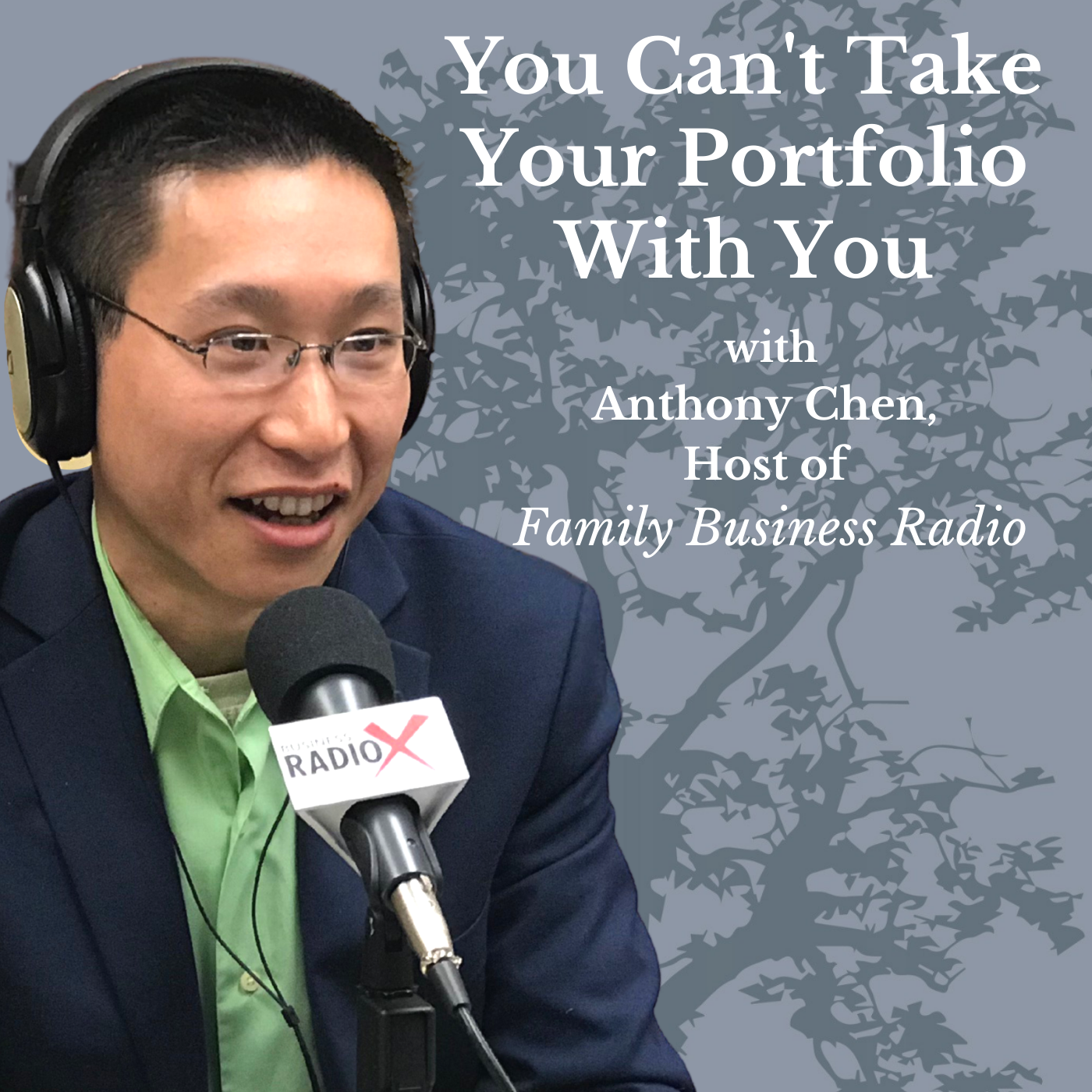

You Can’t Take Your Portfolio With You, with Anthony Chen, Host of Family Business Radio

While financial advisors have an incentive to accumulate client assets, Anthony Chen encourages his clients to make their money work for them and allow them to live their lives to the fullest. He advises this tack for a simple reason: you can’t take your portfolio with you. Family Business Radio is underwritten by Anthony Chen with Lighthouse Financial Network.

Anthony’s commentary was taken from this episode of Family Business Radio.

Anthony Chen, Host of Family Business Radio

This show is sponsored and brought to you by Anthony Chen with Lighthouse Financial Network. Securities and advisory services offered through Royal Alliance Associates, Inc. (RAA), member FINRA/SIPC. RAA is separately owned and other entities and/or marketing names, products or services referenced here are independent of RAA. The main office address is 575 Broadhollow Rd. Melville, NY 11747. You can reach Anthony at 631-465-9090 ext. 5075 or by email at anthonychen@lfnllc.com.

Anthony Chen started his career in financial services with MetLife in Buffalo, NY in 2008. Born and raised in Elmhurst, Queens, he considers himself a full-blooded New Yorker while now enjoying his Atlanta, GA home. Specializing in family businesses and their owners, Anthony works to protect what is most important to them. From preserving to creating wealth, Anthony partners with CPAs and attorneys to help address all of the concerns and help clients achieve their goals. By using a combination of financial products ranging from life, disability, and long-term care insurance to many investment options through Royal Alliance. Anthony looks to be the eyes and ears for his client’s financial foundation. In his spare time, Anthony is an avid long-distance runner.

The complete show archive of Family Business Radio can be found at familybusinessradioshow.com.

Lynda Bishop is a certified executive and empowerment coach, a master’s level mental health therapist, relationship advisor, speaker, author, and an international women’s leadership development facilitator.

Lynda Bishop is a certified executive and empowerment coach, a master’s level mental health therapist, relationship advisor, speaker, author, and an international women’s leadership development facilitator.

Catherine Scrivano is the President of CASCO Financial Group. She started her business to help people create the financial strength they need to achieve their dreams. She believes you don’t have to be wealthy to be wise!

Catherine Scrivano is the President of CASCO Financial Group. She started her business to help people create the financial strength they need to achieve their dreams. She believes you don’t have to be wealthy to be wise!

Thomas Inserra has 30+ years’ banking experience including leadership roles at Pacific Mercantile Bank, Susquehanna Bank/BB&T, HFC, Citibank, the FDIC, served as CEO and Board Member of a publicly traded FinTech and CEO of a bank Asset Resolution corp. He also serves as a Founder/Investor.

Thomas Inserra has 30+ years’ banking experience including leadership roles at Pacific Mercantile Bank, Susquehanna Bank/BB&T, HFC, Citibank, the FDIC, served as CEO and Board Member of a publicly traded FinTech and CEO of a bank Asset Resolution corp. He also serves as a Founder/Investor.

Randy Brunson is the founding shareholder of

Randy Brunson is the founding shareholder of  Sandy LeRoux, has been with

Sandy LeRoux, has been with

Stephanie Sandridge has been with

Stephanie Sandridge has been with

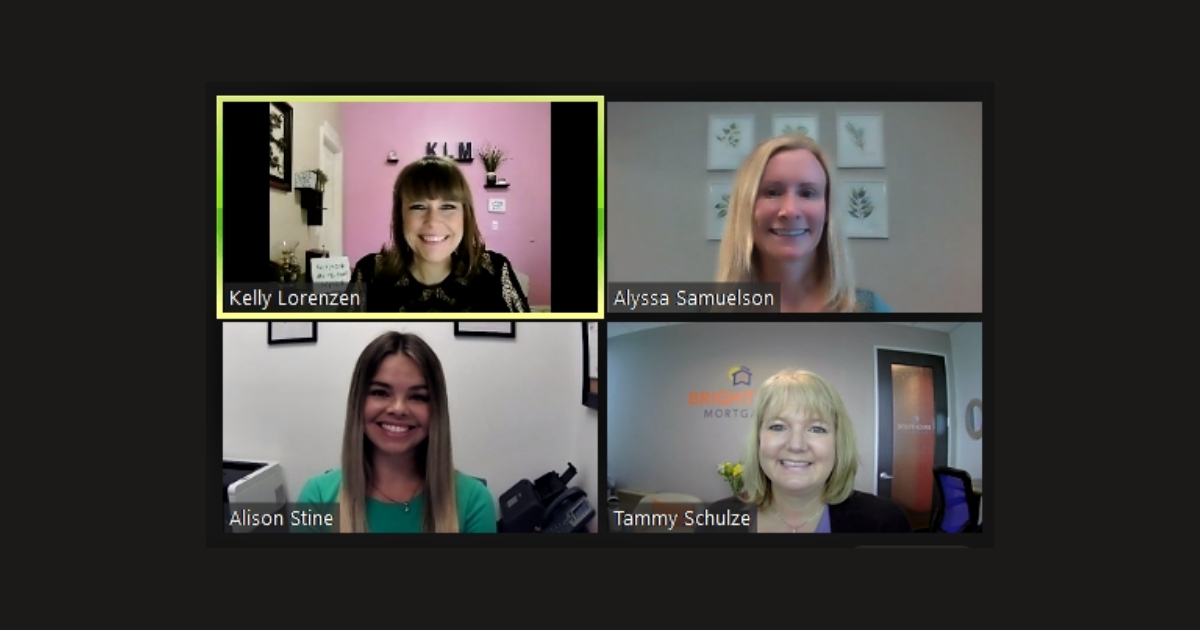

Alyssa Samuelson was born and raised near Des Moines, Iowa. After high school, she decided to venture west and attended The University of Arizona. She received an incredible education from the university and loved the Arizona weather, even the summers!

Alyssa Samuelson was born and raised near Des Moines, Iowa. After high school, she decided to venture west and attended The University of Arizona. She received an incredible education from the university and loved the Arizona weather, even the summers!

Alison Stine is the Founder of Stine Wealth Management. She began her investment career in 2013 as a Financial Representative, as her passion lies in helping others.

Alison Stine is the Founder of Stine Wealth Management. She began her investment career in 2013 as a Financial Representative, as her passion lies in helping others.

Tammy Schulze was born and raised in Spokane, Washington and moved to Phoenix in 2001. She graduated from Cheney High School and Eastern Washington University. She didn’t always know she wanted to be a Mortgage Broker, but she did always know she wanted to help people.

Tammy Schulze was born and raised in Spokane, Washington and moved to Phoenix in 2001. She graduated from Cheney High School and Eastern Washington University. She didn’t always know she wanted to be a Mortgage Broker, but she did always know she wanted to help people.

Kelly Lorenzen, CEO of KLM Consulting, is an award-winning entrepreneur with over 15 years of business-ownership experience. She is also a certified project management professional.

Kelly Lorenzen, CEO of KLM Consulting, is an award-winning entrepreneur with over 15 years of business-ownership experience. She is also a certified project management professional.

A veteran of the financial services industry, Austin Peterson has dedicated his career to helping clients toward achieving greater financial independence.

A veteran of the financial services industry, Austin Peterson has dedicated his career to helping clients toward achieving greater financial independence. With a background in marketing, in various for profit and not for profit companies, Kyle McIntosh wondered, “How can I pair the passion and commitment to community progress of a non-profit with the sustainability and reach of a for profit company?” From this question and perspective a mission evolved to tear down the false distinction between the two sectors and to promote companies with Conscious Capitalism® business models through

With a background in marketing, in various for profit and not for profit companies, Kyle McIntosh wondered, “How can I pair the passion and commitment to community progress of a non-profit with the sustainability and reach of a for profit company?” From this question and perspective a mission evolved to tear down the false distinction between the two sectors and to promote companies with Conscious Capitalism® business models through

Jennifer Burwell, joined MAC6 in 2013. Jennifer is their VP and Director of Programs.

Jennifer Burwell, joined MAC6 in 2013. Jennifer is their VP and Director of Programs.