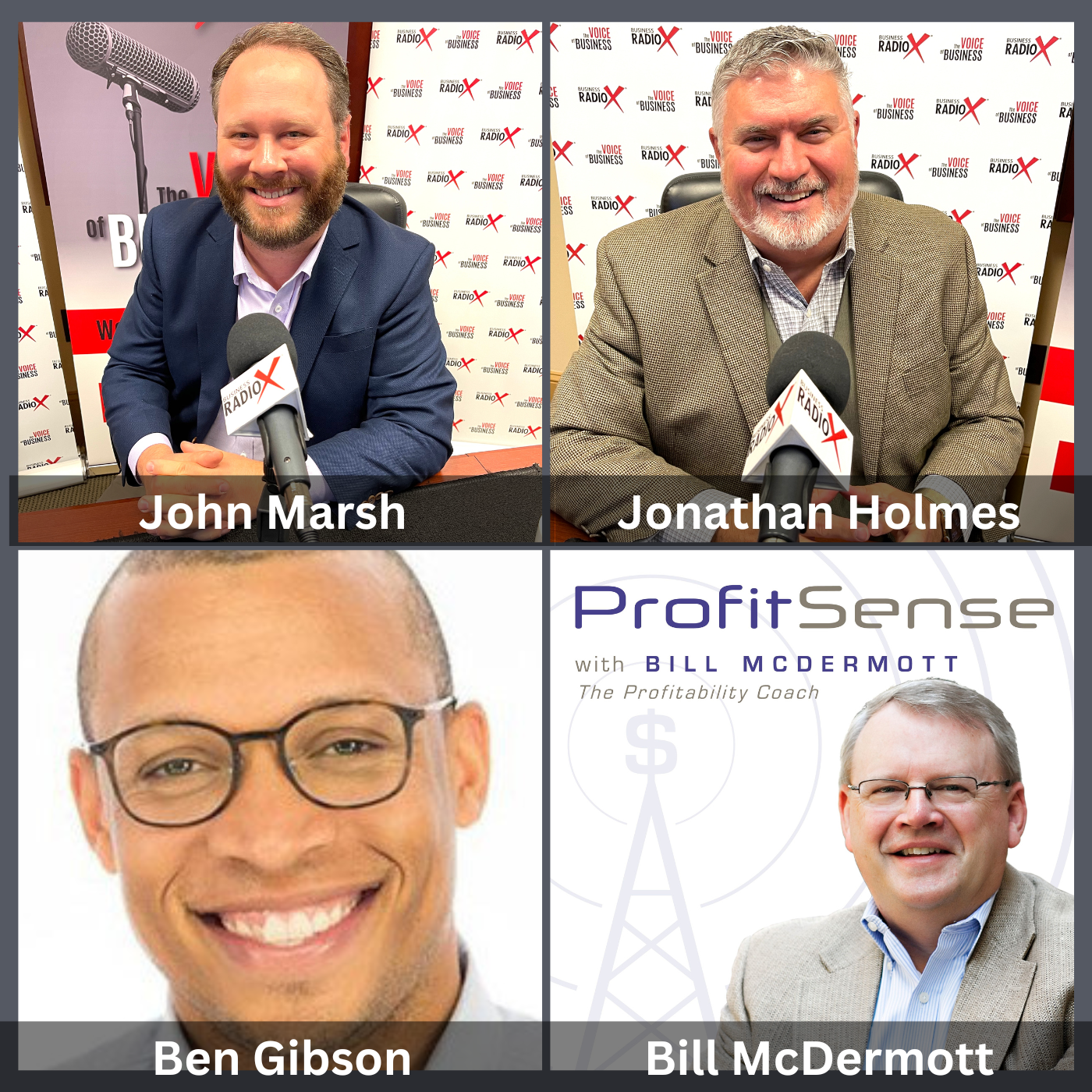

Ben Gibson, JP Morgan Chase, Jonathan Holmes, Mighty 8th Media, and John Marsh, Bristol Group (ProfitSense with Bill McDermott, Episode 37)

On this episode of ProfitSense, host Bill McDermott welcomed three distinguished business advisors. Ben Gibson, JP Morgan Chase, described the satisfaction he gets in helping business owners achieve their goals. Jonathan Holmes, Mighty 8th Media, discussed branding and marketing, while John Marsh shared how he helps business owners successfully sell their companies through his work at Bristol Group.

ProfitSense with Bill McDermott is produced and broadcast by the North Fulton Studio of Business RadioX® in Alpharetta.

JP Morgan Chase

For over 200 years, JPMorgan Chase & Co has provided innovative financial solutions for consumers, small businesses, corporations, governments and institutions around the world.

Today, they’re a leading global financial services firm with operations servicing clients in more than 100 countries.

Whether they are serving customers, helping small businesses, or putting their skills to work with partners, they strive to identify issues and propose solutions that will propel the future and strengthen both their clients and their communities.

Ben Gibson, Executive Director, JP Morgan Chase

Ben Gibson is a Relationship Executive in the Middle Market Banking Group covering the Georgia Middle Market. Ben utilizes the expansive JPMorgan Chase product platform to companies with annual revenues from $20 million to $100 million, offering cash management, credit, investment banking, international banking and wealth management and an array of other solutions.

Ben has 20+ years of banking experience and is responsible for relationship management, new business development and delivering the firm’s solutions locally with his Georgia-based clients.

Ben is a Magna Cum Laude graduate and 40 under 40 awarded alum of Georgia State University. He is married with children and his hobbies include reading, listening to music and watching movies and sports.

Ben is actively involved in the Metro Atlanta community as a member of the Executive Committee of the German American Cultural Foundation and Treasurer of OaksAtl, an affordable housing nonprofit focused in the Vine City and English communities, and serves on the finance committee of Atlanta Westside Charter School.

Mighty 8th Media LLC

Headquartered in the heart of historic Buford, GA, Mighty 8th is an award-winning, nationally recognized marketing and creative agency. Founded in 2005 by industry veterans Jonathan Holmes and Bradley Sherwood, Mighty 8th has become synonymous with producing powerful campaigns that drive business and make a lasting impact. The agency provides everything from strategy and creative development to website design and broadcast production for local, national and international clients across a variety of industries, including Alta Refrigeration, ClearStar, Consolidated Banking Services, Emory University, Gwinnett County Public Schools, Hyster Company, MegaSlab, Pinnacle Bank, Porter Steel, Primus Builders and Reeves Young and State Road Tollway Authority (Peach Pass).

Website | LinkedIn | Facebook | Twitter | Instagram

Jonathan Holmes, Managing Partner, Mighty 8th Media LLC

Jonathan Holmes is co-founder and Managing Partner / CFO of Mighty 8th, a full-service marketing and creative agency. The agency was founded in 2005 and has grown to be an Inc 5000 – top 50 Marketing Agencies in Atlanta, Atlanta Business Chronicle 2017 & 2018. His agency has been awarded Best Places to Work in Atlanta, 2013, 2014, 2015 and 2019 and a Best Places to Work in Georgia, Top 10, 2010 and Top 3, 2016.

Jonathan is a highly trained professional in accounting, non-profit operations, marketing, web and strategic planning with over 35 years of hands-on experience in revenue growth, organizational development, brand repositioning and entrepreneurial start-ups.

He is a native South Carolinian and graduate from the University of South Carolina. A 2018 Graduate of Leadership Gwinnett and 2022 LG Alumni Chair, having lived in Gwinnett for 21 years, Gwinnett is his “hometown”. He is an avid supporter helping to make Gwinnett Great as a growing county to lead the Atlanta Metro Region supporting a diverse population. He currently serves as Board Chair of Artworks Gwinnett, Most recently through his leadership efforts, Artworks has undertaken a Master Plan for Gwinnett’s Creative Economy – growing the Arts, Entertainment and Technology sector as an economic engine for Gwinnett.

He is a Board Member of the Gwinnett Chamber, Board Member Gwinnett Parks Foundation, an Advisor / Investor in Partnership Gwinnett, and a Chairman’s Club member of the Gwinnett Chamber. He also serves on the Board of Visitors of Georgia Gwinnett College and the Georgia Gwinnett College Foundation Development Committee. Most recently, he was appointed as a Board member of Pinnacle Bank based in Elberton, GA.

Bristol Group

John Marsh, Founder, Bristol Group

John is a successful cross-functional executive with experience leading and strengthening finance, accounting, and operations organizations. He has held a variety of executive roles including CFO, VP of Supply Chain and Planning, and EVP of Finance and Operations during his 17-year career. In those roles, John served as an integral part of the leadership team that scaled a medical device company and sold it to a private equity firm for 161M. John led integration efforts and was a part of due diligence on all of the companies acquisitions.

John started his career with the accounting firm, Ernst and Young in Atlanta, GA, and has worked with both start-ups and a large private equity-owned medical device manufacturer. He leverages his significant mergers and acquisition experience to help entrepreneurs successfully transition business ownership.

John graduated from the University of Georgia with a BBA in Accounting and holds an MBA from Kennesaw State University. He currently lives in Sandy Springs, with his wife and two daughters.

“Decision Vision” is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at

“Decision Vision” is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at