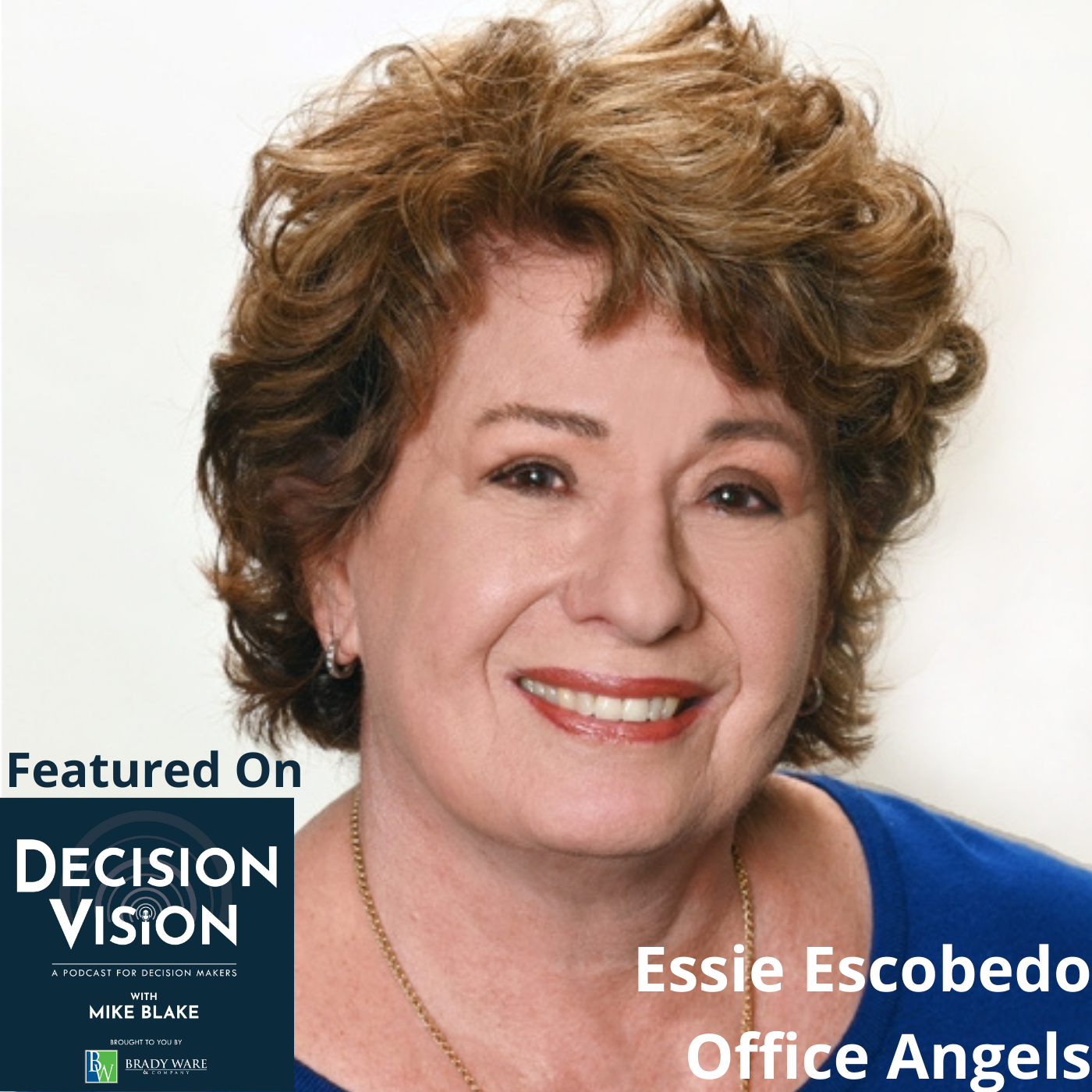

Decision Vision Episode 102: Should I Hire a Virtual Assistant? – An Interview with Essie Escobedo, Office Angels

Essie Escobedo, Founder and “Chief Executive Angel” of Office Angels, joins host Mike Blake to discuss the ins and outs of hiring a virtual assistant and how to manage a virtual assistant to create scale in your business. “Decision Vision” is presented by Brady Ware & Company.

Essie Escobedo, Chief Executive Angel, Office Angels

When Essie Escobedo majored in physics, she had no idea that she would apply her knowledge about how the universe works to the world of business. Essie launched Office Angels® in 2000 after a 25-year career as a successful small business owner. During that time, she honed her gifts of exceptional interpersonal skills and a sharp intellect, while gaining hands-on knowledge about successful business management.

Twenty years ago, Essie presciently observed that a large and growing number of credentialed, seasoned individuals with outstanding skills and proven track records had left corporate America and saw a stellar opportunity. These professionals may have left the full-time workforce, but they wanted to continue working — on their schedules. Essie realized these professionals could bring expertise and a level of professionalism to assist small businesses at rates they could not otherwise afford.

Twenty years ago, Essie presciently observed that a large and growing number of credentialed, seasoned individuals with outstanding skills and proven track records had left corporate America and saw a stellar opportunity. These professionals may have left the full-time workforce, but they wanted to continue working — on their schedules. Essie realized these professionals could bring expertise and a level of professionalism to assist small businesses at rates they could not otherwise afford.

Compelled by her strong entrepreneurial character and drive to help people succeed, she developed a unique business model that addresses two needs: Office Angels helps small business owners focus on business priorities, while Angels perform a range of essential but often-neglected “back office” operations in areas such as administrative support, bookkeeping, and marketing. At the same time, Office Angels provides meaningful work to highly experienced and trained business professionals who wish to work on a flexible, part-time, freelance, or project basis.

A supreme networker, Essie is a well-known and highly respected member of the greater Atlanta business community. She has served on the Boards of the Atlanta Chapter of the National Association of Women Business Owners (NAWBO), the Atlanta Women’s Network (AWN), and the Professional Women’s Information Network (ProWIN). She currently serves on the Advisory Boards for ProWIN and Access for Capital Entrepreneurs (ACE), is an active member of the Georgia Consortium for Personal Financial Literacy, and mentors on starting and running a successful business with The Edge Connection.

The North Fulton Chamber of Commerce named Essie as a Business Person of Excellence for 2018. She was a finalist for the Chamber’s 2018 Small Business Person of the Year award, was honored by ProWIN with a Business Builder Award, and was nominated for a Turknett Leadership Character Award.

Essie has been featured in various business media, including the Atlanta Business Chronicle, VoyageATL, “Atlanta Business Radio,” “North Fulton Business Radio,” and Newstalk 1160.

Essie holds a Bachelor of Science degree in Physics from The American University and served as Adjunct Professor of Business at Lanier Technical College. In addition to her business acumen, Essie has been a beloved mentor, coach, and trainer to her Angels, clients, and friends. Her calm, proactive, practical, and gracious style brings out the best in people and creates winning outcomes.

Mike Blake, Brady Ware & Company

Michael Blake is the host of the “Decision Vision” podcast series and a Director of Brady Ware & Company. Mike specializes in the valuation of intellectual property-driven firms, such as software firms, aerospace firms, and professional services firms, most frequently in the capacity as a transaction advisor, helping clients obtain great outcomes from complex transaction opportunities. He is also a specialist in the appraisal of intellectual properties as stand-alone assets, such as software, trade secrets, and patents.

Mike has been a full-time business appraiser for 13 years with public accounting firms, boutique business appraisal firms, and an owner of his own firm. Prior to that, he spent 8 years in venture capital and investment banking, including transactions in the U.S., Israel, Russia, Ukraine, and Belarus.

Brady Ware & Company

Brady Ware & Company is a regional full-service accounting and advisory firm which helps businesses and entrepreneurs make visions a reality. Brady Ware services clients nationally from its offices in Alpharetta, GA; Columbus and Dayton, OH; and Richmond, IN. The firm is growth-minded, committed to the regions in which they operate, and most importantly, they make significant investments in their people and service offerings to meet the changing financial needs of those they are privileged to serve. The firm is dedicated to providing results that make a difference for its clients.

Decision Vision Podcast Series

“Decision Vision” is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision-maker for a small business, we’d love to hear from you. Contact us at decisionvision@bradyware.com and make sure to listen to every Thursday to the “Decision Vision” podcast.

Past episodes of “Decision Vision” can be found at decisionvisionpodcast.com. “Decision Vision” is produced and broadcast by the North Fulton studio of Business RadioX®.

Visit Brady Ware & Company on social media:

LinkedIn: https://www.linkedin.com/company/brady-ware/

Facebook: https://www.facebook.com/bradywareCPAs/

Twitter: https://twitter.com/BradyWare

Instagram: https://www.instagram.com/bradywarecompany/

TRANSCRIPT

Intro: [00:00:01] Welcome to Decision Vision, a podcast series focusing on critical business decisions. Brought to you by Brady Ware & Company. Brady Ware is a regional, full service accounting and advisory firm that helps businesses and entrepreneurs make visions a reality.

Mike Blake: [00:00:21] And welcome to Decision Vision, a podcast giving you, the listener, clear vision to make great decisions. In each episode, we discuss the process of decision making on a different topic from the business owners’ or executives’ perspective. We aren’t necessarily telling you what to do, but we can put you in a position to make an informed decision on your own and understand when you might need help along the way.

Mike Blake: [00:00:41] My name is Mike Blake, and I’m your host for today’s program. I’m a director at Brady Ware & Company, a full service accounting firm based in Dayton, Ohio, with offices in Dayton; Columbus, Ohio; Richmond, Indiana; and Alpharetta, Georgia. Brady Ware is sponsoring this podcast, which is being recorded in Atlanta per social distancing protocols. If you like this podcast, please subscribe on your favorite podcast aggregator and please consider leaving our view of the podcast as well.

Mike Blake: [00:01:07] So, today’s topic is, Should I hire a virtual assistant? And this has been a topic that I’ve wanted to do for quite some time. And the reason for it is this, is that – you know, there are actually a lot of reasons for it. The first reason is, you know, for a while I was a sole practitioner before I joined Brady Ware. And that practice, frankly, was successful. You know, I didn’t join Brady Ware because I wasn’t having success. It’s just that they offered me opportunities I knew that I could not really find and exploit on my own. But one of the big reason that that practice worked was because early on I hired a virtual assistant. And I actually hired multiple virtual assistants along the way. And we’ll kind of talk about that model.

Mike Blake: [00:02:04] But, you know, I think the single best decision I made for my own company was hiring a virtual assistant because it provided so much leverage, and it took things off my plate, and out of my mental bandwidth that, frankly, just didn’t need to be there. And this virtual assistant was fantastic. She’s since retired. But, you know, it was an individual that there are certain things I can hand off to, scheduling meetings in particular. And I just knew I didn’t have to worry about them. And, you know, frankly, one of the things I miss about being a sole practitioner is having that.

Mike Blake: [00:02:41] And this gets to the second point I wanted to raise, one of the things that our economy has done in the last 35 years is, we have decided to desynthesize our economy. You know, when my father was, frankly, my age – and he just turned 77, so happy birthday, Dad – he had his own personal assistant for a long time, probably about 20 years, actually. And, you know, it wasn’t uncommon for partners in Big Four accounting firms to have their own assistant, or at most they might share that assistant with one or two people. And then, our economy decided that we were going to get efficient. And the way we were going to get efficient as an economy is, we are going to take people that bill that $500 an hour and we are going to have them do $50 an hour work. And that’s the way that we decided that we were going to streamline and really cut the fat out. And as you can tell, I think, frankly, it’s a failed mechanism.

Mike Blake: [00:03:49] You know, I think that kind of change probably looks great on the piano for about a year or so. But, frankly, I think it’s been a mistake. And even though I think the administrative assistants we have at Brady Ware are fantastic and, you know, they do what they do. But for them to get the same level of service, and they’re having to take care of 40 of us garbanzos in our office as opposed to one garbanzo like me, you know, it’s just a different level of service. I cannot expect that same level of service. And, frankly, I will not burden them with it because it’s simply an unfair ask.

Mike Blake: [00:04:30] And so, one of the ways that the market has responded now is with the virtual assistant. In particular, because so many of us have gone solo. We started small businesses and, you know, hiring an assistant add up – I’m just going to throw a number out there – you know, a salary of $40,000 maybe at the lower end, over $100,000 for the really high end ones that rise to levels of chiefs of staff and so forth. You know, that’s tough to add that startup cost, especially if you’re just starting your business. You really don’t know exactly what that assistant is going to do on a day to day basis. And, you know, hiring an assistant is one of those things that it’s like avoiding going to the dentist, you don’t really feel the impact day to day. But, man, when you finally get back in that dentist chair, you sure wish you’d gone back three months earlier. I think assistants are kind of that way as well.

Mike Blake: [00:05:28] And so, I want to visit this topic because I think, you know, now with coronavirus, lots of people are starting their own businesses for a number of reasons. And, frankly, I think the virtual assistant is still a relatively unknown quantity in our economy. And if you don’t know about virtual assistants, I believe that you should because, again, it was so helpful to me. And, frankly, there may be a role yet even in my role working within a company to have one that does some things that I cannot realistically expect, you know, our administrative staff to do. So, I hope you’re going to find this interesting. I think you will.

Mike Blake: [00:06:07] So, joining us for today’s program is Essie Escobedo, who is Chief Executive Angel of Office Angels, which provides meaningful work to highly experienced and trained business professionals who wish to work on a flexible, part-time, freelance ,or profit project basis. A supreme networker, Essie is well known and a highly respected member of the Greater Atlanta Business Community. She has served on the boards of the Atlanta Chapter of the National Association of Women Business Owners, the Atlanta Women’s Network, and the Professional Women’s Information Network, ProWIN. She currently serves on the advisory boards for ProWIN and Access for Capital Entrepreneurs, is an active member of the Georgia Consortium for Personal Financial Literacy, and mentors on starting and running a successful business with The Edge Connection – I didn’t know that. I’m a big fan of The Edge Connection.

Mike Blake: [00:06:57] The North Fulton Chamber of Commerce named Essie as a business person of excellence for 2018. She was a finalist for the Chamber’s 2018 Small Business Person of the Year award and was honored by ProWIN with a Business Builder Award and was nominated for Turknett Leadership Character Award – I was too. Essie has been featured in various business media, including the Atlanta Business Chronicle, Voyage ATL, Atlanta Business Radio, Business RadioX, and NewsTalk 1160. Essie holds a Bachelor of Science Degree in Physics from the American University. And served as adjunct professor of Business at Lanier Technical College.

Mike Blake: [00:07:32] In addition to her business acumen, Essie has been a beloved mentor, coach, and trainer to her angels, clients, and friends. Her calm, proactive, practical, and gracious style brings out the best in people and creates winning outcomes. It sounds like she’s going to class up the joint. Essie, welcome to the program.

Essie Escobedo: [00:07:50] Thank you so much for having me. It’s a pleasure.

Mike Blake: [00:07:53] So, you know, Essie, it’s funny, when I bring people on, I find things that I have in common with them that I didn’t necessarily know. But, you know, we have a number of common touch points, which I’m just going to go out on a limb and say, that’s good, because I think you’re lifting me up rather than my bringing you down. But I have to ask this question, what was the path that took you from physics to doing this?

Essie Escobedo: [00:08:24] Mike, I don’t think we have enough time.

Mike Blake: [00:08:28] Is there a 30 second version or should I just move on?

Essie Escobedo: [00:08:30] Let’s just say it was circuitous.

Mike Blake: [00:08:32] Okay. Fair enough. Well, look, I was a French major in college, and I don’t think I’ve been to France in about 30 years. So, when we talk about a virtual assistant, what is that?

Essie Escobedo: [00:08:49] You know, that can mean so many things to so many different people. So, obviously, it’s someone who assists virtually and not in person. Today, people use that term to mean they want somebody to help them with their marketing. They want someone to do executive admin type work. It could even mean that they want someone to help with bookkeeping. So, you really have to clearly define what the role would be for someone you would like to have as your virtual assistant. Obviously, one person cannot do both your bookkeeping and your marketing.

Mike Blake: [00:09:44] Right. Probably not.

Essie Escobedo: [00:09:46] I don’t think so. I don’t think that they would probably do either one well, but people ask. So, to me, when you decide that you’re looking for a virtual assistant, the first thing you need to do is put a job description together.

Mike Blake: [00:10:05] So, I’m kind of curious now. I mean, as I was putting the show together, I was thinking about virtual assistants in the pandemic environment. I mean, at some point, I kind of wonder – I like you to react to this – if so many assistants are virtual that we now just call them assistants, right? I wonder how much the virtual distinction even matters.

Essie Escobedo: [00:10:34] Well, probably not in the final analysis, because some of the people who work “virtually” are also meeting face to face, before COVID, that is. And it can be a combination of both. The technology enables so much of the work to be done without physically having to go somewhere. So, yeah, I think you’re right. We can call it an assistant and then define where the work is going to take place.

Mike Blake: [00:11:12] Yeah. I think that’s right. And I think, you know, the nature of the assistant’s role is changing so much now because, I mean, just by virtue of the virtualization of the workplace merely overnight, just what we’re asking people to do is different.

Essie Escobedo: [00:11:35] Exactly. And especially now, you know, so many people are looking for work from home because of COVID. And if you haven’t had experience working in a virtual environment, it is different. There’s the communication aspect. You have to be very, very clear in your communication and in being very specific about what your expectations are, what your turnaround times are. You’re not in close proximity so you have to trust that the person is going to execute and deliver according to your expectation.

Mike Blake: [00:12:29] Yeah. And I want to get back to that, because I do think the management element is a very important part of this conversation. But I don’t want to jump ahead because there are a couple of topics I want to cover first. And one of them is, what are the kinds of things you could ask a virtual assistant to do?

Essie Escobedo: [00:12:48] I would say that it would be limited to anything, you know, administrative tasks, setting appointments, keeping the calendar, formatting documents, reviewing, proofreading, copy editing. You know, it’s a broad range of what we would typically know of being administrative. But then, on top of that, there are some people who are asking for, what I call, a marketing support services, which are very different than what we have known to be the role of an executive admin, for example.

Mike Blake: [00:13:34] Yeah. And, you know, interestingly enough, too, I think one area where I’ve noticed the name virtual assistant pop up more frequently now is with social media. You know, I maintain my own social media account and I’m pretty aggressive with it, but I’m tapped out. I probably need a virtual assistant realistically to do more. But, you know, so much effort is required to maintain a social media presence and actually get something out of it that – I’m seeing and I’m curious if you’re going to say you see the same thing – I think there’s going to develop or maybe there’s already developing a subspecialty just of people that can manage affirms or an individual’s social media presence, particularly across a number of platforms.

Essie Escobedo: [00:14:24] Absolutely. I don’t call them virtual assistants. I call them marketing assistants.

Mike Blake: [00:14:32] And is there a reason for that? I mean, is it because marketing assistants, they prefer that term or it’s just easier branding? Or why is it that you choose to use a different term for that?

Essie Escobedo: [00:14:45] Because their focus and their expertise is in marketing. It’s not in proofreading documents and doing, you know, traditional administrative support services. And it’s not something they necessarily like to do or want to do either.

Mike Blake: [00:15:03] Yeah. And I agree with that, you know, those things are entirely different. And social media, you know, it just doesn’t work anymore if you address it on an amateur level. It really has to be addressed professionally or you’re just wasting your time. And so, having a specialist that understands that, that likes that, and also, frankly, can keep up with the cadence of work. Because it’s not just post one thing and done. To really do it right, you have to post things on multiple platforms multiple times a day. And, you know, when I talk social media with my colleagues and my clients, you know, they complain that it’s effectively a full-time job. And they’re not wrong. It sounds like that’s another great use for a virtual assistant or a marketing assistant, to use your words.

Essie Escobedo: [00:15:58] Right. Absolutely. Well, in my company, we put teams together. I typically do not have an administrative person who says she knows how to use HootSuite, for example, do marketing. They don’t know marketing. So, I would put a team together and have an admin, and a marketing person, and then a bookkeeper.

Mike Blake: [00:16:28] So, you know what? That’s an interesting model. I’d like to kind of drill down on that. So, you see scenarios or, actually, help clients with scenarios where they in fact need more than one virtual assistant to get done what they need done, and you actually put a team together.

Essie Escobedo: [00:16:46] Absolutely. You have to bring in the people who have the expertise in the different areas. I mean, it doesn’t work to have – you can’t have an admin doing bookkeeping if they don’t know bookkeeping, if they don’t know accounting. It doesn’t work.

Mike Blake: [00:17:12] And when you put teams together, are they often people that have worked together before? Or are they more often people that are working together for the first time?

Essie Escobedo: [00:17:26] They’re working together for the first time, but they’re working virtually. And as long as we have a very clearly defined job description and everybody knows what their job is, it works like a dream.

Mike Blake: [00:17:44] So, that segues nicely into what I think is going to be a big chunk of this conversation, which is, managing virtual assistants. I think one of the things that I think has been underrated a little bit – not terribly, but I think it focuses on some very narrow things – but the fact that we have to approach management differently. You know, the days of managing by walking around and sort of looking over people’s shoulders and correcting them on the fly, I mean, they’re just gone. And, frankly, I never manage that way anyway because I’m too lazy. But, to me, that’s a good thing, you know, managing by walking around, which basically means that you’re sort of shooting first and asking questions later. I’m not convinced that was a great management style to begin with.

Mike Blake: [00:18:41] So, it sounds like, to me, when I worked with virtual assistants, it required a great deal of discipline on my part to communicate thoroughly, to anticipate potential questions. Particularly in the beginning, things aren’t going to get done as quickly as you would like because there’s a training period. And even from my perspective, what I did is, I made training videos. So, I had little stupid videos I made with my Mac and QuickTime – or, actually Zoom, and recorded like a five minute training video. Here’s how you do X, Y, or Z. And I do think that that’s a big part of why my virtual assistant experience worked very well. Do you think things like that represent best practices? And if so, what other best practices have I missed?

Essie Escobedo: [00:19:34] Yeah. I think the more you can document your processes and procedures, the better, be it video or however you want to get that done. To me, in my world, I work with people who don’t need to be managed. And I think selecting the right person, who can work independently, who is proactive, who can anticipate, who is seasoned, basically, and knows pretty much what the role entails, that should be the people that you should select to work with.

Essie Escobedo: [00:20:19] So, the question is, who is not a good fit for a virtual assistant? And I say it’s a person who’s a micromanager. If you have the right person, if you have a clearly defined job description with detailed SOP, Standard Operating Procedures, you just work through what your expectations are, what your turnaround time is, how best to communicate with one another, and then let it rip.

Mike Blake: [00:21:01] And, you know, it goes back to kind of a core theme that, you know, these are things that I think good managers should have been doing all along. It’s well-documented that micromanagers are not very effective. Teams generally hate working for micromanagers, particularly teams that are high powered, that are intelligent, ones that aren’t so or maybe are less motivated. Maybe they like working for a micromanager because it takes the thought process out. But if you really want high performing people, being able to let go is so critical.

Mike Blake: [00:21:41] And, you know, like it or not, for a lot of us in this pandemic, you’re having to let go. And, you know, for a while what we were hearing – I wonder, did you hear about these apps that were starting to gain traction where companies are trying to make their employees load apps on their computers to track just how much time they actually were working versus not? And I mean, that just drove me crazy. I’m like, “If my firm ever did that, I’m out. I’m not going to subject my employees to that.”

Essie Escobedo: [00:22:13] Well, the thing about it is, when you hire someone, you have to go into the relationship based on trust. Otherwise, you don’t have anything going on.

Mike Blake: [00:22:25] So, you bring up an interesting point right there, and you touched upon this earlier and I want to come back to it. So, I mean, in your world, you must interview lots of prospective virtual assistants, correct?

Essie Escobedo: [00:22:41] I do. However, I do have some – I’ve recruited some of my H.R. angels to do a prescreening screening for me.

Mike Blake: [00:22:51] Okay. Good. So, when you are considering a virtual assistant, in your mind, what are the most important things to find out about them? And what’s the best way to go about doing that?

Essie Escobedo: [00:23:09] Well, of course, I want to see their resume. I want to see their work history. We do a thorough vetting process. I developed an Angel questionnaire where they have to write an essay, basically speaking, and they have to tell me in their own words why they want to do this and what do they bring to the table, how can they improve the life of a small business owner with the work that they would provide. So, it gives me a lot of good input as to where they’re coming from in terms of their personality.

Essie Escobedo: [00:24:01] And then, of course, I always interview them in person, or now through Zoom, to get a really better sense for their personality. Because skill set being equal, for me, what really makes or breaks a relationship is the chemistry. Can these two people work effectively together? Can they communicate well? For example, I was talking – and I interview the clients as well because I have to know from both ends if it’s going to be a good fit. So, I talked to one client and he’s from up north, and he talks real fast, and he’s very intense. And he says, “Essie, I can’t handle somebody who talks real slow.” I said, “Got it.”

Mike Blake: [00:25:00] Well, that’s fair. And I know exactly what you’re talking about. I used to work on Wall Street for a few years, and there’s a different cadence, right? They used to have those old FedEx fast talker commercials. And I guess in Nashville, that was considered fast talking. But up in New York and Boston, that’s just how we talk. We were kind of wondering what the gag was, frankly.

Mike Blake: [00:25:28] So, you talked about personality, and the thing that strikes me as we get into this conversation – and maybe I should have realized it before, but it’s only really hitting me now is – you know, you are a recruiter in effect.

Essie Escobedo: [00:25:45] I’m a matchmaker.

Mike Blake: [00:25:45] A matchmaker. And, I mean, is it fair to say that the hiring practices that are good for hiring a full-time employee, a lot of those do kind of translate over into hiring somebody or some people as virtual assistants?

Essie Escobedo: [00:26:06] Oh, I would say so. Absolutely. But, you know, I have a question, why is there so much dysfunction in corporate America if everybody does smart hiring?

Mike Blake: [00:26:17] Yeah. Well, there’s definitely a lot of bad hiring out there, and sort of puzzling. But, unfortunately, I think it’s because there’s a lot of cynicism out there. There are just a number of managers that treat people as commodities and the way they get to a good person is they feel like they just have to go through eight others, like it’s cold calling, basically.

Essie Escobedo: [00:26:48] I always say that you have to really learn how to be a good boss.

Mike Blake: [00:26:56] So, how do you be a good boss to a virtual assistant? And do they have needs that are maybe different from, you know, a more conventional employee?

Essie Escobedo: [00:27:08] Well, again, from my own experience, I worked with what I have dubbed the at home work force. And these are seasoned professionals who have chosen to permanently leave the full-time workforce for various and sundry reasons. So, they’re not temping. They’re not interested in anything full-time. So, you have to be mindful that they do have other things going on in their lives. They may have other clients. They may be caring for a special needs child or their aging parents. So, I think that it’s very, very important to understand, you know, if you’re hiring someone full-time, then, of course, they’re going to be on call, say, 40 hours a week from 9:00 to 5:00.

Essie Escobedo: [00:28:11] But most of the people that I know that are using virtual assistants are not in need of a full-time person. And so then, it becomes, you know, you need to have a person who has extremely good time management skills. And who is accustomed to working – say, if they’re working with multiple clients, managing all of them. So, therefore, it becomes very important on vetting the person that you’re going to bring in, making sure that they already have experience in doing this. You know, you can give somebody a first chance, but understand that it’s going to take a while to get into a good rhythm to make sure that it’s working and that you’re getting the value out of what you’re buying in terms of their time and expertise.

Mike Blake: [00:29:24] So, there are two points that I want to follow up on, because I think they’re so important. One is, you know, another kind of profile of somebody who probably is not a good fit for a virtual assistant, at least as their primary one, is someone who just needs to own their time. So, if you need to have somebody on call, 9:00 to 5:00, 8:00 to 6:00, whatever the job description is, that whenever you call, they’re more or less going to drop whatever they’re doing and address your issue. That’s not necessarily an appropriate role for a virtual assistant, because you are maybe one of a number of clients. And they’re a virtual assistant for a particular reason, because they have a family obligation, health obligation, whatnot. And so, that’s a way to decide not to go that route that you need to have somebody that really is on your staff.

Essie Escobedo: [00:30:19] Absolutely. Because most virtual assistants are working as independent contractors, which means that you’re not controlling them. They are controlling their own time and methods of delivery of the service. To me, I draw the line at 20 hours a week. If you need someone more than 20 hours a week, then you really just need to hire a bona fide employee.

Mike Blake: [00:30:51] Yeah. And, frankly, I guess not I’m an accountant, but, I mean, after a certain number of hours, the IRS takes over and says they have to be an employee. If you dominate enough of their income, then the IRS doesn’t care what your contract says. They will come in and say this person is an employee.

Essie Escobedo: [00:31:11] And I think they’re getting – it’s going to become much more stringent.

Mike Blake: [00:31:16] You do? Why is that?

Essie Escobedo: [00:31:18] There’s a new administration.

Mike Blake: [00:31:20] Yeah. That’s true. So, the other question I wanted to follow up with you, a comment I want to make, too, is that, I think, unfortunately, there’s a temptation for some people to treat a virtual relationship different from a physical – not intimate, but physical – just analog relationship, for lack of a better term. Right? And something you touched upon that I want to kind of toss out here or suss out here is, you know, just as you would give an employee sort of a breaking in period, you need to do that with virtual assistants, maybe even more so just because of the limitations of technology in terms of communication. You know, it’s a bad mistake just because somebody has their relationship with you online, that doesn’t make them interchangeable and disposable.

Essie Escobedo: [00:32:23] Absolutely. I think, you know, you have to go into the relationship with mutual respect and trust. And if you’ve done a good job at putting together a job description that your assistant is signing off on and agreeing with, then that becomes the way that you can hold that person responsible for their job performance. And you do have to trust that they’re going to get the work done. That’s why it’s so important to set the time frame, the expectation, and the communication. When do I need this finished by? Let’s schedule a touch base every Monday morning at 9:00. And then, sketch out the task to be done during the week. And what’s the best way to communicate? And you can’t expect – and some people send emails to their assistants at 2:00 in the morning.

Mike Blake: [00:33:38] Right. Which is okay. I mean, which is okay on a surface. I confess, I’m a night owl just because of the way our own daily routine is set up. I’m helping with the house and home schooling during the day and I get a lot of my work done at night. But I don’t expect a response at 2:00 a.m..

Essie Escobedo: [00:33:58] Right. So, if you were to expect that response, it wouldn’t work out too well.

Mike Blake: [00:34:05] Yeah. Although, that brings up another question I wanted to ask. Because, I have he’s more than a virtual assistant. He is a part-time financial analyst. But the framework is the same, who’s in India. And there’s a significant time difference, I think it’s 11 hours, if I remember – it’s a lot. And my understanding is, in fact, a lot of virtual assistants do work overseas. Philippines is a big source for them, I think, in particular because a lot of them have good command of English.

Mike Blake: [00:34:44] And my question is, do you have experience and do you have in your relationships people who are abroad that work as virtual assistants? And can you talk about, maybe, the disadvantages and some of the advantages of having somebody as your virtual assistant who works halfway around the world?

Essie Escobedo: [00:35:03] Well, I think one of the advantages, depending on the time zone, is that, you can really leverage that time difference. Well, first of all, I want to provide jobs to people right here in the good old U.S. of A. I have many clients who have worked with overseas virtual assistants end up coming around. You know, we can’t compete price- wise, clearly. But they find that the culture is different. And even though they are English speaking, it’s not the same.

Mike Blake: [00:35:47] It’s different.

Essie Escobedo: [00:35:49] It’s different, And so, it turns out, depending on the nature of the work at hand, it’s just really not giving them the results that they need, so they come over to me.

Mike Blake: [00:36:07] Okay. Well, I like to talk about something you said because I sense in your voice it’s really important to you. You clearly have decided you’re going to focus on sourcing talent here in the United States. So, why is that so important to you?

Essie Escobedo: [00:36:26] Well, because I am very proud to be an American and I think that there are plenty of people right here at home that need good work. I started my company 21 years ago just to support women in particular who needed to work with on their own terms, basically speaking, because they needed to be at home to raise their kids and care for their special needs kids. And it was an all or nothing proposition. If you wanted to have a corporate job, you had to really put your family on the back burner, and your own health, not to mention that. So, I said, “Well, there are so many small businesses and nonprofits and associations that need help but don’t need a full-time employee.” Why shouldn’t these people be able to work? So, that’s my mission. That’s my focus.

Mike Blake: [00:37:34] I’m curious. I’m kind of going off script, but I’m just asking out of curiosity, how many virtual assistants do you currently have that are active that you connected with clients?

Essie Escobedo: [00:37:47] Around 50.

Mike Blake: [00:37:48] Okay. That’s a lot. That’s a lot. It sounds like a lot of air traffic control and a lot of jobs.

Essie Escobedo: [00:37:56] There’s not a lot of air traffic control. All of these people basically fly on autopilot because they don’t need to be managed. If I do a good job at matching up the clients and my angels, as I call them, I have very little need to interfere.

Mike Blake: [00:38:18] Okay. So, how does the payment model work for – I guess, you can’t talk about everything in the world, of course – but your virtual assistants, is the payment model simply an hourly rate? Is that a flat monthly retainer? Is it a minimum number of hour commitment to kind of keep them on the roster? Is it project based? Is it all over the board? Something I’m not thinking of? How does the economics work?

Essie Escobedo: [00:38:49] Well, there are virtual assistant agencies out there, who, you have to buy a block of time, user or lose. You may or may not have the same person supporting you from week to week, month to month. For my business, we don’t do that. We have no minimums. I basically make a match and most of the work that we do, we do on an hourly fee basis. We do projects. We will put a scope of work together and do a project, but for the most part, it’s on an hourly basis. Because we need to go with the ebb and flow of the small business owner. And why should you be paying for something when you don’t have the work to be done? That doesn’t sit well with me.

Essie Escobedo: [00:39:56] And because I’m working with people who are at home, they understand that this is not a full-time permanent job with a steady, steady stream of revenue. It’s going to be as needed in my business model, which is, I have to say, it’s out of the ordinary. I don’t know anybody else who’s doing it this way, but it works.

Mike Blake: [00:40:23] Well, I mean, it seems to work. I mean, you’re right. I think one of the barriers – one question that might cause someone to hesitate about retaining a virtual assistant or any assistant is, you know, I’m not sure I have enough work for them. Now, I think in my experience – and correct me if I’m wrong – I think once you have a relationship with a virtual assistant that works, pretty quickly you’re going to find out you’re going to want to offload more and more things. You’re going to keep them more busy, not less.

Essie Escobedo: [00:40:52] Okay. You’re absolutely right. And one of the things that I do when I’m talking to a prospective client, they will come to me with one or two or three pain points. And I’ll give them a homework assignment. And I’ll say, “As you go about your routine, I want you to jot down tasks. And jot down tasks that we’ll go over the list, we’ll prioritize it, we’ll figure out your tasks that only you can do.” But for the most part, most of the tasks you can outsource. And so, that helps me in the matchmaking process, because I’ll find a person who can do a good number of the tasks on the list. And then, I’ll say, “Hey, we can start off with baby steps. And as we grow into the relationship and have a good workflow and have good communication -” and I always say, “- number one, we have to earn your trust. Number two, we have to demonstrate that our services more than pay for themselves.” And that happens very quickly. And sure enough, you start offloading more tasks to that one person.

Mike Blake: [00:42:10] So, let’s say that, you know, there’s a listener and they’re thinking to themselves, “Great. I want to try out this virtual assistant model.” How would they get started?

Essie Escobedo: [00:42:27] Like I said, the first thing they need to do is decide. You know, look around and, typically, what are the things that you’re going to need help with? You can ask yourself the question, what am I procrastinating about? Usually, we procrastinate when it’s something that we don’t like to do, want to do, know how to do, or have time to do. So, it’s a procrastination problem.

Mike Blake: [00:42:56] I’m sorry, I didn’t phrase that question as well as I would like. How do you go about finding one? Once you’ve gone through that task of setting up what you like that individual or maybe team to do, how do you find that team?

Essie Escobedo: [00:43:14] Okay. Well, that’s a good question. I guess you can ask around, you can go out to the Internet, or you can give me a call.

Mike Blake: [00:43:24] Okay. Well, hopefully, they’ll call you first before they go out to the wild west of the Internet. So, we’re talking to Essie Escobedo of Office Angels, and we’re talking about retaining virtual assistants. We’re running out of time and I want to be respectful of your time, but a couple more questions I do want to get in. And one is, we’ve spoken, I think, largely from the perspective of a small business owner that needs virtual assistant help. Is it only small business owners that might be hiring a virtual assistant? Or can somebody like me that that doesn’t have a dedicated assistant resource within a larger firm? Are there people like me who hire a virtual assistant in order to kind of have their own resource? Or are there other scenarios, maybe family-office scenario or something else, where somebody else might find it useful and reasonable to consider a virtual assistant?

Essie Escobedo: [00:44:29] Yes. We’ve worked with real estate agents, financial advisors, some attorneys, even some CPAs that have brought in outsourced help, so to speak, without having to hire an employee. Sometimes the company will pay for that. Oftentimes, it comes out of the individual’s own pocket.

Mike Blake: [00:45:01] Now, another question I want to ask is, one way one could find a virtual assistant is through one of these online matchmaking sites, the Fiverrs of the world, the Elance of the world, and so forth. What are the benefits of working through an organization like yours relative to one of those online kind of marketplaces, if you will?

Essie Escobedo: [00:45:27] I think it’s in our vetting process. We’re highly selective and go through a rigorous interview process. We also have a very stable workforce. And we also put in place a backup mechanism. You know, if you’re hiring somebody, you really don’t know who they are out there in the world. Everyone who comes to work for us has to be referred. So, I think that you have a much higher quality. And in working in a virtual situation, you really have to place a lot of trust in the person that’s supporting you. They’re going to be privy to a lot of confidential information and passwords and so forth.

Mike Blake: [00:46:26] That’s really interesting, the fact that they have to be referred. So, you’re kind of like the Freemasons of the virtual assisting world. To get in, you have to be referred in as a member. That’s really interesting. And I think that’s important because, you know, Fiverr and Elance and the others, they have their rating systems. But, you know, there are services, there are bots that will artificially create those rating services. And, you know, I consider myself fairly technologically advanced, but I’m still enough of a curmudgeonly Gen Xer, where, you know, I think one referral is worth 100 rating stars any day of the week. It’s better than 100 rating stars.

Essie Escobedo: [00:47:08] Well, the bottom line is, it makes my life so much easier because I know who these people are and where they came from. And so, the people in my network are not going to send me someone who’s going to cause trouble, bottom line.

Mike Blake: [00:47:29] Yeah. I can imagine. And I would not want to cause trouble for you, that’s for sure. So, Essie, this has been a great conversation. We’re running out of time. I got to wrap things up. But if people want to learn more about this topic or want to ask you maybe a follow up about virtual assistants, can they contact you? And if so, what’s the best way to do so?

Essie Escobedo: [00:47:51] I like to talk to people, so they can call me, 770-442-9246. We could set up a Zoom call. Of course, they can email me. I’ll take a text if I have to.

Mike Blake: [00:48:13] So, the telephone, that’s very quaintly retro. I have to go back, I think you’re probably only the second person that’s giving out their phone number on the program, so good for you.

Mike Blake: [00:48:29] That’s going to wrap it up for today’s program. I’d like to thank Essie Escobedo so much for joining us and sharing her expertise with us. We’ll be exploring a new topic each week, so please tune in so that when you’re faced with your next business decision, you have clear vision when making it. If you enjoy these podcasts, please consider leaving a review with your favorite podcast aggregator. It helps people find us that we can help them. Once again, this is Mike Blake. Our sponsor is Brady Ware & Company. And this has been the Decision Vision podcast.

Morrow Family Medicine Affiliates with Village Medical – An Interview with Andrew Thompson, Village Medical (Episode 49, To Your Health with Dr. Jim Morrow)

Morrow Family Medicine Affiliates with Village Medical – An Interview with Andrew Thompson, Village Medical (Episode 49, To Your Health with Dr. Jim Morrow)

Barry is a passionate communicator who has a mission together with Scott Noble, of helping people think about their wealth from a new perspective… showing them how they can use the best of the financial and estate planning industry tools and strategies to create a living legacy of not just money, but also of their values and significant influence in their community. Together they have been interviewed by an original “Shark” from ABC’s Emmy Award-winning TV show Shark Tank, Kevin Harrington, about their stories, passion, and unique process for helping families who desire a secure and satisfying retirement. Their counsel and assistance have saved families millions in estate, capital gains, and income taxes and helped secure a sound financial future.

Barry is a passionate communicator who has a mission together with Scott Noble, of helping people think about their wealth from a new perspective… showing them how they can use the best of the financial and estate planning industry tools and strategies to create a living legacy of not just money, but also of their values and significant influence in their community. Together they have been interviewed by an original “Shark” from ABC’s Emmy Award-winning TV show Shark Tank, Kevin Harrington, about their stories, passion, and unique process for helping families who desire a secure and satisfying retirement. Their counsel and assistance have saved families millions in estate, capital gains, and income taxes and helped secure a sound financial future.