Avi Pinsky on Making Your Financials Track Client Value Creation, Five Key Business Drivers That Never Appear on Statements, and Why Smart Service Providers Still Struggle With Business Finances (The Price and Value Journey, Episode 155)

Smart service providers often run profitable businesses, even very profitable ones, but often do not understand the dynamics and drivers of their income statement. Avi Pinsky, the Business Finance Doctor, joins host John Ray on The Price and Value Journey to walk through the disconnect between accounting statements and business reality for solo and small firm practitioners who could benefit from answers their CPA doesn’t provide.

Avi explains five revenue levers that never appear on financial statements but determine whether your practice thrives or barely survives: leads, conversion rate, retention, billing frequency, and average sale value. For consultants, coaches, and professional service providers who’ve mastered their craft but struggle with the business side, he reveals why accounts receivable functions as an interest-free loan you’re giving clients while your bills come due, how to classify team member salaries so you actually know if you’re pricing high enough, and why paying vendors the day invoices arrive is overly generous because it’s also strangling your cash flow.

You’ll learn to shift from “I need more sales” to “I need to create more value” and understand why your financial statements should track value creation for clients, not just satisfy reporting requirements for accountants who bill you and then disappear until next tax season.

The Price and Value Journey is presented by John Ray and produced by North Fulton Business Radio, LLC, an affiliate of the Business RadioX® podcast network.

Key Takeaways You Can Use from This Episode

- Track five revenue levers your accountant never measures: leads, conversion rate, retention rate, billing frequency, and average sale value. These numbers drive your business but don’t appear on financial statements, so you have to track them yourself.

- Profit on paper doesn’t equal cash in the bank. Your P&L might show a million-dollar profit while your bank account is overdrawn because accounting statements are theoretical, not actual cash flow.

- Classify employee salaries by value creation. Put client-facing team members (associates, therapists, consultants) in cost of goods sold, separate from overhead staff, so you can see if you’re pricing services high enough to cover what you’re actually selling.

- Accounts receivable is an interest-free loan you’re giving customers. Every invoice you let sit unpaid ties up cash you need to pay vendors who won’t give you the same courtesy.

- Stop paying vendors faster than your terms require. If your payment terms are 30 days, paying on day one might be generous, but it’s also draining cash your business needs to operate.

- Build a value scoreboard, not just financial statements. Track the health metrics that tell you which part of your business needs attention in the next 30, 60, or 90 days rather than just looking backward at what already happened.

Topics Discussed in this Episode

00:00 Introduction and Welcome to The Price and Value Journey

00:15 Avi Pinsky’s Background and Business Philosophy

01:57 Challenges Faced by CPAs and Business Owners

04:35 The Transition from Operator to Owner

07:03 Understanding Business Development and Financial Dynamics

09:17 The Five Revenue Levers

12:18 Value Creation and Price Justification

13:55 Building a Value Scoreboard

18:13 Mindset Shift: From Sales to Value Creation

25:57 Understanding Revenue and Profit

26:33 The Importance of Cash Flow

27:15 The Disconnect Between Profit and Bank Balance

28:21 The Role of Accountants and Bookkeepers

30:14 Key Revenue Levers for Business Owners

30:47 Setting Realistic Business Goals

33:27 Common Cash Flow Killers

36:50 Classifying Costs Correctly

41:23 Cash Flow Forecasting for Non-Numbers People

44:30 Practical Cash Preservation Strategies

46:19 Conclusion and Final Thoughts

Avi Pinsky, Pinsky Consulting

Avi Pinsky is the founder of Pinsky Consulting and is known as the “Business Finance Doctor.” After more than a decade as a public accountant, Avi realized that small business owners don’t just need someone to crunch numbers; they need a financial partner who can diagnose hidden issues and prescribe practical solutions that actually grow the business.

He helps entrepreneurs get clear on what’s really driving (or draining) their revenue, profit, and cash flow. Through his signature “Business Wellness Checks,” he pinpoints operational blind spots and delivers simple, results-focused “treatment plans” that business owners can act on immediately.

His specialty is helping service-based small businesses stop guessing, start tracking, and scale with confidence. Avi offers a fresh, down-to-earth approach to financial clarity and sustainable growth.

John Ray, Host of The Price and Value Journey

John Ray is the host of The Price and Value Journey.

John owns Ray Business Advisors, a business advisory practice. John’s services include business coaching and advisory work, as well as advising solopreneurs and small professional services firms on their pricing. John is passionate about the power of pricing for business owners, as changing pricing is the fastest way to change the profitability of a business. His clients are professionals who are selling their expertise, such as attorneys, CPAs, accountants and bookkeepers, consultants, coaches, marketing professionals, and other professional services practitioners.

John is a podcast show host and the owner of North Fulton Business Radio, LLC, an affiliate of Business RadioX®. John and his team work with B2B professionals to create and conduct their podcast using The Generosity Mindset® Method: building and deepening relationships in a non-salesy way that translates into revenue for their business.

John is also the host of North Fulton Business Radio. With over 900 shows and having featured over 1,300 guests, North Fulton Business Radio is the longest-running podcast in the North Fulton area, covering business in its region like no one else.

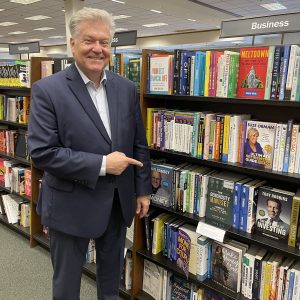

John’s book, The Generosity Mindset: A Journey to Business Success by Raising Your Confidence, Value, and Prices

John Ray is the author of the five-star rated book The Generosity Mindset: A Journey to Business Success by Raising Your Confidence, Value, and Prices, praised by readers for its practical insights on raising confidence, value, and prices.

John Ray is the author of the five-star rated book The Generosity Mindset: A Journey to Business Success by Raising Your Confidence, Value, and Prices, praised by readers for its practical insights on raising confidence, value, and prices.

If you are a professional services provider, your goal is to do transformative work for clients you love working with and get paid commensurate with the value you deliver to them. While negative mindsets can inhibit your growth, adopting a different mindset, The Generosity Mindset®, can replace those self-limiting beliefs. The Generosity Mindset enables you to diagnose and communicate the value you deliver to clients and, in turn, more effectively price to receive a portion of that value.

Whether you’re a consultant, coach, marketing or branding professional, business advisor, attorney, CPA, or work in virtually any other professional services discipline, your content and technical expertise are not proprietary. What’s unique, though, is your experience and how you synthesize and deliver your knowledge. What’s special is your demeanor or the way you deal with your best-fit clients. What’s invaluable is how you deliver outstanding value by guiding people through massive changes in their personal lives and in their businesses that bring them to a place they never thought possible.

Your combination of these elements is unique in your industry. There lies your value, but it’s not the value you see. It’s the value your best-fit customers see in you.

If pricing your value feels uncomfortable or unfamiliar to you, this book will teach you why putting a price on the value your clients perceive and identify serves both them and you, and you’ll learn the factors involved in getting your price right.

The book is available at all major physical and online book retailers worldwide. Follow this link for further details.

03:16 Challenges in Family Businesses

03:16 Challenges in Family Businesses

Decision Vision is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at

Decision Vision is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at

Decision Vision is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at

Decision Vision is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at

Dave Wilkins has over 30 years experience working for companies such as E&Y, Whitridge Associates, PriceWaterhouseCoopers and IBM in business and technology management and consulting. He is currently the Senior Vice President of

Dave Wilkins has over 30 years experience working for companies such as E&Y, Whitridge Associates, PriceWaterhouseCoopers and IBM in business and technology management and consulting. He is currently the Senior Vice President of

Dave Wilkins has over 30 years experience working for companies such as E&Y, Whitridge Associates, PriceWaterhouseCoopers and IBM in business and technology management and consulting. He is currently the Senior Vice President of

Dave Wilkins has over 30 years experience working for companies such as E&Y, Whitridge Associates, PriceWaterhouseCoopers and IBM in business and technology management and consulting. He is currently the Senior Vice President of

Dave Wilkins has over 30 years experience working for companies such as E&Y, Whitridge Associates, PriceWaterhouseCoopers and IBM in business and technology management and consulting. He is currently the Senior Vice President of

Dave Wilkins has over 30 years experience working for companies such as E&Y, Whitridge Associates, PriceWaterhouseCoopers and IBM in business and technology management and consulting. He is currently the Senior Vice President of

Sterling Rose Consulting Corp

Sterling Rose Consulting Corp