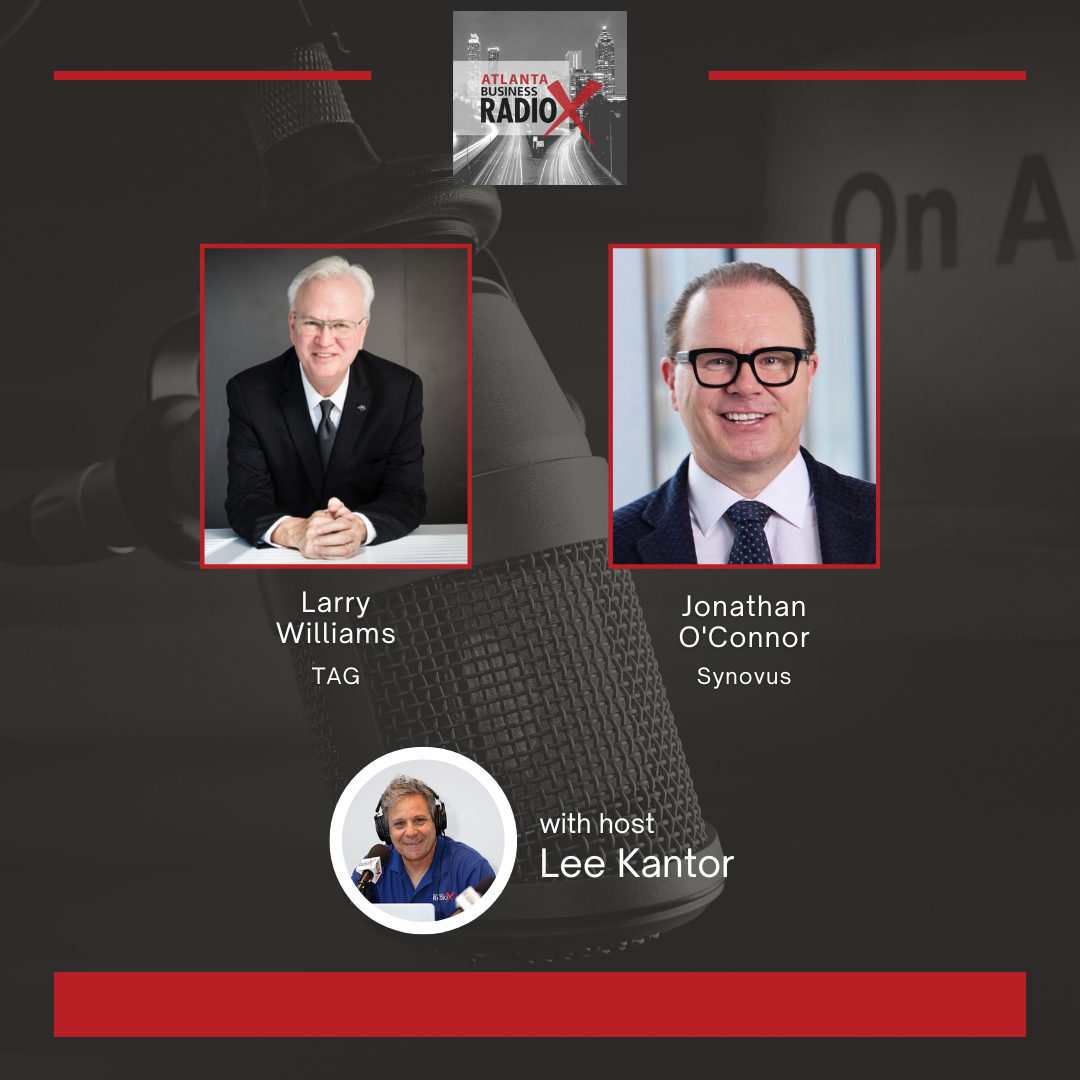

Jonathan O’Connor, Fintech South 2025 Chair; Division President, Third-Party Payments, Synovus.

Jonathan O’Connor, Fintech South 2025 Chair; Division President, Third-Party Payments, Synovus.

Jonathan is a results-oriented Executive, with 25+ years of experience leading sales teams, driving revenue, and identifying operational improvement strategies. Expert knowledge of global payment solutions, e-commerce, risk mitigation, digital currencies, merchant processing, mergers and acquisitions.

Adept at effective communication with internal executive leaders and external partners, building strategic relationships to drive corporate objectives and profit margin expectations. Forward thinker, with unique ability to collaborate with stakeholders driving innovative strategies and product offerings.

Dedicated team leader, with a passion for fostering an inclusive culture for teams and clients, prioritizing effective communication, team production, collaboration and respect. Unlocked staff potential with motivational mentoring and ownership techniques, leveraging inter-company resources to exceed project completion timelines.

Connect with Jonathan on LinkedIn.

![]() This transcript is machine transcribed by Sonix.

This transcript is machine transcribed by Sonix.

TRANSCRIPT

Intro: Broadcasting live from Fintech South 2025 at the Woodruff Arts Center in Atlanta, Georgia. It’s time for Atlanta Business Radio now. Here’s your host.

Lee Kantor: Lee Kantor here, broadcasting live from ten Tech South 2025. So excited to be talking to my next guest, Jonathan O’Connor with Synovus.

Jonathan O’Connor: Welcome, Lee. Great to be here. And great to have you guys here. It’s such a great event.

Lee Kantor: Yeah. So we chatted a little bit before the conference started. Now that the conference is in is going full bore here, uh, what have you learned?

Jonathan O’Connor: Look, it’s been an amazing, you know, day and a half. I’ve been here as emcee as well. So trying to convince people I’m not from Dublin, Georgia, but from Dublin, Ireland has been an adventure. But it really has been a great, uh, you know, you know, building our team around the power of connection and the innovation of finance in the future. Ai has been central to everything, and it’s amazing to go around to all of our exhibitors and see the amount of Atlantic AI signs. You know, it really is the the power horse of change as we go through. And and we’ve had some amazing speakers as well, you know, as Sean Neville has been here, uh, you know, hoo hoo circle guy who’s now going to, you know, take on the financial, traditional financial institution banks and have an AI agent driven financial institution. So, you know, the innovation has been amazing. Uh, you know, having a lot of our students here as well to the Georgia Fintech Academy has been very beneficial to see the generation, you know, that’s going to come up after all of us, like the Pepsi ad, the next generation. And, uh, you know, we’ve had also some Hall of Fame inductees as well. And, you know, it’s generally been a great, great two days.

Lee Kantor: So now, uh, you you talk about the power of connection and community. Why is it important for Synovus this to be the kind of the lead sponsor of this event. And and and how is this, uh, fintech south and tag kind of really play into the Synovus mission?

Jonathan O’Connor: Yeah. Look, you know, first of all, let’s talk about Georgia and Atlanta itself for fintech. You know, over 300 billion in transactions flowed through it through Atlanta, with 70% of all global payments flowing through the city. In that we’ve got about 260 fintechs and six out of ten of every international large processor as a presence here and as Synovus, we’re we’re you know, we’re glad to be part of the fintech ecosystem in Atlanta. You know, we’re our community is very important to us. And we play a great role there, helping not only the the fintechs, you know, established banking relationships, but also, you know, working with some larger processors as well as they look at their financial needs from a students perspective. You know, Synovus and the third party payments team were very engaged with mentoring some students. In fact, we have four students now from UGA who have launched a pay by bank product, and we’ve mentored those guys and are launching now second week of September in Athens, Georgia, with a coffee store. And we’re immensely proud of that because that’s what it’s all about. It’s all about community at the end of the day and passing back a little bit of knowledge. You know, the older folks in payments have to the next generation.

Lee Kantor: So how does you and your team encourage the Synovus folks, um, to get involved with organizations like Tag or conferences like Fintech South? Like, how is that kind of integrated into the DNA of your organizations?

Jonathan O’Connor: Yeah. Look, I’ve been very lucky from a from a leadership perspective to have our, our, our COO and CTO, both, uh, board members of Tag, uh, Zach Bishop and Vikram Ramani. So having those two great leaders in Tag and then giving me the opportunity to represent Synovus as headline sponsor at Fintech 2025. In addition to the MC has truly been great. In addition to that, Synovus has always supported not only Fintech Atlanta, uh, but also the ATC, where we’re we try to be influential from a policy perspective. You know, we’ve we’ve had representation for interchange, the interchange debates we’ve had we’ve also spoken and and also tried to influence around surcharges. So, you know, the bank itself is is always here to support and payments is is so critical to our relationship with our customers. You know, the bank will primarily drive loans and deposits. But you know it’s it’s like businesses like third party payments that we we drive merchant services and sponsorship. We drive non-interest revenue for the bank. And that’s a key component as well.

Lee Kantor: So what would you say to the folks out there, maybe the young people out there that are considering a career in finance, in fintech? Um, are you bullish about the opportunities for the next generation of, uh, you know, leaders?

Jonathan O’Connor: Absolutely. As I said, mentoring some some students recently was really an eye opener for me to to get involved. And I suppose the next generational turn in payments, we’re at a pivotal pivot point again, where a lot of the payment tools will reformat itself with AI, for example, the payment page, uh, you know, the the shopping carts and e-commerce, you know, we now see a gigantic AI. Ah, you know, we’re all blessed with these new terms, ambient commerce they’re also talking about. But we really feel that, you know, the new frontier of payments with AI will bring a new skill set. And I think an amazing challenge and opportunity for the next generation.

Lee Kantor: Now, what about the, you know, the slowness of some of the enterprise organizations and these, um, legacy companies to adopt digital payments and, uh, you know, move away from, you know, hard checks when their consumers have seemingly already pivoted towards a comfort with digital.

Jonathan O’Connor: Yeah. Look, I think people are people are happy and people are creatures of routine. So I think, you know, people who like checks will use checks. People who like ACH will use ACH. People who take out money from ATMs will take money out from ATMs. But as we think about payment acceptance, we think about everything moving to our phone, we carried around and unfortunately we look at it for so much during the day. You know, payment is now part of a digital wallet, and I really believe the future will see everything move to a digital wallet. It’ll move away from a plastic instrument or a paper instrument, and you’ll have everything through your digital wallet. So, you know, it always amazes me as well. When I used to watch my kids play video games and all they do is collect coins all the time. They’re they’re already trained for digital coins. And we have to mention stablecoin. We have to mention crypto Because as you marry at digital wallets with digital coins, you know that is the future. And I think we will see a huge uptake in digital wallet usage over the next, the next 2 to 4 years.

Lee Kantor: So do you. So you think that this is going to be kind of a a gradually then suddenly experience, or is this going to be just slow kind of drip until, uh, you know, I guess it just changes formally.

Jonathan O’Connor: Yeah. I think it’s already happening. If you, if you, you know, when you, when you go to to shop now or go to go to eat out, people are using contactless payments. So they’re already touching their phones. They’re trying to get over the terminals to make it connect. And that’s the first evolution here. The next will be, you know, the wallet will recognize you’re in the store and you’ll be able to connect things. And then we get into the scary side where the AI agent will be online, and we’ll do all the shopping for you, and we’ll select the best payment type to use in your wallet. And hopefully we’ll have some involvement there. And but I think it’s all happening. So you know. Certainly I think the train has left the station.

Lee Kantor: So now in, um, how does Synovus kind of, um, serve their different clientele? So you mentioned, like there’s obviously banking clients where you have people coming in and, and using banking services, but then you have these other kind of services in and around fintech. Are those customers kind of lead gen for the other services like, like which comes first, you know, the chicken or the egg when it comes to a Synovus customer?

Jonathan O’Connor: Absolutely. So, you know, we we primarily you know, our CEO is very passionate about people buying off people. And we lead with our commercial bankers. We lead with our branches. And, you know, we’re very much a community people driven bank. So by doing that the the relationship normally starts with a loan or a deposit or some type of, you know, commercial relationship. And then we’re probably what I position a value added service to that relationship. The banker will introduce the merchant services team and then we will We will hopefully earn the right for their business to enable their payment acceptance online, or even in a store or restaurant or shop.

Lee Kantor: So it starts with though the human to human interaction, maybe at a branch or a call from somebody from a branch.

Jonathan O’Connor: Absolutely. I’m a big believer in people buy off people. And I think if we if we stick to that simple mantra, you know, you earn the right for business and you you earn trust. And, you know, I also believe in the power of community. Since I’ve since I’ve started my career at Synovus.

Lee Kantor: So now you mentioned, um, stablecoin and crypto and things like that. Um, are you seeing an adoption and a comfort with that, or are we still at the beginning stages of that?

Jonathan O’Connor: I think we’re at early stages. You know, I what’s happened, probably the most positive elements is regulation. You know, we’ve had some large movements in regulation this year with the Unity Act and the Genius Act. So regulatory environments need to catch up with the technology. That’s the first thing that needs to happen. But I think there’s already snippets of where crypto or a stablecoin can be effective. We think international payments is one area you’ll be able to make payments a lot faster internationally with a particular coin and and around not only the coin or the stablecoin or the crypto. If you married out with a blockchain, you’ve got a lot stronger security. You’ve got a lot more, um, you know, control around the transaction and knowing where the funds are moving. What we need to happen now is in parallel that that the AML, BSA compliance regulatory environment kind of catches up with the technology because it’s not effective unless we can, particularly for for a financial institution, we need to minimize residual risk, operational risk and reputational risk.

Lee Kantor: Right. It’s one of these things where the consumer is just expecting speed, and then there’s so much you have to take care of when it comes to compliance and security.

Jonathan O’Connor: Absolutely.

Lee Kantor: And to marry that and balance that is tricky. I mean, the bad guys are paying attention to, right?

Jonathan O’Connor: They really are. As we evolve here, the bad guys are normally one step ahead. Yeah.

Lee Kantor: So if, um, when it comes to tag, what do you see kind of in the future of maybe this event or just in tag in general as, uh, tags looking to expand beyond just Georgia, but maybe be a leader within the the southeast region?

Jonathan O’Connor: Yeah. Look, I think there’s a couple of things. One is to, you know, continue supporting the next generation, our students. It was great to have such a great presence of our students here this year. I think they’re the they’re the DNA of what we all do for the future. Collaboration is key as well. We’ve we’ve had some, you know, representation here from the UK and Europe, which was great to see. And also for some other states. I met some people from Canada and, and also from, you know, out west. What really struck me as well was how do we glue the payment innovation in Silicon Valley with the traditional payment rails in Atlanta? And that’s something I’m going to have a good conversation with Larry about, because I think that’s something we should think about for next year. Is there you know, there’s so much great innovation on the West Coast around payments. How do we tag and fintech Marriott, maybe for some of our event next year now?

Lee Kantor: And also the opportunities kind of marrying some of the stuff that’s happening in Asia and internationally as well. I mean, it’s a big world out there.

Jonathan O’Connor: It really is. I agree. And, you know, from a regulatory standpoint. You know, Europe probably has they have their own AI act now and their crypto act has been in play. And there’s also some very interesting stuff happening here in Georgia. There’s the merchant acquiring limited charter uh license which the state issues. And that’s attracting a lot of fintechs into Atlanta. Fiserv was just granted that stripe was just granted that. And what that allows is it allows a company essentially process Visa and Mastercard without having a bank, but they can’t be a bank, so it gives them a lot more control on their payment ecosystem. I would I expect to see a lot more international inbound company setting up to avail of this license. So I think from an international perspective, we should see a lot of that movement over the next 12 months.

Lee Kantor: And then what do you see or hear from the folks you know internationally? How do they feel about Atlanta? Are they as bullish about Atlanta as the folks here in this room?

Jonathan O’Connor: Look, they love our airport. Number one. We can go anywhere. We can arrive anywhere. So that’s the first thing I love about Atlanta. Atlanta is a great transient city. And you know you’ve got a great mix of cultural people. In fact, my team, you know, if I look at the I’ve got four leaders and three of those are are not from Georgia. And sometimes I’ll be at a meeting said I work for snow was Bank and they’re saying is that the bank in Georgia. They’re confused. So you know I like that there’s such an internationalization feel here. Uh, you know, we’ve got good taxes, we’ve got great support systems. You know, we’ve got all of these great associations to help people get set up here. So I feel very confident. Only to see, you know, what’s going on recently with the amount of land purchased by Amazon for data centers. And, you know, some of the some of the larger companies setting up, um, headquarters here. You know, we we definitely are pivoting back into a leadership position here.

Lee Kantor: So if somebody wants to learn more about Synovus, uh, where should they go?

Jonathan O’Connor: Sure. You can go to our website, Synovus Comm, or you can also email me at Jonathan O’Connor at Synovus. Com.

Lee Kantor: Well, Jonathan, thank you so much for all you do for this event. And and your work with Tag and what you do in the community. It’s very important and we appreciate you.

Jonathan O’Connor: Thank you very much. And everyone have a great day.

Larry K. Williams is President and Chief Executive Officer of The Technology Association of Georgia (TAG) and has served in this role since October 2016. As part of Mr. Williams responsibilities, he leads the NTSC (National Technology Security Coalition) and TAG Education Collaborative (TAG-Ed) benefiting workforce development across Georgia.

Larry K. Williams is President and Chief Executive Officer of The Technology Association of Georgia (TAG) and has served in this role since October 2016. As part of Mr. Williams responsibilities, he leads the NTSC (National Technology Security Coalition) and TAG Education Collaborative (TAG-Ed) benefiting workforce development across Georgia.

Jonathan O’Connor, Fintech South 2025 Chair; Division President, Third-Party Payments,

Jonathan O’Connor, Fintech South 2025 Chair; Division President, Third-Party Payments,

Vikram Ramani, CIO of

Vikram Ramani, CIO of

Their humble beginnings date back to a Georgia textile mill and a simple act of kindness. One day, a worker’s hard-earned savings spilled from the hem of her dress after it became entangled in factory machinery. Taking notice, an executive offered to secure her money in the company vault and pay her interest – a service soon extended to all workers at the mill. Those deposits marked the beginning of the company that would become

Their humble beginnings date back to a Georgia textile mill and a simple act of kindness. One day, a worker’s hard-earned savings spilled from the hem of her dress after it became entangled in factory machinery. Taking notice, an executive offered to secure her money in the company vault and pay her interest – a service soon extended to all workers at the mill. Those deposits marked the beginning of the company that would become  For over a decade,

For over a decade,  The

The