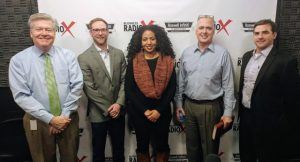

On this episode of “The Bottom Line with Jacqueline Sheldon”, hosts Tom and Jacqueline discuss some common tax problems and tax resolutions.

Jacqueline & Tom Sheldon/Bottom Line Tax Solutions

Bottom Line Tax Solutions specializes in tax planning and tax resolution. The firm focuses on proactive tax planning and working with their clients throughout the year lower their tax liability and to help them keep more of what they make. Bottom Line Tax Solutions can assist clients who have back tax issues work out payment terms with the IRS, get penalties reduced, and in some cases settle their tax debts for less than what they owe.

Bottom Line Tax Solutions

Bottom Line Tax Solutions

Reno has over 30 years of experience in Accounting and Finance. After an internship as a staff accountant in a CPA firm, Reno began his career in Healthcare services in 1982, with a proven track record of accomplishments. Beginning as a Staff Accountant with one of the nation’s largest and leading healthcare providers, Beverly Enterprises, and progressing upwards to a Director of Finance and Management Information Services position. Reno joined with some close Beverly colleagues and spun off a new affiliate of Beverly, called ADVINET, introducing the first national preferred-provider network of sub-acute healthcare providers coupled with a nurse-staffed patient case management service. Successful in its market entrance, ADVINET was acquired by an insurance firm within just 4 years of operation.

Reno has over 30 years of experience in Accounting and Finance. After an internship as a staff accountant in a CPA firm, Reno began his career in Healthcare services in 1982, with a proven track record of accomplishments. Beginning as a Staff Accountant with one of the nation’s largest and leading healthcare providers, Beverly Enterprises, and progressing upwards to a Director of Finance and Management Information Services position. Reno joined with some close Beverly colleagues and spun off a new affiliate of Beverly, called ADVINET, introducing the first national preferred-provider network of sub-acute healthcare providers coupled with a nurse-staffed patient case management service. Successful in its market entrance, ADVINET was acquired by an insurance firm within just 4 years of operation. Reno Jr has shown an interest in accounting since high school. During his high school career, he took all business classes offered! Reno Jr graduated with a BBA in Accounting from the Coles College of Business at Kennesaw State University. By year-end 2015, Reno Jr completed the additional thirty hours of post-degree credit required to sit for the CPA exam, and continues to work towards that goal. Reno Jr joined the firm in January 2016, and handles monthly accounting services, sales and property taxes, and personal and small business income taxes.

Reno Jr has shown an interest in accounting since high school. During his high school career, he took all business classes offered! Reno Jr graduated with a BBA in Accounting from the Coles College of Business at Kennesaw State University. By year-end 2015, Reno Jr completed the additional thirty hours of post-degree credit required to sit for the CPA exam, and continues to work towards that goal. Reno Jr joined the firm in January 2016, and handles monthly accounting services, sales and property taxes, and personal and small business income taxes.

Strategic Wealth

Strategic Wealth Renee Barnes is a software entrepreneur and founder of

Renee Barnes is a software entrepreneur and founder of  Developing a successful financial strategy for your business, your family, and yourself has become more difficult then ever. The economy is creating challenges across industries. Tax and health care laws change daily, and regulatory oversight grows increasingly intense.

Developing a successful financial strategy for your business, your family, and yourself has become more difficult then ever. The economy is creating challenges across industries. Tax and health care laws change daily, and regulatory oversight grows increasingly intense.

The mission at

The mission at  Power Slide’s

Power Slide’s In today’s competitive environment, information is power. With

In today’s competitive environment, information is power. With  The

The