Why People Work, with Ercell Charles and Merle Heckman, Co-Authors of Why People Work (North Fulton Business Radio, Episode 771)

Ercell Charles and Merle Heckman, co-authors of Why People Work, join host John Ray on this episode of North Fulton Business Radio. Why People Work is highlighted as a profound exploration into the motivational factors behind employees’ dedication to their work, offering a fresh perspective against the backdrop of numerous leadership books. The co-authors draw from their extensive corporate experience to address employee motivation from an individual’s perspective, focusing on intrinsic values and the importance of understanding an employee’s personal “why.” The discussion covers key themes of the book, including the significance of respect, responsibility, recognition, and reverence in the workplace, aiming to guide leaders and employees alike in fostering a fulfilling and productive work environment.

John Ray is the host of North Fulton Business Radio. The show is recorded and produced from the North Fulton studio of Business RadioX® inside Renasant Bank in Alpharetta.

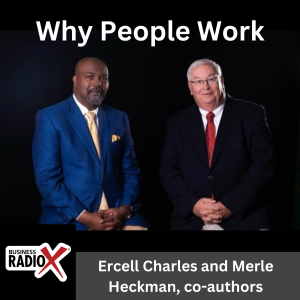

Why People Work

There are most likely thousands of leadership books written to equip leaders to develop the skills and behaviors necessary to encourage their teams to achieve goals and purposes. However, the primary focus of Why People Work is to assist leaders in looking deeper into the expectations and motivations of the people they serve. So as the organization is achieving its strategic plans and objectives, it is also meeting the critical needs and ambitions of its most important essential resources, better known as its human resources.

There are most likely thousands of leadership books written to equip leaders to develop the skills and behaviors necessary to encourage their teams to achieve goals and purposes. However, the primary focus of Why People Work is to assist leaders in looking deeper into the expectations and motivations of the people they serve. So as the organization is achieving its strategic plans and objectives, it is also meeting the critical needs and ambitions of its most important essential resources, better known as its human resources.

In businesses and organizations today, everything begins and ends with leadership. Leaders who go beyond the obvious to uncover these critical hidden expectations of their employees are able to create a culture of engagement and retention where employees not only give you their hands but, most importantly, their hearts. The return on investment for this effort is that the leader will earn their employees’ best effort. Therefore, when you know your employees “why” game, they will bring their “A-game.”

Ercell Charles

As the Vice President of Customer Transformation for Dale Carnegie & Associates, Ercell Charles oversees the entire customer experience by creating quality products that facilitate personal and professional breakthroughs for clients and developing a rigorous trainer certification system rooted in their unique delivery methodology. He ensures that both product quality and training will drive profitability for their franchise network while serving clients’ human capital training needs.

His responsibilities include overseeing the development of new product offerings and training quality for over 1700 global trainers. Previous to joining Dale Carnegie, Ercell worked with Cap Gemini America (now Capgemini) as Manager of Professional Staff, where he directed consulting activities for his staff of IT consultants providing information systems and programming services for top Fortune 500 companies like Coca-Cola, AT&T, Alcan, and UPS.

Ercell is regarded as a rapport builder—someone who can break down barriers and build bridges with messages and insights that transcend cultural and organizational differences. As a Carnegie Master, he is dedicated to coaching, evaluating, and directing the skills and abilities of future Dale Carnegie trainers on a global scale.

Ercell currently lives in Atlanta. He is married to his wife, Kynley Hayward Charles and they have three children, Cydnei, Blair, and Nola, and one granddaughter, Madison.

Merle Heckman

Dr. Merle Heckman is presently the Chief Culture Officer, Master Trainer and Consultant for Dale Carnegie of the Heartland.

Merle’s work experience is quite diverse. He grew up on a grain farm in Missouri. Merle’s work experience is very diverse, interacting with organizations like M&M Mars, Wrigley, Tootsie Roll, the World Bank, Kaiser Permanente, UPS, and others. His work experience in the areas of a non-profit organization, a privately held transportation business, a government agency, and a large publicly held global manufacturing company allows him to relate to employees at many different levels.

Merle served as Manager of Organizational Development for Emerson Electric, which was a Fortune 125 company. He is the designer and master trainer of “Safety Leadership Skills,” an Emerson course, and trained over 500 internal trainers, who in turn presented the course to over 27,000 employees worldwide. He was also the designer and master trainer of sales training for Regal Beloit, a global manufacturing company.

With a MA in counseling, an MBA with concentrations in Human Resources, Finance, and Marketing, a MPA and an Ed.D. in Educational Leadership, he has taught at various universities over the last 19 years, both in-person and online. Heckman has the SPHR-SCP certification (Senior Professional in Human Resources) from the Society of Human Resource Management. He was awarded the certification of Certified Speaking Professional (CSP) through the National Speakers Association.

He and his wife, Cindy, have seven children and twelve grandchildren.

Topics Discussed in this Episode

00:00 Welcome to North Fulton Business Radio

01:28 Introducing Why People Work: A New Perspective on Leadership

02:01 Exploring the Essence of Work: Employee Perspectives

05:39 Beyond Compensation: Understanding Reward in the Workplace

10:23 Building Relationships and Respect at Work

18:33 The Significance of Responsibility and Reverence in Work

24:49 The Book’s Broader Impact Beyond Leaders

27:57 Final Thoughts and How to Get the Book

Renasant Bank and Casa Nuova Italian Restaurant support North Fulton Business Radio

Renasant Bank has humble roots, starting in 1904 as a $100,000 bank in a Lee County, Mississippi, bakery. Since then, Renasant has become one of the Southeast’s strongest financial institutions, with over $13 billion in assets and more than 190 banking, lending, wealth management, and financial services offices in Mississippi, Alabama, Tennessee, Georgia, and Florida. All of Renasant’s success stems from each of their banker’s commitment to investing in their communities as a way of better understanding the people they serve. At Renasant Bank, they understand you because they work and live alongside you every day.

Renasant Bank has humble roots, starting in 1904 as a $100,000 bank in a Lee County, Mississippi, bakery. Since then, Renasant has become one of the Southeast’s strongest financial institutions, with over $13 billion in assets and more than 190 banking, lending, wealth management, and financial services offices in Mississippi, Alabama, Tennessee, Georgia, and Florida. All of Renasant’s success stems from each of their banker’s commitment to investing in their communities as a way of better understanding the people they serve. At Renasant Bank, they understand you because they work and live alongside you every day.

Casa Nuova is a proud family-owned and operated restaurant, serving classic, authentic and traditional Italian cuisine and top tier hospitality since 1998.

Casa Nuova is a proud family-owned and operated restaurant, serving classic, authentic and traditional Italian cuisine and top tier hospitality since 1998.

Casa Nuova is a cook-to-order kitchen, serving traditional fare including pasta, chicken, seafood, veal, vegetarian and gluten-free options, plus daily specials. They are a farm-to-table establishment, meaning that in the summertime, they cultivate their own vegetables in their garden, steps away from the restaurant, including tomatoes, corn, peppers, zucchini, sunflowers and more!

Celebrating more than 25 years, Casa Nuova has become a true staple in the Alpharetta area, serving more than three generations of families, including friends old and new, visiting near and far from all over the metro Atlanta area and beyond.

Website | LinkedIn | Facebook | Instagram

About North Fulton Business Radio and host John Ray

With over 760 shows and having featured over 1,200 guests, North Fulton Business Radio is the longest-running podcast in the North Fulton area, covering business in our community like no one else. We are the undisputed “Voice of Business” in North Fulton!

The show welcomes a wide variety of business, non-profit, and community leaders to get the word out about the important work they’re doing to serve their market, their community, and their profession. There’s no discrimination based on company size, and there’s never any “pay to play.” North Fulton Business Radio supports and celebrates business by sharing positive business stories that traditional media ignore. Some media leans left. Some media leans right. We lean business.

John Ray is the host of North Fulton Business Radio. The show is recorded and produced from the North Fulton studio of Business RadioX® inside Renasant Bank in Alpharetta. You can find the full archive of shows by following this link. The show is available on all the major podcast apps, including Apple Podcasts, Spotify, Google, Amazon, iHeart Radio, and many others.

The studio address is 275 South Main Street, Alpharetta, GA 30009.

John Ray also operates his own business advisory practice. John’s services include advising solopreneurs and small professional services firms on their value, their positioning and business development, and their pricing. His clients are professionals who are selling their expertise, such as consultants, coaches, attorneys, CPAs, accountants and bookkeepers, marketing professionals, and other professional services practitioners.

John Ray also operates his own business advisory practice. John’s services include advising solopreneurs and small professional services firms on their value, their positioning and business development, and their pricing. His clients are professionals who are selling their expertise, such as consultants, coaches, attorneys, CPAs, accountants and bookkeepers, marketing professionals, and other professional services practitioners.

John is the national bestselling author of The Generosity Mindset: A Journey to Business Success by Raising Your Confidence, Value, and Prices.

Sylvia Stinson-Perez has had an over 25 year career in the blindness field, including as the CEO of the Lighthouse for the Visually Impaired and Blind in New Port Richey/Brooksville Florida, Program Manager at the Miami Lighthouse for the Blind, Director of the Vision Specialist Graduate Certificate Program and the Older Blind Technical Assistance Center at the National Research and Training Center on Blindness and Low Vision at Mississippi State University prior to joining the American Foundation for the Blind in 2021.

Sylvia Stinson-Perez has had an over 25 year career in the blindness field, including as the CEO of the Lighthouse for the Visually Impaired and Blind in New Port Richey/Brooksville Florida, Program Manager at the Miami Lighthouse for the Blind, Director of the Vision Specialist Graduate Certificate Program and the Older Blind Technical Assistance Center at the National Research and Training Center on Blindness and Low Vision at Mississippi State University prior to joining the American Foundation for the Blind in 2021. As the manager of Community and Public Relations, David Steinmetz uses his expertise, education, and personal experiences to “change the perception of blindness.”

As the manager of Community and Public Relations, David Steinmetz uses his expertise, education, and personal experiences to “change the perception of blindness.”

Laura Whitaker began as a volunteer at Extra Special People in 2003. With her passion for enhancing the lives of children with developmental disabilities, Laura became the Executive Director at the age of 19 after the founder, Martha Wyllie’s sudden passing in 2004.

Laura Whitaker began as a volunteer at Extra Special People in 2003. With her passion for enhancing the lives of children with developmental disabilities, Laura became the Executive Director at the age of 19 after the founder, Martha Wyllie’s sudden passing in 2004.

Stephanie Quincy is the Chair of the Labor & Employment Practice Group in the Phoenix office, where she maintains a regular caseload of employment litigation matters and has extensive experience handling class action and multi-plaintiff lawsuits. She counsels employers on a variety of employment law matters, including covenants not to compete, wrongful termination, sexual harassment, and defamation.

Stephanie Quincy is the Chair of the Labor & Employment Practice Group in the Phoenix office, where she maintains a regular caseload of employment litigation matters and has extensive experience handling class action and multi-plaintiff lawsuits. She counsels employers on a variety of employment law matters, including covenants not to compete, wrongful termination, sexual harassment, and defamation. Robert Vaught is a partner in Quarles & Brady’s Labor & Employment Practice Group. He regularly counsels human resources and risk management personnel regarding Title VII, ADEA, FMLA, ADA, OSHA, wage and hour matters, hiring and discipline issues and wrongful discharge complaints, and represents employers in related proceedings in state and federal courts, and before the Equal Employment Opportunity Commission, Department of Labor, and state administrative agencies. He also has significant experience handling trade secret, unfair competition and restrictive covenant matters throughout the United States, and representing employers in related court proceedings.

Robert Vaught is a partner in Quarles & Brady’s Labor & Employment Practice Group. He regularly counsels human resources and risk management personnel regarding Title VII, ADEA, FMLA, ADA, OSHA, wage and hour matters, hiring and discipline issues and wrongful discharge complaints, and represents employers in related proceedings in state and federal courts, and before the Equal Employment Opportunity Commission, Department of Labor, and state administrative agencies. He also has significant experience handling trade secret, unfair competition and restrictive covenant matters throughout the United States, and representing employers in related court proceedings.

Job Creators Network

Job Creators Network

Insperity

Insperity From the first fire policy in the 1920’s to the billions of dollars in assets and investments they protect and manage today, their history tells the story.

From the first fire policy in the 1920’s to the billions of dollars in assets and investments they protect and manage today, their history tells the story.  Founded in 1930,

Founded in 1930,  The mission of the

The mission of the