Brought to you by OnPay. Built in Atlanta, OnPay is the top-rated payroll and HR software anywhere. Get one month free at OnPay.com.

Christy Brown is President of Launchpad2X with a vast amount of previous experience in scaling and growing companies ranging from startups to Fortune 500 turnaround business units. In these roles, she has held executive leadership roles over the past 20 years but in 2019, she became the Managing Executive Partner a venture capital firm focused on pairing venture capital with shared services in a studio environment to scale rapidly with services to support early-stage startups.

Christy Brown is President of Launchpad2X with a vast amount of previous experience in scaling and growing companies ranging from startups to Fortune 500 turnaround business units. In these roles, she has held executive leadership roles over the past 20 years but in 2019, she became the Managing Executive Partner a venture capital firm focused on pairing venture capital with shared services in a studio environment to scale rapidly with services to support early-stage startups.

Prior to assuming the executive investment role, Christy was the Executive Vice President at a Fortune 100 human capital management software company where she lead the business transformation & client success organization globally. However, Christy is a rabid founder and has scaled three service-based companies focused on digital marketing and human capital services which she exited across a 12-year interval.

Following the last exit, she became a consummate innovator, futurist, and angel investor and is aligned to multiple startup incubators as a mentor and advisor focused on scaling and growing the founders alongside the business. She has also served as a board member across the Atlanta ecosystem including as a Venture Partner with Republic.co, Entrepreneur’s Organization, Metro Atlanta Chamber of Commerce, American Cancer Society, Technology Association of Georgia, and various across early and series stage startups in technology.

Connect with Christy on LinkedIn and follow Launchpad2X on Facebook and Twitter.

What You’ll Learn in This Episode

- The partnership between Launchpad2X and TIE Atlanta

- Access to the Capital for women

About Our Sponsor

OnPay’s payroll services and HR software give you more time to focus on what’s most important. Rated “Excellent” by PC Magazine, we make it easy to pay employees fast, we automate all payroll taxes, and we even keep all your HR and benefits organized and compliant.

payroll services and HR software give you more time to focus on what’s most important. Rated “Excellent” by PC Magazine, we make it easy to pay employees fast, we automate all payroll taxes, and we even keep all your HR and benefits organized and compliant.

Our award-winning customer service includes an accuracy guarantee, deep integrations with popular accounting software, and we’ll even enter all your employee information for you — whether you have five employees or 500. Take a closer look to see all the ways we can save you time and money in the back office.

“Decision Vision” is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at

“Decision Vision” is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at

Decision Vision is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at

Decision Vision is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at

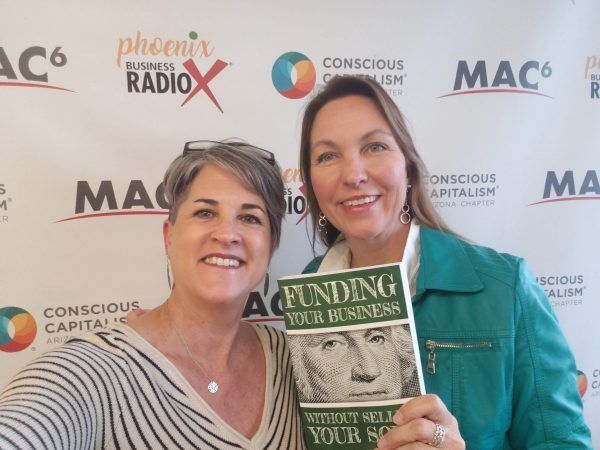

Stephanie Sims is a recovering investment banker, 2nd generation entrepreneur, speaker and author. She started her career working with Goldman, CSFB and Lehman in the US and Europe, and then rode the high tech start-up roller coaster all the way to an exit – complete with angels, venture capitalists, and household-name clients.

Stephanie Sims is a recovering investment banker, 2nd generation entrepreneur, speaker and author. She started her career working with Goldman, CSFB and Lehman in the US and Europe, and then rode the high tech start-up roller coaster all the way to an exit – complete with angels, venture capitalists, and household-name clients.

Army Veteran (2001-2005) and 12 years in pharmaceutical sales,

Army Veteran (2001-2005) and 12 years in pharmaceutical sales,