Keely McNeal/Remax Legends

As a RE/MAX agent, Keely McNeal is dedicated to helping her clients find the home of their dreams. Whether you are buying or selling a home or just curious about the local market, she would love to offer her support and services. She knows the local community — both as an agent and a neighbor — and can help guide you through the nuances of the local market. With access to top listings, a worldwide network, exceptional marketing strategies, and cutting-edge technology, Keely works hard to make your real estate experience memorable and enjoyable.

As a RE/MAX agent, Keely McNeal is dedicated to helping her clients find the home of their dreams. Whether you are buying or selling a home or just curious about the local market, she would love to offer her support and services. She knows the local community — both as an agent and a neighbor — and can help guide you through the nuances of the local market. With access to top listings, a worldwide network, exceptional marketing strategies, and cutting-edge technology, Keely works hard to make your real estate experience memorable and enjoyable.

Mallely Then/Keller Williams Realty Atlanta Partners

Becoming a realtor was always the career aspiration for Mallely Then. Though it did not happen sooner, her time is now, and she is on her journey to connect with people, and make their dream come true with the perfect property. Mallely thrives on interacting with and helping people, and has exceptional attention to detail.

Top Realtors of Atlanta is proudly presented by

Top Realtors of Atlanta is proudly presented by

The

The  The

The

Since 2005,

Since 2005,

Founded in 2018,

Founded in 2018,  Tyler Weant, Founder of

Tyler Weant, Founder of

Tyler Weant/Legendary Home Sales Advantage

Tyler Weant/Legendary Home Sales Advantage Phil Olsen/Kiwanis Club of North Gwinnett

Phil Olsen/Kiwanis Club of North Gwinnett Oren Bar/Rebalansing Health

Oren Bar/Rebalansing Health Joan Williams/Kiwanis Club of North Gwinnett

Joan Williams/Kiwanis Club of North Gwinnett John Slappey/Peggy Slappey Properties

John Slappey/Peggy Slappey Properties Clint Dixon/Clint Dixon for State Senate

Clint Dixon/Clint Dixon for State Senate Pastor Avery Headd/Poplar Hill Baptist Church

Pastor Avery Headd/Poplar Hill Baptist Church Doug Meyer/Home of Hope at Gwinnett Children’s Shelter

Doug Meyer/Home of Hope at Gwinnett Children’s Shelter Greg Edwards/My Sauce

Greg Edwards/My Sauce Keith Howell/Homestar Financial

Keith Howell/Homestar Financial Scott Snedecor/Ace Hardware

Scott Snedecor/Ace Hardware Maureen Kornowa & Tyler Weant/Home of Hope at Gwinnett Children’s Shelter

Maureen Kornowa & Tyler Weant/Home of Hope at Gwinnett Children’s Shelter

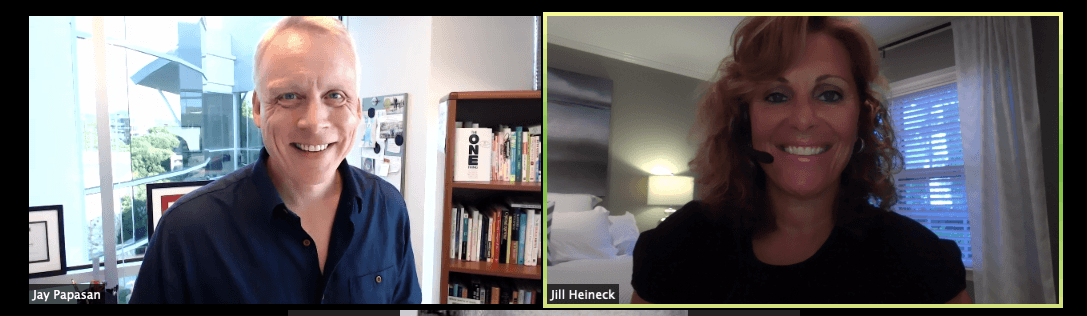

Jay Papasan [Pap-uh-zan] is a bestselling author that serves as the vice president of learning for Keller Williams Realty International, the world’s largest real estate company.

Jay Papasan [Pap-uh-zan] is a bestselling author that serves as the vice president of learning for Keller Williams Realty International, the world’s largest real estate company. Jill Heineck is a leading authority on corporate relocations, and is highly sought after for her real estate industry acumen and business insights. As a published author, frequent panelist and keynote speaker, Jill shares her experience and perceptions with people from around the globe.

Jill Heineck is a leading authority on corporate relocations, and is highly sought after for her real estate industry acumen and business insights. As a published author, frequent panelist and keynote speaker, Jill shares her experience and perceptions with people from around the globe.