Why You’re Really Afraid to Raise Your Prices with John Ray (The Price and Value Journey, Episode 141)

Are you afraid to raise prices? You’re not alone.

Raising your prices isn’t just a financial move. It’s an emotional decision that can stir up fear, doubt, and second-guessing.

In this solo episode of The Price and Value Journey, John Ray explores the five hidden fears that often hold expert-service providers back from charging what their work is truly worth. Whether it’s fear of losing a client relationship, feeling pressure to be perfect, or anxiety about the economy, these concerns are real and often unspoken.

John shares how to move past those fears by focusing on what your clients actually value. He explains why your best pricing insight comes not from what you believe about your work, but from what your clients experience and are willing to pay for.

If raising your prices gives you that knot-in-the-stomach feeling, this episode is for you.

The Price and Value Journey is presented by John Ray and produced by North Fulton Business Radio, LLC, an affiliate of the Business RadioX® podcast network.

Key Takeaways You Can Use from This Episode

- Fear of raising prices is rarely about money. It’s about identity, rejection, and self-worth.

- Clients evaluate value, not personal worth. A “no” is not a judgment of you.

- Perfectionism is a trap. Clients value responsiveness, clarity, and honesty more than flawlessness.

- Cable news and clickbait headlines can distort your perspective. Trust your clients, not the media.

- You can make thoughtful exceptions for certain clients without holding your whole business back.

- The most valuable insights about your worth come from client conversations and feedback.

- Clients often see more value in your work than you do. Your job is to listen and own it.

Topics Discussed in this Episode

00:00 Introduction to The Price and Value Journey and a Personal Anecdote

00:39 The Real Fear Behind Raising Prices

02:09 Hidden Fear #1: You’ll Lose the Relationship

03:29 Hidden Fear #2: You’ll Have to Be Perfect

04:34 Hidden Fear #3: You’ll Be Seen as Greedy or Full of Yourself

06:27 Hidden Fear #4: The Economy Is So Uncertain

08:13 Hidden Fear #5: You Know You Have Clients That Need Help

08:06 Gaining Clarity on Your Value

10:08 Conclusion and Call to Action

About The Price and Value Journey Podcast

The Price and Value Journey is a show for expert-service professionals who want more than formulas and quick fixes. If you’re a solo or small-firm provider—consultant, coach, attorney, CPA, or fractional executive—you know the real work of building a practice goes far beyond pricing. It’s about finding clarity, showing up with confidence, and learning how to express the full value of what you do in ways that clients understand and appreciate.

Hosted by John Ray, business advisor and author of The Generosity Mindset, this podcast explores the deeper journey behind running a services business: how you think about your work, how you relate to clients, and how you sustain a business that’s not only profitable but deeply fulfilling. Yes, we talk pricing, but we also talk mindset, business development, trust, empathy, positioning, and all the intangible ingredients that make a practice thrive.

Hosted by John Ray, business advisor and author of The Generosity Mindset, this podcast explores the deeper journey behind running a services business: how you think about your work, how you relate to clients, and how you sustain a business that’s not only profitable but deeply fulfilling. Yes, we talk pricing, but we also talk mindset, business development, trust, empathy, positioning, and all the intangible ingredients that make a practice thrive.

With solo episodes and conversations featuring thoughtful guests, The Price and Value Journey is a companion for professionals who are building something meaningful. Produced in partnership with North Fulton Business Radio, LLC, an affiliate of Business RadioX®, the podcast is accessible on all major podcast platforms. The complete show archive is here.

John Ray, Host of The Price and Value Journey

John Ray is the host of The Price and Value Journey.

John owns Ray Business Advisors, a business advisory practice. John’s services include business coaching and advisory work, as well as advising solopreneurs and small professional services firms on their pricing. John is passionate about the power of pricing for business owners, as changing pricing is the fastest way to change the profitability of a business. His clients are professionals who are selling their expertise, such as attorneys, CPAs, accountants and bookkeepers, consultants, coaches, marketing professionals, and other professional services practitioners.

In his other business, John is a podcast show host, strategist, and the owner of North Fulton Business Radio, LLC, an affiliate of Business RadioX®. John and his team work with B2B professionals to create and conduct their podcast using The Generosity Mindset® Method: building and deepening relationships in a non-salesy way that translates into revenue for their business.

John is also the host of North Fulton Business Radio. With over 880 shows and having featured over 1,300 guests, North Fulton Business Radio is the longest-running podcast in the North Fulton area, covering business in its region like no one else.

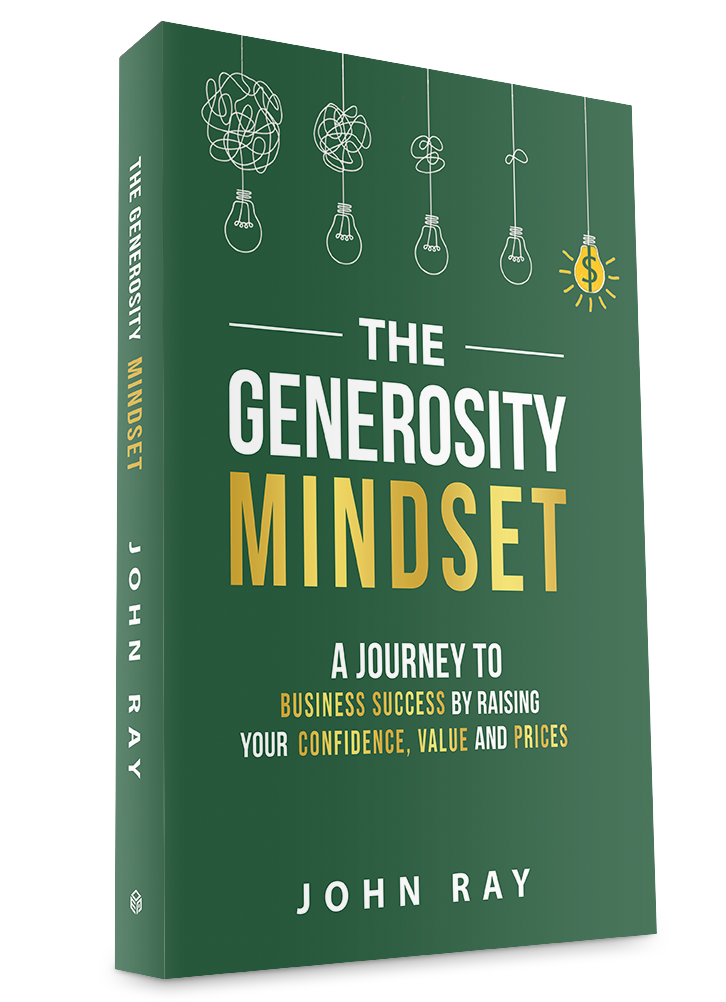

John’s book, The Generosity Mindset: A Journey to Business Success by Raising Your Confidence, Value, and Prices

John is the #1 national best-selling author of The Generosity Mindset: A Journey to Business Success by Raising Your Confidence, Value, and Prices.

John is the #1 national best-selling author of The Generosity Mindset: A Journey to Business Success by Raising Your Confidence, Value, and Prices.

If you are a professional services provider, your goal is to do transformative work for clients you love working with and get paid commensurate with the value you deliver to them. While negative mindsets can inhibit your growth, adopting a different mindset, The Generosity Mindset®, can replace those self-limiting beliefs. The Generosity Mindset enables you to diagnose and communicate the value you deliver to clients and, in turn, more effectively price to receive a portion of that value.

Whether you’re a consultant, coach, marketing or branding professional, business advisor, attorney, CPA, or work in virtually any other professional services discipline, your content and technical expertise are not proprietary. What’s unique, though, is your experience and how you synthesize and deliver your knowledge. What’s special is your demeanor or the way you deal with your best-fit clients. What’s invaluable is how you deliver outstanding value by guiding people through massive changes in their personal lives and in their businesses that bring them to a place they never thought possible.

Your combination of these elements is unique in your industry. There lies your value, but it’s not the value you see. It’s the value your best-fit customers see in you.

If pricing your value feels uncomfortable or unfamiliar to you, this book will teach you why putting a price on the value your clients perceive and identify serves both them and you, and you’ll learn the factors involved in getting your price right.

The book is available at all major physical and online book retailers worldwide. Follow this link for further details.

A great tip Rob shared was for the parent to present a calm demeanor and not look frightened in front of the child. Rob says the child is looking to the parent for visual cues to let him/her know what is going on. So if the parent looks panicked then the child is going to feel scared as well. Rob also explained that having the parent demonstrate the procedure first the child can see that it isn’t so bad and will go along. this works especially well with showing your child how to swallow a pill or get his/her blood pressure taken. He has worked with lots of kids who have juvenile diabetes and has helped their families manage the regular injections and blood testing they have to deal with. His goal is to educate parents and nursing students on some proven techniques that will make children of all ages feel safer and less fearful in the doctor’s office. To learn more please go to his website

A great tip Rob shared was for the parent to present a calm demeanor and not look frightened in front of the child. Rob says the child is looking to the parent for visual cues to let him/her know what is going on. So if the parent looks panicked then the child is going to feel scared as well. Rob also explained that having the parent demonstrate the procedure first the child can see that it isn’t so bad and will go along. this works especially well with showing your child how to swallow a pill or get his/her blood pressure taken. He has worked with lots of kids who have juvenile diabetes and has helped their families manage the regular injections and blood testing they have to deal with. His goal is to educate parents and nursing students on some proven techniques that will make children of all ages feel safer and less fearful in the doctor’s office. To learn more please go to his website