Jeff Lovejoy, Action Coach and David McDonough, Modern Image (North Fulton Business Radio, Episode 237)

Business coach Jeff Lovejoy joins the show to discuss issues businesses are facing in the pandemic, and David McDonough talks document and photo scanning. The host of “North Fulton Business Radio” is John Ray and the show is produced virtually by the North Fulton studio of Business RadioX® in Alpharetta.

Jeff Lovejoy, Action Coach

As one of Atlanta’s leading business coaches, Jeff teach business owners how to run the kind of business they want and deserve. He gets them working ON the business —focusing on marketing, finance, leadership, service delivery—rather than working solely IN their business. And along the way, we achieve dramatic results.

In small and medium size businesses, strategy is frequently lacking but is a cornerstone to success. If you don’t have a strategy or don’t have a strategy that is working, call Jeff. You’ll start with a business growth plan that will be customized with the strategies and techniques that will get you started on what’s needed to launch you towards your vision.

These are the kinds of transformations Jeff’s clients achieve:

–Significant increase in your take-home income from your business, achieved by getting you to spend more time focused ON your business

–Dramatic increase in efficiency, achieved by installing processes that result in your business running more efficiently and smoothly

–Superior team, achieved by building an empowered team to help you achieve your goals

–Make better use of your time, achieved by developing plans, setting goals and holding you accountable

You can visit Jeff’s website, email him directly, or call 404-444-1836.

David McDonough, Modern Image

Modern Image is a local document and photo scanning company. They convert files, photos and media to digital format for compliance policies, easier sharing, enhanced security, or just to get it out of the way! No job is too big or too small and all work is done in-house, locally.

The owner, David McDonough is a native of New Orleans and had a business and family there, during Hurricane Katrina. Having seen the devastation that results from losing business records, personal papers and photos – can be overwhelming. Many businesses closed due to lost records – many people’s entire personal photo collection was lost – as was David’s family. They also offer photo organizing workshops, bootcamps and 1-1 work.

Email David for a DIY guide on how to get started, or visit the Modern Image website.

North Fulton Business Radio” is produced virtually from the North Fulton studio of Business RadioX® in Alpharetta. You can find the full archive of shows by following this link. The show is available on all the major podcast apps, including Apple Podcasts, Spotify, Google, iHeart Radio, Stitcher, TuneIn, and others.

Renasant Bank has humble roots, starting in 1904 as a $100,000 bank in a Lee County, Mississippi, bakery. Since then, Renasant has grown to become one of the Southeast’s strongest financial institutions with over $13 billion in assets and more than 190 banking, lending, wealth management and financial services offices in Mississippi, Alabama, Tennessee, Georgia and Florida. All of Renasant’s success stems from each of their banker’s commitment to investing in their communities as a way of better understanding the people they serve. At Renasant Bank, they understand you because they work and live alongside you every day.

“Decision Vision” is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at

“Decision Vision” is a podcast covering topics and issues facing small business owners and connecting them with solutions from leading experts. This series is presented by Brady Ware & Company. If you are a decision maker for a small business, we’d love to hear from you. Contact us at

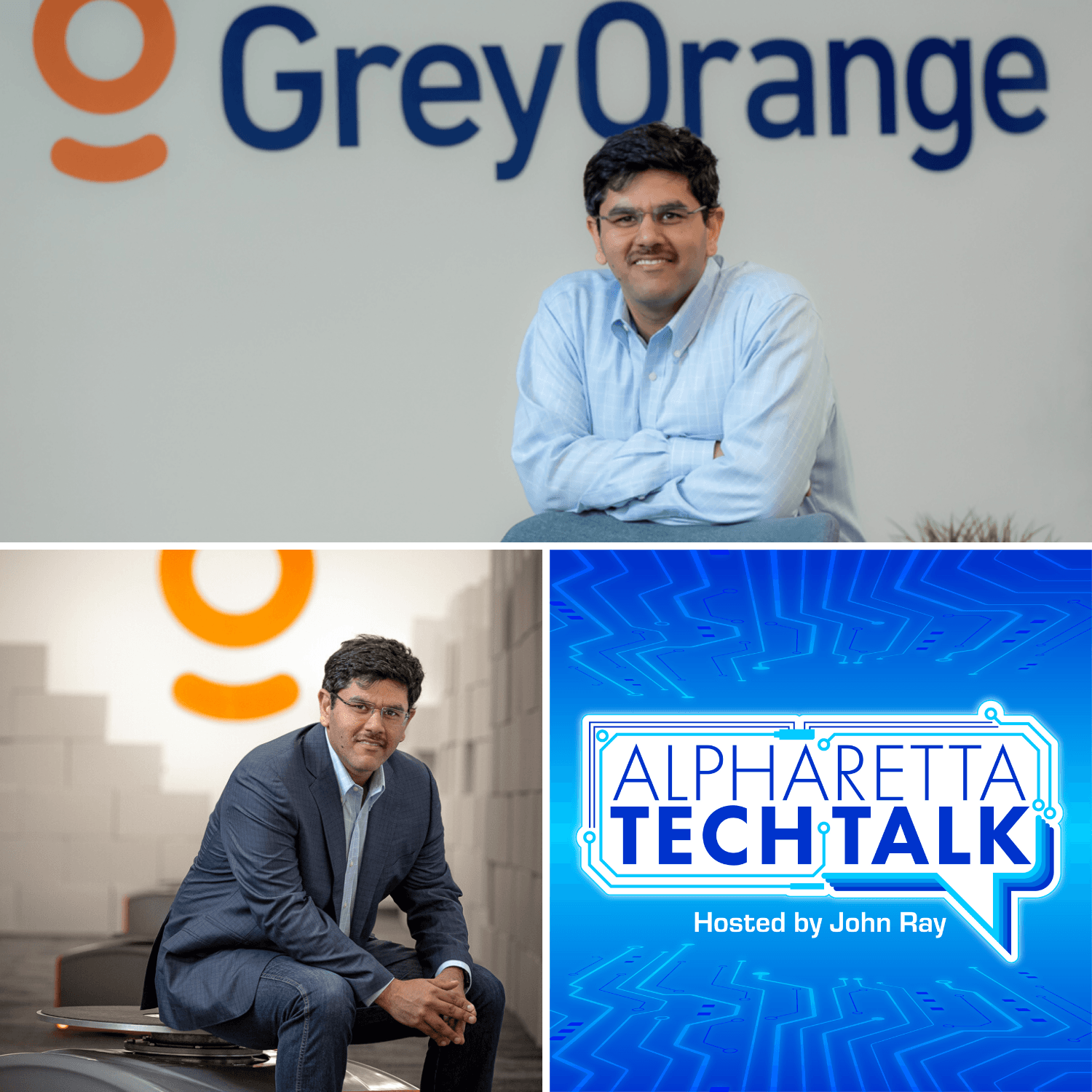

While still an engineering student at India’s Birla Institute of Tech and Science (BITS Pilani), Samay Kohli began attracting attention as an innovator in robotics as the founder and leader of a team of students who invented a humanoid robot, AcYut, at the institute’s Center for Robotics and Intelligent Systems.

While still an engineering student at India’s Birla Institute of Tech and Science (BITS Pilani), Samay Kohli began attracting attention as an innovator in robotics as the founder and leader of a team of students who invented a humanoid robot, AcYut, at the institute’s Center for Robotics and Intelligent Systems. What Samay and Akash understood that others didn’t is that tacking robots onto software built for earlier times improves fulfillment performance some…but not nearly enough. After all, those robots are simply hardware appendages limited by the capabilities of the software systems to which they interface.

What Samay and Akash understood that others didn’t is that tacking robots onto software built for earlier times improves fulfillment performance some…but not nearly enough. After all, those robots are simply hardware appendages limited by the capabilities of the software systems to which they interface.