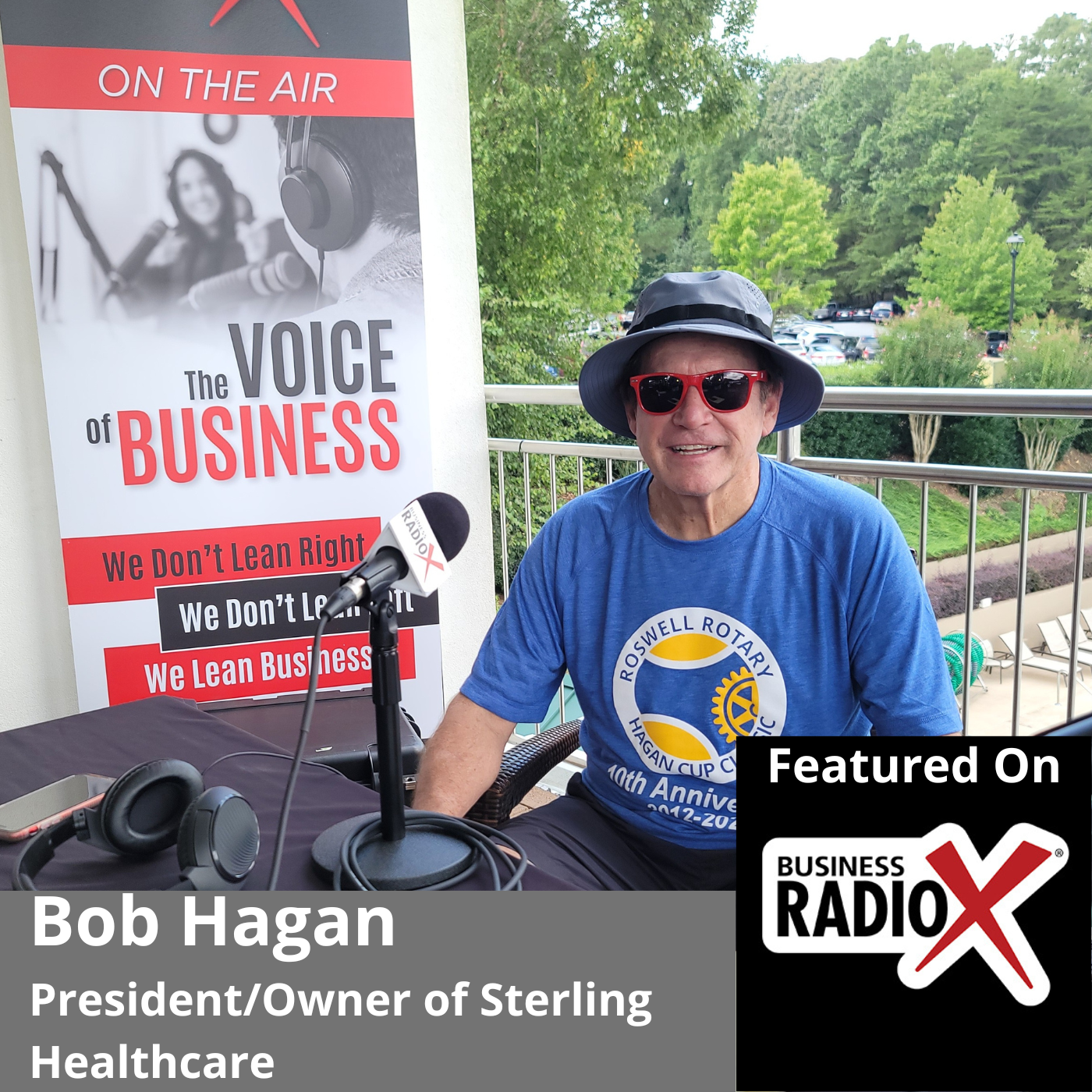

LIVE from the 2022 Roswell Rotary Golf and Tennis Tournament: Frank Brown, Brown & Co. Jewelers (North Fulton Business Radio, Episode 536)

Frank Brown of Brown & Co. Jewelers joined host John Ray at the 2022 Roswell Rotary Golf and Tennis Tournament, LIVE at Brookfield Country Club. They discussed the creation of the tournament, the superb work Roswell Rotary does in the community, the tournament and the projects that it funds, and much more.

This show was originally broadcast live from the 2022 Roswell Rotary Golf and Tennis Tournament at Brookfield Country Club in Roswell, Georgia, on September 12th, 2022.

North Fulton Business Radio is produced and broadcast by the North Fulton studio of Business RadioX® inside Renasant Bank in Alpharetta.

Frank Brown, Brown & Co. Jewelers

Brown & Co. Jewelers was founded in 1974 by Frank and Richard Brown. Brown and Company was built on the legacy of Frank Brown’s grandmother, Marie Burns. Marie founded the Jewel Box in 1923, located in the Grand Historic Davenport Hotel in Spokane, Washington. Brown & Co. is an independent, family-owned, and -operated business and has no plans to change. Frank Brown is the father of two daughters, who are both extremely passionate about all things Brown & Co. The girls grew up running around the stores, helping on the sales floor over the summer, and gift wrapping during the holidays. Frank’s daughter Amy Brown Greene officially joined the company in 2003, and his daughter Sara Beth Brown Prendeville came on board in 2013. Amy and Sara Beth are now vice presidents of Brown & Co. and love learning from and working alongside their father.

Brown & Co.’s two stores are located in Historic Roswell and the heart of Buckhead and are two of the largest independent jewelry stores in the country. Brown & Co. is a member of the Jewelers Vigilance Commission and has been a member of the American Gem Society (AGS) since 1976. Their knowledgeable and personable staff consists of multiple graduates of the Gemological Institute of America, master jewelers, and AGS-certified gemologists with vast backgrounds in the jewelry industry.

Brown & Co. offers everything from top designer fashion jewelry and high-end timepieces to the largest selection of diamond engagement rings in the city. The Brown & Co. custom design team is unlike any other, with world-renowned jewelers to turn your jewelry dreams into a reality. It’s Brown and Company’s ultimate pleasure to serve the great city of Atlanta.

Roswell Rotary

Roswell Rotary has been serving the community for over 70 years and is one of the largest service organizations in the southeast. Their members come from all walks of life and combine to provide a diverse group of servant-minded business leaders. Their mantra of putting “Service Above Self” is easy when you do it alongside some of your best friends. With numerous service projects within their community and abroad, you can be sure that you will find a place to give back and have fun doing it.

This year the Rotary International theme is “Imagine Rotary” and Roswell Rotarians are using their imaginations to make the community and world a better place. With over 1.4 million members internationally focusing on water/sanitation, mental/child health, basic education/literacy, economic/community development, the environment, disease prevention/treatment and peace and conflict prevention/resolution, you can be assured that Rotary is changing lives in the community and the world.

Roswell Rotary’s signature event is the Aubrey Greenway Golf and the Hagan Cup Tennis Tournaments. These tournaments serve as their main fundraiser and engage our 240 members in a one-day event that includes a full day of golf, a tennis tournament, an after party, and silent/live auctions. The event typically raises over $150,000. Proceeds fund an annual Community Impact Project as well as provide grants to various charities during the Rotary year; helping organizations large and small fulfill their charitable missions.

Frank Brown invites you to suit up, help them give back to the community and join in the fun.

Questions and Topics in the Interview:

- About the creation of the tournament

- Roswell Rotary’s projects and impact

- The Golf and Tennis Tournament

North Fulton Business Radio is hosted by John Ray and broadcast and produced from the North Fulton studio of Business RadioX® inside Renasant Bank in Alpharetta. You can find the full archive of shows by following this link. The show is available on all the major podcast apps, including Apple Podcasts, Spotify, Google, Amazon, iHeart Radio, Stitcher, TuneIn, and others.

Renasant Bank has humble roots, starting in 1904 as a $100,000 bank in a Lee County, Mississippi, bakery. Since then, Renasant has grown to become one of the Southeast’s strongest financial institutions with over $13 billion in assets and more than 190 banking, lending, wealth management and financial services offices in Mississippi, Alabama, Tennessee, Georgia and Florida. All of Renasant’s success stems from each of their banker’s commitment to investing in their communities as a way of better understanding the people they serve. At Renasant Bank, they understand you because they work and live alongside you every day.

Special thanks to A&S Culinary Concepts for their support of this edition of North Fulton Business Radio. A&S Culinary Concepts, based in Johns Creek, is an award-winning culinary studio, celebrated for corporate catering, corporate team building, Big Green Egg Boot Camps, and private group events. They also provide oven-ready, cooked-from-scratch meals to go they call “Let Us Cook for You.” To see their menus and events, go to their website or call 678-336-9196.

Special thanks to A&S Culinary Concepts for their support of this edition of North Fulton Business Radio. A&S Culinary Concepts, based in Johns Creek, is an award-winning culinary studio, celebrated for corporate catering, corporate team building, Big Green Egg Boot Camps, and private group events. They also provide oven-ready, cooked-from-scratch meals to go they call “Let Us Cook for You.” To see their menus and events, go to their website or call 678-336-9196.