Ryan Kauth, Kauth & Associates, and Host of The Fractional Executive Podcast

Ryan Kauth, founder of Kauth & Associates and host of The Fractional Executive Podcast, joined host John Ray on this edition of Business Leaders Radio to discuss his business coaching practice and his podcast. Ryan talked about what led to his founding the entrepreneurship program at the University of Wisconsin Green Bay, creating courses for entrepreneurship, the five areas he coaches his clients on, the value of coaching, his podcast, and more.

Business Leaders Radio is produced and broadcast by the North Fulton Studio of Business RadioX® in Atlanta.

The Fractional Executive Podcast

Growing a company beyond a certain point can be incredibly challenging, particularly for smaller businesses with limited resources. These executives find themselves facing a range of issues, from a lack of funding and resources to market saturation and increased competition.

These executives find themselves facing a range of issues, from a lack of funding and resources to market saturation and increased competition.

Ryan’s guest experts share their insights and experiences on the most effective strategies for overcoming these challenges, including building a strong team, expanding into new markets, leveraging technology, discussing the importance of developing a clear vision and strategy, and how to effectively communicate this to stakeholders.

Ryan Kauth, Founder, Kauth & Associates and Host of The Fractional Executive Podcast

Ryan Kauth is a business coach and executive who founded the current entrepreneurship program at the University of Wisconsin Green Bay. Over the past 25 years, he has helped hundreds of founders and family business owners grow their businesses. Ryan holds several business degrees and certifications, and has taught undergraduate and graduate business students and entrepreneurs.

Questions and Topics in this Interview

- Why does a founder or family business owner need a business coach?

- How has your professional career path lead you to coaching founders and family business owners?

- What are the five areas you work on with founders and family business owners?

- Why have you hired business coaches for yourself throughout your career?

Business Leaders Radio is hosted by John Ray and produced virtually from the North Fulton studio of Business RadioX® in Alpharetta. The show can be found on all the major podcast apps and a full archive can be found here.

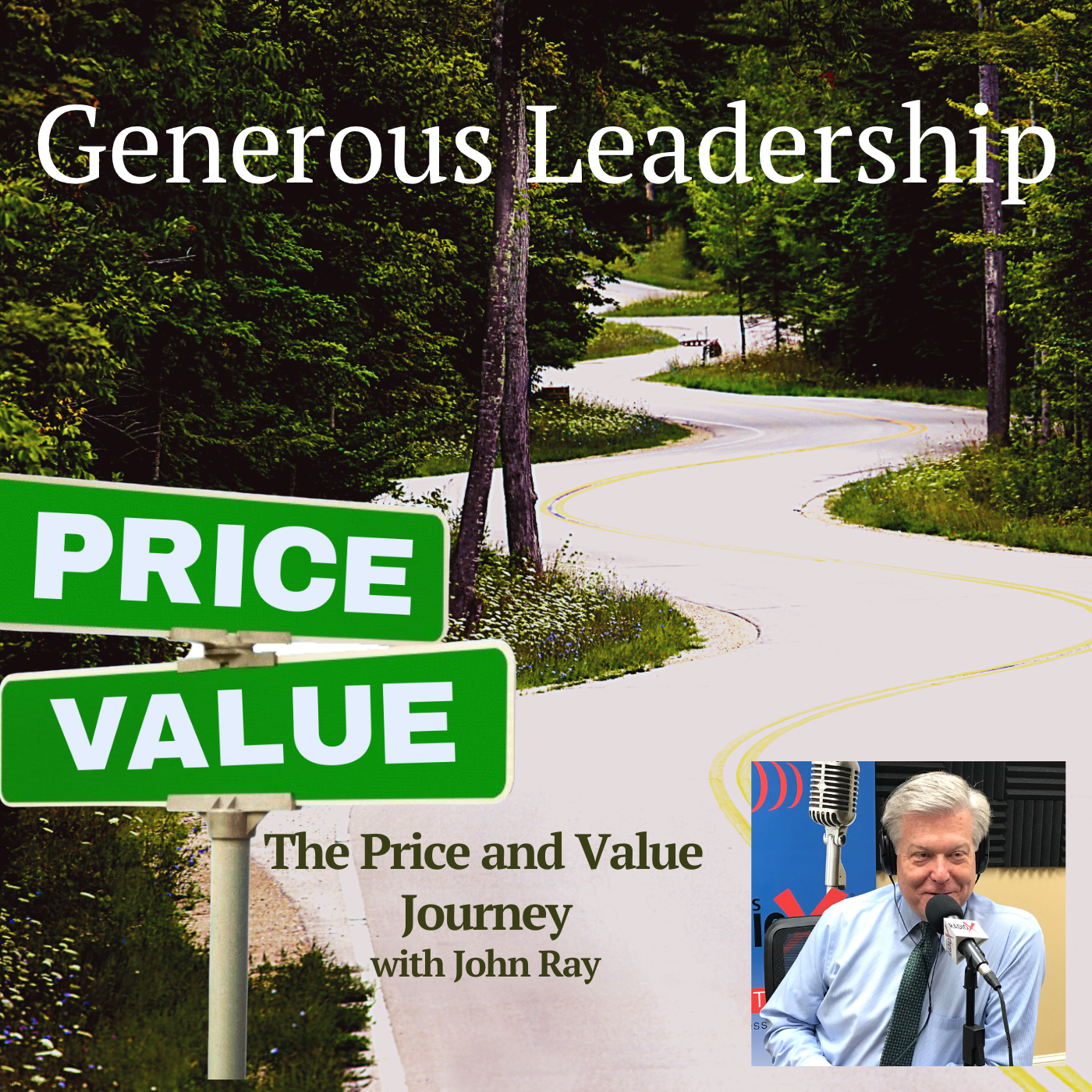

Generous Leadership

Generous Leadership

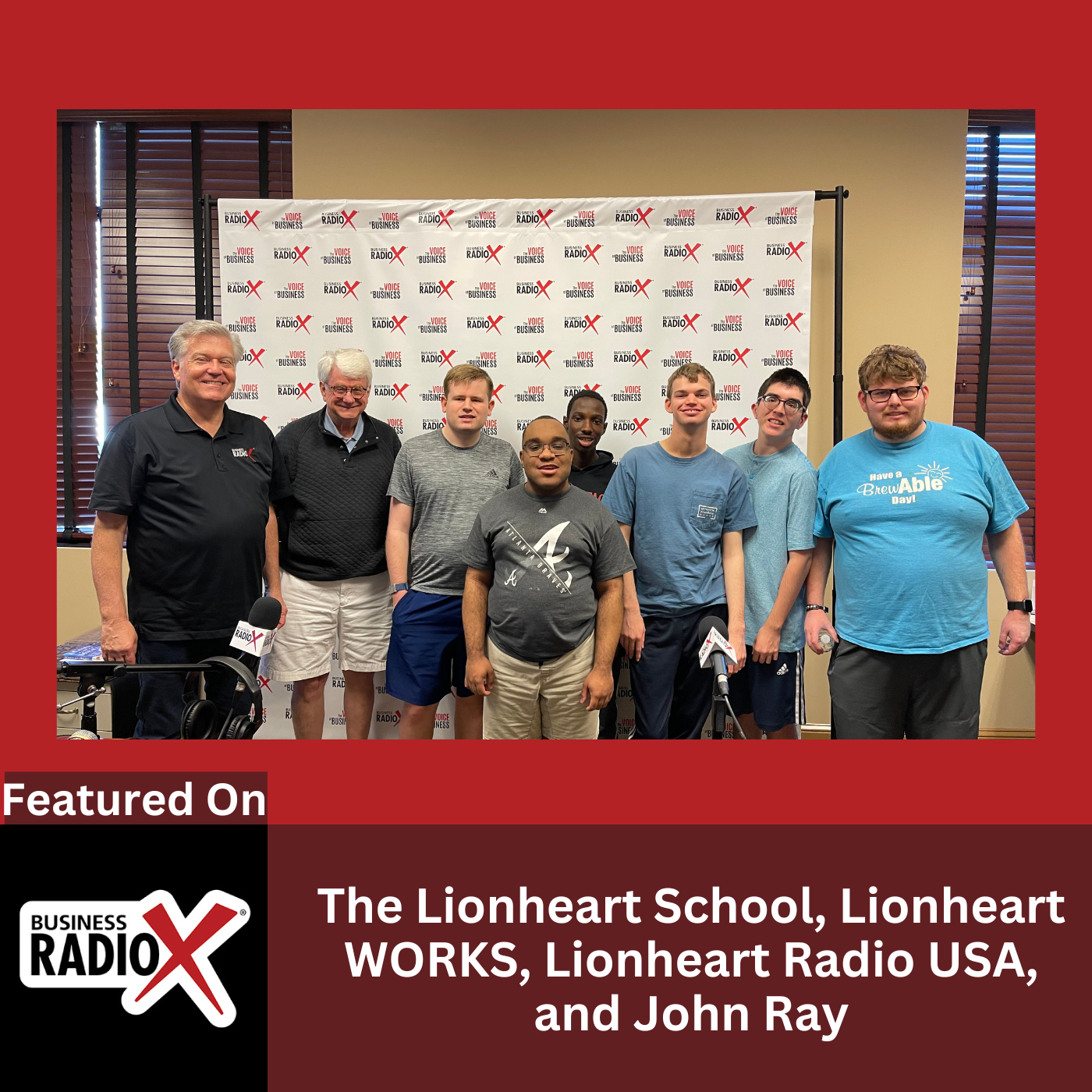

The Lionheart School is a non-profit 501(c)(3) organization founded in the year 2000 by a group of parents and professionals who created a supportive and nurturing environment for children with challenges in relating and communicating.

The Lionheart School is a non-profit 501(c)(3) organization founded in the year 2000 by a group of parents and professionals who created a supportive and nurturing environment for children with challenges in relating and communicating.

Family Promise of North Fulton/DeKalb provides temporary assistance, hospitality, and case management for families with children experiencing homelessness.

Family Promise of North Fulton/DeKalb provides temporary assistance, hospitality, and case management for families with children experiencing homelessness.

Network in Action (NIA) is the world’s second-largest business referral organization but the only one with paid professionals and state-of-the-art technology bringing busy business owners and decision-makers together with a once-a-month commitment. Since 2014, business owners can participate in monthly meetings that will always focus on the member.

Network in Action (NIA) is the world’s second-largest business referral organization but the only one with paid professionals and state-of-the-art technology bringing busy business owners and decision-makers together with a once-a-month commitment. Since 2014, business owners can participate in monthly meetings that will always focus on the member.

Liza is grateful to her family, friends, and professional partners as they supported her through her first year of business. The launch of Hand-in-Hand Copy in January 2022 went well, but health issues related to achalasia interfered with true growth. Now that she’s on the other side of a life-changing surgery, she’s ready to skyrocket her business and help more people with their copywriting needs.

Liza is grateful to her family, friends, and professional partners as they supported her through her first year of business. The launch of Hand-in-Hand Copy in January 2022 went well, but health issues related to achalasia interfered with true growth. Now that she’s on the other side of a life-changing surgery, she’s ready to skyrocket her business and help more people with their copywriting needs.