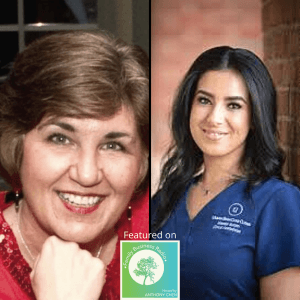

Family Business Radio, Episode 10: Kathy Stone, Camp Bow Wow Lawrenceville, and Maedeh Samimi, Urban Skin Care Clinic

Kathy Stone of Camp Bow Wow Lawrenceville joined “Family Business Radio” to discuss her doggy day care and boarding business. Host Anthony Chen also welcomed Maedeh Samimi, Urban Skin Care Clinic, to talk about how she helps her clients gain radiant-looking skin. “Family Business Radio” is broadcast from the North Fulton Studio of Business RadioX®.

Kathy Stone, Owner, Camp Bow Wow Lawrenceville

Camp Bow Wow Lawrenceville GA is part of the largest dog care franchise in the US. A premiere dog day camp, overnight boarding and full-service grooming service organization, CBW Lawrenceville GA specializes in all day play/open play environments where a dog can be a dog. CBW Lawrenceville GA even has Camper Cams through a free app so that parents can watch their pups play during the day. CBW Lawrenceville GA just celebrated its fifth anniversary.

Maedeh Samimi, Founder, Urban Skin Care Clinic

Urban Skin Care Clinic is committed to providing clinically-proven, results-driven treatments with the highest integrity of customer service in the aesthetic industry.

By specializing in results-driven, clinically-based treatments, Maedeh is able to educate her clients on how to take better care of their skin and customize a treatment plan as well as proper home care regimen so that they can look as confident as they feel.

Anthony Chen, Host of “Family Business Radio”

This show is sponsored and brought to you by Anthony Chen with Lighthouse Financial Network. Securities and advisory services offered through Royal Alliance Associates, Inc. (RAA), member FINRA/SIPC. RAA is separately owned and other entities and/or marketing names, products or services referenced here are independent of RAA. The main office address is 575 Broadhollow Rd. Melville, NY 11747. You can reach Anthony at 631-465-9090 ext 5075 or by email at anthonychen@lfnllc.com.

Anthony Chen started his career in financial services with MetLife in Buffalo, NY in 2008. Born and raised in Elmhurst, Queens, he considers himself a full-blooded New Yorker while now enjoying his Atlanta, GA home. Specializing in family businesses and their owners, Anthony works to protect what is most important to them. From preserving to creating wealth, Anthony partners with CPAs and attorneys to help address all of the concerns and help clients achieve their goals. By using a combination of financial products ranging from life, disability, and long term care insurance to many investment options through Royal Alliance. Anthony looks to be the eyes and ears for his client’s financial foundation. In his spare time, Anthony is an avid long-distance runner.

The complete show archive of “Family Business Radio” can be found at familybusinessradioshow.com.

C

C