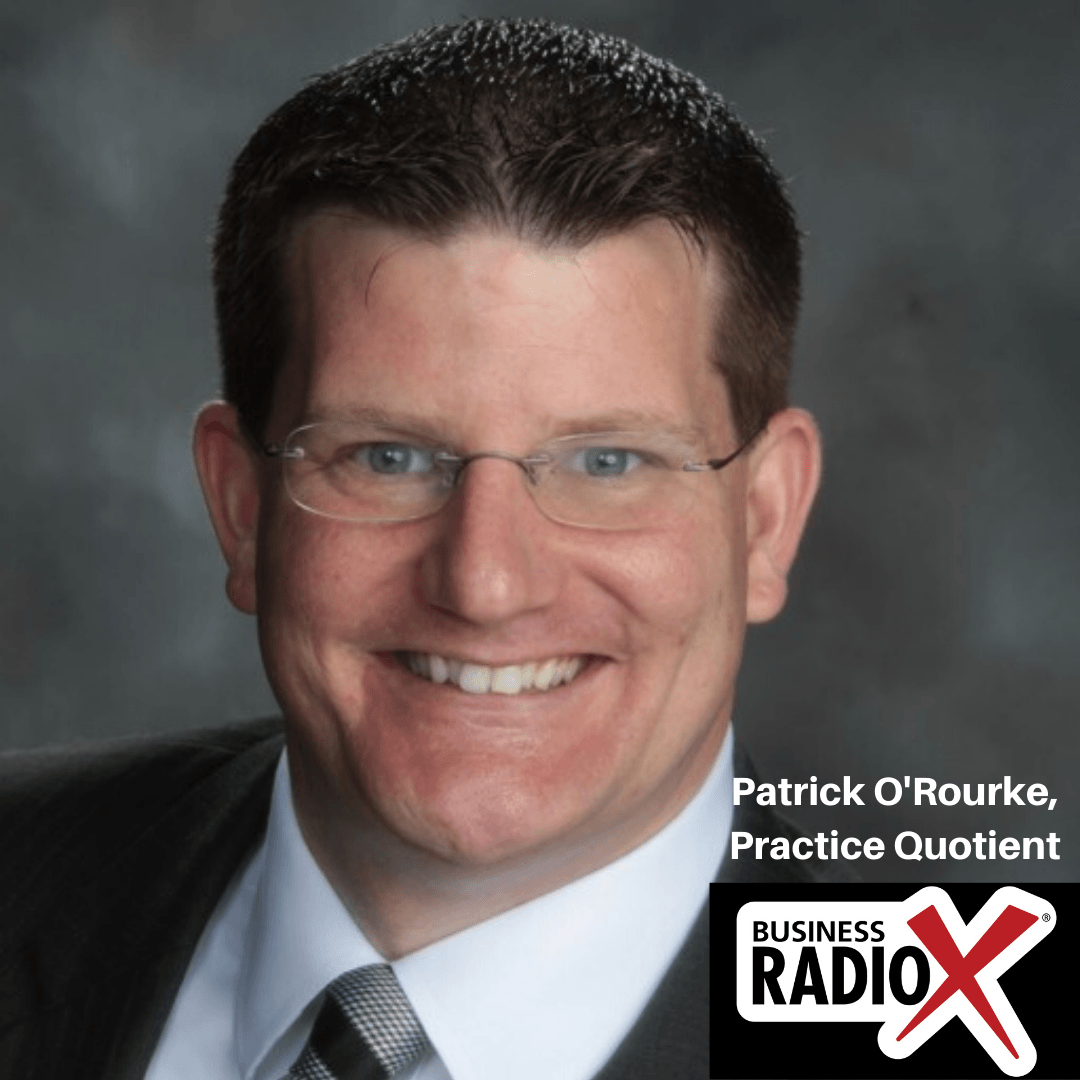

Live from Insurance Extravaganza 2025: Teresa Duncan, Odyssey Management (Dental Business Radio, Episode 58)

In this episode of Dental Business Radio, host Patrick O’Rourke talks with Teresa Duncan at the Insurance Extravaganza in Orlando, Florida. Teresa shares insights from her presentation on the importance of understanding the behind-the-scenes aspects of dental insurance, such as the Certificate of Coverage and premium pricing. They discuss common misconceptions about insurance, the complexities of customizing plans for employers, and the importance of detailed documentation to prevent issues with state boards and malpractice claims. Teresa emphasizes the need for dental managers and billing professionals to attend malpractice seminars and engage in continuing education to ensure compliance and protect their practices.

Dental Business Radio is underwritten and presented by Practice Quotient: PPO Negotiations & Analysis and produced by John Ray and the North Fulton affiliate of Business RadioX®.

Teresa Duncan, Odyssey Management

Teresa Duncan is a distinguished speaker and writer with over 20 years of experience in healthcare, specializing in revenue protection, accounts receivable, insurance methods, and practice management systems. She has been honored with the Lifetime Achievement Award from the American Association of Dental Office Management, underscoring her commitment to continuing education and professional development in the dental industry.

As the author of “Moving Your Patients to Yes: Easy Insurance Conversations” and a regular contributor to the ADA’s CDT Companion Guide™, Teresa is a frequent voice in dental publications. She played a key role as a founding Trustee for the DALE Foundation, which focuses on auxiliary learning, and is actively involved in organizations such as Women in DSO and the National Association of Dental Plans. Her expertise is further recognized through her consulting work on the American Dental Association’s Guidelines for Practice Success™, and she is the host of two podcasts, “Nobody Told Me That!” and “Chew On This!”, which address coding and management topics for dental professionals.

Teresa’s leadership has been acknowledged by her inclusion as one of the Top 25 Women in Dentistry by Dental Products Report Magazine and her annual recognition as a Leader in Consulting by Dentistry Today. She holds a Master’s Degree in Healthcare Management from Marymount University, reflecting her deep academic and practical knowledge in the field

Website | LinkedIn | Instagram | Facebook

Topics Discussed in this Episode

00:00 Introduction and Welcome to Dental Business Radio

00:12 Introduction to Teresa Duncan and Initial Impressions

00:31 Behind the Scenes of Insurance

01:12 Understanding Employer Group Coverage

02:08 The Importance of Certificate of Coverage

03:08 Customizing Insurance Plans

06:40 Malpractice Policies and Their Importance

11:23 Managing Risk and Compliance

13:06 Conclusion and Final Thoughts

About Dental Business Radio

Dental Business Radio covers the business side of dentistry. Host Patrick O’Rourke and his guests cover industry trends, insights, success stories, and more in this wide-ranging show. The show’s guests include successful doctors across the spectrum of dental practice providers, as well as trusted advisors and noted industry participants.

Dental Business Radio is underwritten and presented by Practice Quotient and produced by the North Fulton studio of Business RadioX®. The show can be found on all the major podcast apps and a complete show archive is here.

Practice Quotient

Practice Quotient is the sponsor of Dental Business Radio. Practice Quotient, Inc. serves as a bridge between the payor and provider communities. Their clients include general dentists and dental specialty practices across the nation of all sizes, from completely fee-for-service-only to active network participation with every dental plan possible. They work with independent practices, emerging multi-practice entities, and various large ownership entities in the dental space. Their PPO negotiations and analysis projects evaluate the merits of the various in-network participation contract options specific to your practice’s patient acquisition strategy. There is no one-size-fits-all solution.

Practice Quotient is the sponsor of Dental Business Radio. Practice Quotient, Inc. serves as a bridge between the payor and provider communities. Their clients include general dentists and dental specialty practices across the nation of all sizes, from completely fee-for-service-only to active network participation with every dental plan possible. They work with independent practices, emerging multi-practice entities, and various large ownership entities in the dental space. Their PPO negotiations and analysis projects evaluate the merits of the various in-network participation contract options specific to your practice’s patient acquisition strategy. There is no one-size-fits-all solution.

Connect with Practice Quotient

Website | LinkedIn | Facebook | X (Twitter)

Dr. Chris Adkins is the 2023 President of the Georgia Dental Association and Owner of Chris Adkins, DDS, in Stockbridge, Georgia.

Dr. Chris Adkins is the 2023 President of the Georgia Dental Association and Owner of Chris Adkins, DDS, in Stockbridge, Georgia.

Travis Rodgers has been called the #1 entrepreneur in the dental industry. He enjoys building innovative dental software solutions and has built software solutions around dental referrals, insurance, communication, integration, analytics, and more.

Travis Rodgers has been called the #1 entrepreneur in the dental industry. He enjoys building innovative dental software solutions and has built software solutions around dental referrals, insurance, communication, integration, analytics, and more.

Before serving as Mayor of the

Before serving as Mayor of the  Crosstex International

Crosstex International

Dr. Natasha Lisin and the experienced staff at

Dr. Natasha Lisin and the experienced staff at  Benco Dental

Benco Dental WellSource Integrative Health Solutions

WellSource Integrative Health Solutions

Atlanta Divorce Law Group

Atlanta Divorce Law Group Reich Dental Center

Reich Dental Center

HealthMarkets Insurance Agency

HealthMarkets Insurance Agency