The Future of Financial Planning with Austin Peterson E28

On this episode of the Future of Work: Water Cooler Conversations we are joined by Austin Peterson of Backbone Financial. He shares his how growing up and spending time on a farm influenced his work ethic and how one class in school changed the course of his life.

Austin also shares with us his passion for working with privately held businesses and the importance of planning for the future. He helps business owners navigate everything from insurance and managing liabilities to exit and succession planning.

If you are a business owner and do not have an exit or succession plan in place – this is a great episode to listen to for advice on how to get started. Austin also talks through the long list of things all business owners should be considering.

He also challenges all owners to think of their business as an investment and stresses the importance of working with a professional who can help you protect it. We cover the gambit on this episode from difficult childhoods, to parenting, to running a business and struggling to balance – it was a fun one and has something for everyone who is involved in small business.

Backbone Financial is based in Scottsdale, Arizona and strives to help take the guesswork out of your financial life by always acting in your best interest. Our goal is to help you build confidence with your financial decisions by providing solutions that best suit your needs and your unique financial situation.

Backbone Financial specializes in personalized financial planning and custom retirement plan analysis. We also help business owners and executives improve the effectiveness of their retirement plans through independent financial advice.

A veteran of the financial services industry, Austin Peterson has dedicated his career to helping clients toward achieving greater financial independence.

A veteran of the financial services industry, Austin Peterson has dedicated his career to helping clients toward achieving greater financial independence.

With over 18 years of experience, his extensive background includes working at leading firms across the financial world, including Pacific Life Insurance Company, Oak Tree Management Group, Symetra Life Insurance Company and many others.

In founding his own firm, Backbone Financial, Austin sought to focus his expertise on providing clients with a truly personalized financial planning experience.

Having earned an MBA and CERTIFIED FINANCIAL PLANNER™ (CFP®) and CHARTERED LIFE UNDERWRITER™ (CLU®) designations, Austin holds the educational degree and certifications necessary to truly understand his clients’ needs and guide them appropriately toward meeting their business and financial goals.

While he thrives in a spectrum of services, he specializes in helping business owners, their executives, and families toward achieving their most valued financial goals. Whether providing corporate retirement plans, estate planning, business succession plans, or custom retirement income strategies, Austin always keeps his clients’ best interests at the heart of his process.

A graduate of California State University,Fullerton, Austin earned his MBA from Brigham Young University. In addition to working with investors, he has also helped train many advisors to help meet the needs of their clients.

While managing his own practice, Backbone Financial, he also counsels with and partners with advisors associated with Lincoln Financial Group that live in the western half of the United States on partnering with third party relationships to better serve their joint clients.

Outside of the office, Austin enjoys competing in triathlons, playing a round of golf, snowboarding, surfing, and watching sports. Most of all, he looks forward to spending time with his wife and kids.

Connect with Austin on LinkedIn and Instagram, and follow Backbone Financial on Facebook.

Austin Peterson is a registered representative of Lincoln Financial Advisors Corp. Securities and investment advisory services offered through Lincoln Financial Advisors Corp., a broker/dealer (member SIPC) and registered investment advisor. Insurance offered through Lincoln affiliates and other fine companies. Backbone Financial is a marketing name for registered representatives of Lincoln Financial Advisors Corp. CRN-3506780-032421

Lincoln Financial Advisors Corp. and its representatives do not provide legal or tax advice. You may want to consult a legal or tax advisor regarding any legal or tax information as it relates to your personal circumstances.

The content presented is for informational and educational purposes. The information covered and posted are views and opinions of the guests and not necessarily those of Lincoln Financial Advisors Corp.

Business RadioX® is a separate entity not affiliated with Lincoln Financial Advisors Corp.

ABOUT THE FUTURE OF WORK: WATER COOLER CONVERSATIONS

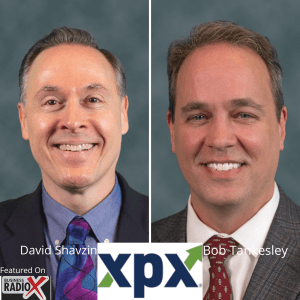

Welcome to Future of Work: Water Cooler Conversations Radio Show and Podcast – where business leaders share how they integrate humanity and technology through innovative approaches, healthy culture, flexible workspaces and seamless virtual technology.

ABOUT YOUR CO-HOSTS

With a background in marketing, in various for profit and not for profit companies, Kyle McIntosh wondered, “How can I pair the passion and commitment to community progress of a non-profit with the sustainability and reach of a for profit company?” From this question and perspective a mission evolved to tear down the false distinction between the two sectors and to promote companies with Conscious Capitalism® business models through MAC6.

With a background in marketing, in various for profit and not for profit companies, Kyle McIntosh wondered, “How can I pair the passion and commitment to community progress of a non-profit with the sustainability and reach of a for profit company?” From this question and perspective a mission evolved to tear down the false distinction between the two sectors and to promote companies with Conscious Capitalism® business models through MAC6.

Kyle is the President and Creative Excitant of MAC6. Day to day, his main operational role is on the “spaces” side of the business, focusing on creating thriving communities in the commercial office buildings, the co-working space, and the co-manufacturing space. The other role that he plays is that of EOS implementer, working with clients to bring the Entrepreneurial Operating System, from the book Traction® to their businesses. Additionally, he sits on the boards of Conscious Capitalism Arizona, telling the stories of good businesses in Arizona, and The Tempe Chamber of Commerce, sustaining Tempe’s quality of life and keeping our community and economy vibrant.

Kyle loves Arizona and wants to see us all collectively find great success based on the awesome things that are happening here every day.

Follow MAC6 on Facebook and Twitter.

Jennifer Burwell, joined MAC6 in 2013. Jennifer is their VP and Director of Programs.

Jennifer Burwell, joined MAC6 in 2013. Jennifer is their VP and Director of Programs.

She uses her experience in real estate, team development and management to seamlessly integrate each of the MAC6 business units to assure they are all focused on the long-term company vision. She is also a student of human behavior.

As a Certified Professional Behavioral Analyst, she uses her knowledge to facilitate culture-focused leadership programs with organizations of all sizes to integrate the company’s values and create higher-performing teams.

To learn more about MAC6 Communities, call 480-293-4075 or find them on Facebook

ABOUT OUR SPONSOR

MAC6 offers flexible spaces and programs to help your team grow, and a community of thriving businesses, just like yours. Advocating Capitalism as a Force for Good, MAC6 is Accelerating the shift to Conscious Capitalism (where Purpose and Profit Unite) through Creativity, Collaboration, Community and Change.

Mary Adams, Exit Planning Exchange (The Exit Exchange, Episode 1)

Mary Adams, Exit Planning Exchange (The Exit Exchange, Episode 1)

Austin Peterson is a Comprehensive Financial Planner and owner of Backbone Financial in Scottsdale, AZ. Austin is a registered rep and investment advisor representative with Lincoln Financial Advisors. Prior to joining Lincoln Financial Advisors, Austin worked in a variety of roles in the financial services industry.

Austin Peterson is a Comprehensive Financial Planner and owner of Backbone Financial in Scottsdale, AZ. Austin is a registered rep and investment advisor representative with Lincoln Financial Advisors. Prior to joining Lincoln Financial Advisors, Austin worked in a variety of roles in the financial services industry. After Pacific Life, Austin formed his own financial planning company in Southern California that he built and ran for 6 years and eventually sold when he moved his family to Salt Lake City to pursue his MBA.

After Pacific Life, Austin formed his own financial planning company in Southern California that he built and ran for 6 years and eventually sold when he moved his family to Salt Lake City to pursue his MBA.

Landon Mance is a Financial Planner and founder of YourFuture Planning Partners out of Las Vegas, Nevada. His firm came to life in 2020 after operating as Mance Wealth Management since 2015 when Landon broke off from a major bank and started his own “shop.”

Landon Mance is a Financial Planner and founder of YourFuture Planning Partners out of Las Vegas, Nevada. His firm came to life in 2020 after operating as Mance Wealth Management since 2015 when Landon broke off from a major bank and started his own “shop.” Whether you’re an established local company, or a brand new start-up, you can count on

Whether you’re an established local company, or a brand new start-up, you can count on

At

At  The Estate & Asset Protection Law Firm

The Estate & Asset Protection Law Firm