Secrets to a Successful Business Sale, with Bob Tankesley, Exit Teams (Family Business Radio, Episode 61)

In this episode, Family Business Radio kicks off 2025 with Anthony Chen hosting m&a advisor and author Bob Tankesley. They discuss the intricacies of exit planning for family businesses, including common misconceptions, the importance of thinking like a buyer, and the value of building a strong advisory team. Bob shares insights from his book Exit Teams and highlights the critical factors that can either discount or drive a premium for a business during a sale. They explore the necessity of early strategic planning, the impact of family dynamics, and the rising relevance of human capital in business valuation.

Anthony concludes the show with thoughts on how to find the best advisor.

This episode is essential for any business owner contemplating an exit strategy or seeking to maximize their business value.

Family Business Radio is underwritten and brought to you by Anthony Chen with Lighthouse Financial Network. The show is produced by John Ray and the North Fulton affiliate of Business RadioX®.

Bob Tankesley, Exit Teams

Bob Tankesley is a fourth-generation entrepreneur, an MBA, and a CPA with a keen insight into and understanding of the business owner mindset. As an M&A advisor, he uses his 27 years of experience to sell companies grossing up to $75,000,000 in revenue throughout the southeast U.S., as well as the commercial real estate associated with such holdings. When a company is not ready to sell, Bob regularly partners with advisors of all types to optimize it throughout the ownership lifecycle and is a frequent speaker/educator to owners and their various advisors.

Bob’s experience ranges from a division of a Fortune 500 corporation to a Big Four accounting firm to multiple micro-cap and lower mid-market closely held businesses. He also ran his own tax and financial advisory firm for over a decade. For the past 22 years, he has advised over 150 business owners and executives on valuation, market readiness, and proven methods to engage in proper financial management.

Bob’s formal education includes both a BS degree in Accounting (cum laude) from UNC Asheville and an MBA in Finance from Appalachian State University, as well as multiple industry certifications. He is also a co-founder and board member of the Exit Planning Exchange (XPX) Atlanta Chapter.

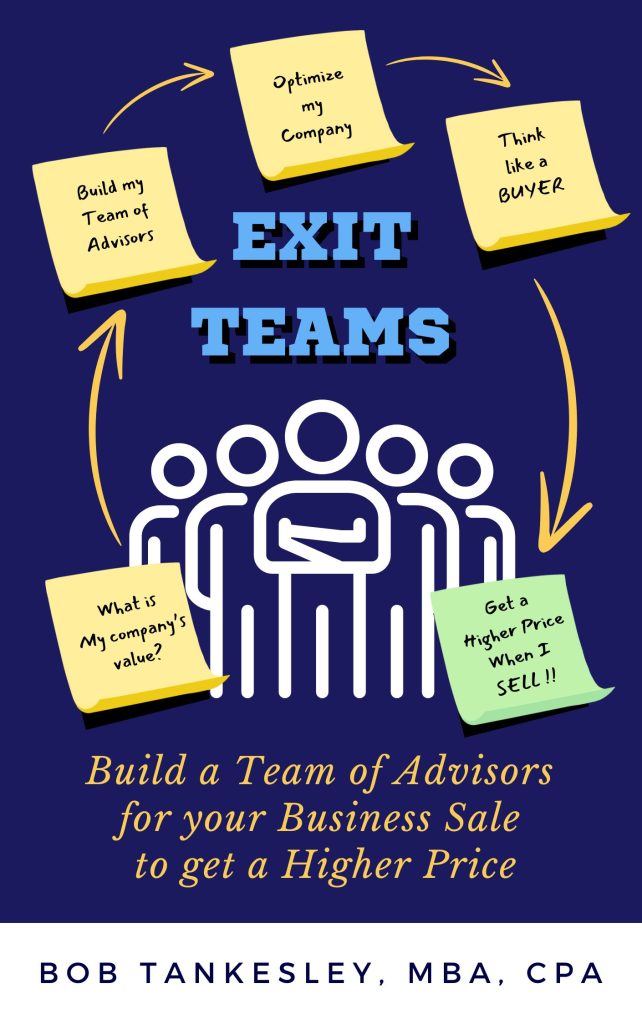

Exit Teams: Build a Team of Advisors for Your Business Sale to Get a Higher Price

You’ve got one shot to sell your business right!

The American Dream fulfilled! You are a business owner, and it’s time to cash in on the sale of your business. Except the buyers on the other side of the table are prepared with a team of experts ready to lower your price.

Enter Exit Teams. This book won’t give you tactics that don’t pertain to your situation, and it won’t promise you beach chairs and Caribbean sunsets. This book will tell you the truth, letting you know the psychological dangers that play into a business sale, and how buyers can use that psychology to acquire your business for far less than you, the owner, could have made.

Enter Exit Teams. This book won’t give you tactics that don’t pertain to your situation, and it won’t promise you beach chairs and Caribbean sunsets. This book will tell you the truth, letting you know the psychological dangers that play into a business sale, and how buyers can use that psychology to acquire your business for far less than you, the owner, could have made.

Follow along with Dave, the owner of FineLine Manufacturing, who received notice of a health scare, forcing him to think about selling before he’s ready. Dave makes many of the typical business seller moves, getting advice from seemingly logical but misaligned resources. Pressures mount from his employees, his customers, his friends, and his family as he juggles a business sale while maintaining secrecy.

When Dave finally gets an offer, it’s for far less than he had hoped. This sends Dave on a whirlwind of choices that pull him in many directions. Will Dave learn the lessons required to give him the best chance at business sale success before he loses his largest customer?

Exit Teams will:

- Alert you to the emotional roller coaster that arises during a business sale.

- Educate you to the common pitfalls business owners fall into, often of their own making.

- Explain what an Exit Team is, and why they are necessary for the ultimate business sale success.

- Warn you of some of the strategies buyers employ to pressure business sellers to lower their price.

- Caution you about lifting expectations according to a colleague’s experience (hint: it may not be all he says it is).

- Counsel you on how to handle family dynamics during a business sale.

- Present you with common decisions made by inexperienced business sellers so you won’t make the same choices.

- Display the challenge of secrecy among employees and customers.

- Address health challenges and how they often impact the business owner while trying to sell.

- Stress the need to understand your company’s value on an ongoing basis.

- Provide you with a business selling experience without your having to learn the hard way from real life at the cost of millions of dollars

To order the book, follow this link.

Anthony Chen, Host of Family Business Radio

Family Business Radio is sponsored and brought to you by Anthony Chen with Lighthouse Financial Network. Securities and advisory services are offered through OSAIC, member FINRA/SIPC. RAA is separately owned, and other entities and/or marketing names, products, or services referenced here are independent of OSAIC. The main office address is 575 Broadhollow Rd., Melville, NY 11747. You can reach Anthony at 631-465-9090, ext. 5075, or by email at anthonychen@lfnllc.com.

Anthony Chen started his career in financial services with MetLife in Buffalo, NY, in 2008. Born and raised in Elmhurst, Queens, he considers himself a full-blooded New Yorker while now enjoying his Atlanta, GA, home. Specializing in family businesses and their owners, Anthony works to protect what is most important to them. From preserving to creating wealth, Anthony partners with CPAs and attorneys to help address all of the concerns and help clients achieve their goals. By using a combination of financial products ranging from life, disability, and long-term care insurance to many investment options through Royal Alliance, Anthony looks to be the eyes and ears for his client’s financial foundation. In his spare time, Anthony is an avid long-distance runner.

The complete show archive of Family Business Radio can be found by following this link.

John Ray also operates his own

John Ray also operates his own