Gary Robinson, Panel Systems Unlimited (North Fulton Business Radio, Episode 285)

Gary Robinson, Panel Systems Unlimited, is a veteran of the office furniture industry and an ideal guest to join host John Ray and give a current perspective on this sector. Gary discusses work from home furniture options, sit to stand and other popular ergonomic solutions, how companies are redoing their spacing, and more. “North Fulton Business Radio” is produced virtually by the North Fulton studio of Business RadioX® in Alpharetta.

Panel Systems Unlimited

Panel Systems Unlimited was formed in 1996 in response to Metro Atlanta’s need for a professional supplier of clean quality affordable office furniture and office panels.

Panel Systems Unlimited’s mission is to transform the way buildings and communities are designed, built, and operated, enabling an environmentally and socially responsible, healthy, and prosperous environment that improves the quality of life.

Gary Robinson, Senior Account Executive, Panel Systems Unlimited

Gary Robinson has been in the commercial office furniture industry for the last 27 years in the Atlanta Metro area helping all types and sizes of businesses with their office furniture needs by providing professional customer service and creative office space solutions.

Gary helps his clients save money by offering numerous options with new, re-manufactured, and pre-owned furniture.

Follow Panel Systems Unlimited on LinkedIn, Facebook and Instagram.

Questions/Topics Discussed in this Show

- The types of furniture Panel Systems Unlimited sells

- The services they offer

- The kind of ergonomic solutions they provide

- How they are addressing the COVID-19 issues in the workplace

- What sets them apart from the competition

North Fulton Business Radio” is hosted by John Ray and produced virtually from the North Fulton studio of Business RadioX® in Alpharetta. You can find the full archive of shows by following this link. The show is available on all the major podcast apps, including Apple Podcasts, Spotify, Google, iHeart Radio, Stitcher, TuneIn, and others.

Renasant Bank has humble roots, starting in 1904 as a $100,000 bank in a Lee County, Mississippi, bakery. Since then, Renasant has grown to become one of the Southeast’s strongest financial institutions with over $13 billion in assets and more than 190 banking, lending, wealth management and financial services offices in Mississippi, Alabama, Tennessee, Georgia and Florida. All of Renasant’s success stems from each of their banker’s commitment to investing in their communities as a way of better understanding the people they serve. At Renasant Bank, they understand you because they work and live alongside you every day.

NickPrint, Inc. is a full service commercial printing company specializing in marketing materials and print collateral for small businesses. If you need Letterhead, Envelopes, Business Cards, Brochures, Flyers, Postcards, Newsletters or Pocket Folders, give us a call or send us an email! We’d love to quote your next project.

NickPrint, Inc. is a full service commercial printing company specializing in marketing materials and print collateral for small businesses. If you need Letterhead, Envelopes, Business Cards, Brochures, Flyers, Postcards, Newsletters or Pocket Folders, give us a call or send us an email! We’d love to quote your next project.

The Social Gloo is an email marketing/social media marketing company. They work with local businesses, start-ups, national and international companies supporting their email and social media needs. The scope of work includes email marketing, social media sites including Facebook management and design, Twitter management and design, LinkedIn management, YouTube video creation & more.

The Social Gloo is an email marketing/social media marketing company. They work with local businesses, start-ups, national and international companies supporting their email and social media needs. The scope of work includes email marketing, social media sites including Facebook management and design, Twitter management and design, LinkedIn management, YouTube video creation & more.

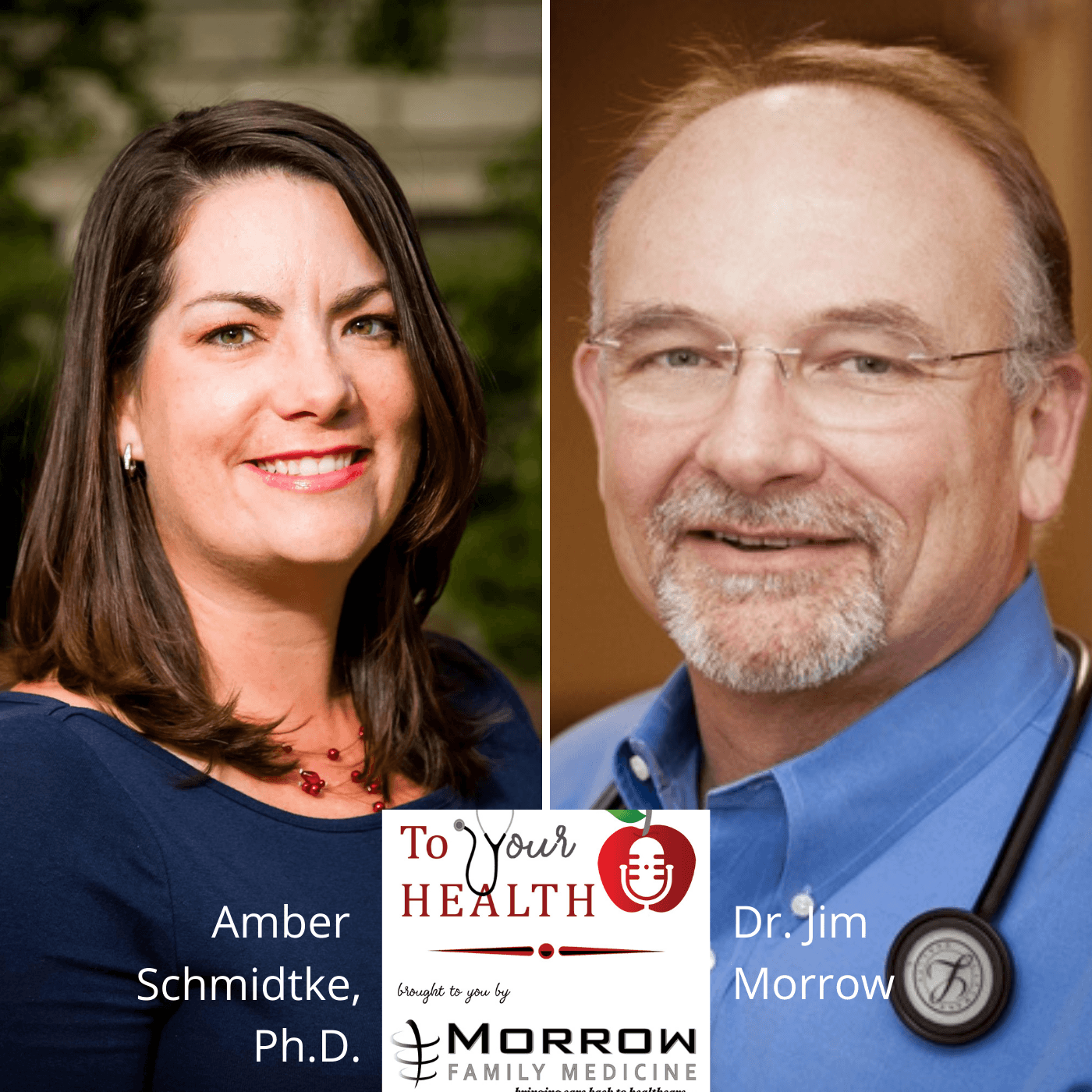

Amber Schmidtke, PhD., Microbiologist, Public Health Educator, and Science Writer – Episode 40, To Your Health With Dr. Jim Morrow

Amber Schmidtke, PhD., Microbiologist, Public Health Educator, and Science Writer – Episode 40, To Your Health With Dr. Jim Morrow