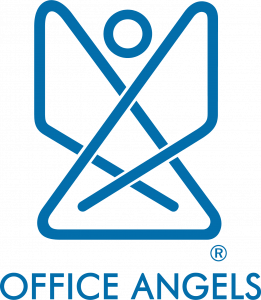

North Fulton Business Radio, Episode 650)

Nikki Evans refers to herself as a “Chief Thought Provoker” for her coaching clients. On this episode of North Fulton Business Radio, Nikki joined host John Ray to discuss the challenges she sees business owners have as they lead people, what makes her approach to coaching different, problems which arise as businesses grow, and much more.

North Fulton Business Radio is broadcast from the North Fulton studio of Business RadioX® inside Renasant Bank in Alpharetta.

At Ridgeline Coaching, they customize programs that work for you and meet your needs. Their process includes a needs discovery and co-creation process to ensure you plan together for your success.

Website | Facebook | LinkedIn | Twitter

Meet Nikki Evans, a coach with a behavioral approach to helping her clients achieve their goals. Nikki believes that success comes from being intentional about choices and recognizing individual strengths.

With her expertise in behavioral patterns, she helps her clients identify their strengths and create actionable plans to achieve the success they want. Nikki’s unique approach to solving issues in business goes beyond just addressing surface-level issues. She takes the time to understand the root cause of problems within an organization, recognizing that making changes in one area may impact other areas.

Her framework for understanding complex and changing systems ensures that the right root cause is being addressed, leading to the intended outcome while being mindful of any unintended consequences of change.

Nikki’s approach to communication is clear and concise. She recognizes the power of context in shaping perceptions and attitudes and advocates for a collaborative approach to problem-solving. She uses metaphor and humor to drive clarity with clients.

With her 20+ year background in information technology and her certifications in coaching individuals and teams, Nikki has worked with a diverse range of clients, from executive women’s leadership forums to non-profit groups dealing with the challenges of the pandemic. Her focus on recognizing strengths, understanding root causes, and communicating clearly has helped her clients achieve their goals and become more effective, joyful, and productive in their work.

- What are the challenges you see with business owners around leading people?

- What mistakes do you see business owners make around hiring?

- What makes your approach different?

- What behavior patterns should business owners have?

- What are a few of the problems that you see as businesses start to grow?

- How can working with a coach help?

- Business owners have to make a lot of tough financial decisions, what kind of ROI can they get from coaching?

North Fulton Business Radio is hosted by John Ray and broadcast and produced from the North Fulton studio of Business RadioX® inside Renasant Bank in Alpharetta. You can find the full archive of shows by following this link. The show is available on all the major podcast apps, including Apple Podcasts, Spotify, Google, Amazon, iHeart Radio, Stitcher, TuneIn, and others.

Renasant Bank has humble roots, starting in 1904 as a $100,000 bank in a Lee County, Mississippi, bakery. Since then, Renasant has grown to become one of the Southeast’s strongest financial institutions with over $13 billion in assets and more than 190 banking, lending, wealth management, and financial services offices in Mississippi, Alabama, Tennessee, Georgia, and Florida. All of Renasant’s success stems from each of their banker’s commitment to investing in their communities as a way of better understanding the people they serve. At Renasant Bank, they understand you because they work and live alongside you every day.

Since 2000, Office Angels® has been restoring joy to the life of small business owners, enabling them to focus on what they do best. At the same time, we honor and support at-home experts who wish to continue working on an as-needed basis. Not a temp firm or a placement service, Office Angels matches a business owner’s support needs with Angels who have the talent and experience necessary to handle work that is essential to creating and maintaining a successful small business. Need help with administrative tasks, bookkeeping, marketing, presentations, workshops, speaking engagements, and more? Visit us at https://officeangels.us/.

Little PINK Book is America’s #1 digital platform for ambitious, intelligent women passionate about making a difference. They deliver monthly editorial content to the PINK Enote, as well as bimonthly gatherings in the form of deep dive zoominars, the PINK Power Alliance, to help develop high potential women in originations committed to supporting their rising stars while advancing women and diversity.

Little PINK Book is America’s #1 digital platform for ambitious, intelligent women passionate about making a difference. They deliver monthly editorial content to the PINK Enote, as well as bimonthly gatherings in the form of deep dive zoominars, the PINK Power Alliance, to help develop high potential women in originations committed to supporting their rising stars while advancing women and diversity.

At Greathouse Trial Law, LLC, they fight to get injured victims the compensation that they deserve. The firm’s focus is on auto accidents, hit & runs, DUI accidents, slip & fall, and wrongful death.

At Greathouse Trial Law, LLC, they fight to get injured victims the compensation that they deserve. The firm’s focus is on auto accidents, hit & runs, DUI accidents, slip & fall, and wrongful death.